I was at a party recently where the conversation turned to travel. One person in particular was trying to get to a destination (somewhere in South America, I forget the specific city) the following month, and wanted to know how they … Read More … Read More

Blog

Blog

Musings on personal finance and more. Not written with AI since 2012.

This might be why you don’t believe you’ll be financially successful

It’s not hard to find bad economic news that applies to you. If you’re a millennial, chances are the job market is terrible for you. If you’re a baby boomer, chances are that you’re either underwater in your house or … Read More … Read More

How to handle when your luggage doesn’t show up

Alaska Airlines has been pretty good to me. While their product isn’t anything extravagant, it’s certainly enjoyable enough, and I pretty much never have to deal with agents who totally hate their life (which was something I encountered with regularity … Read More … Read More

How you can use same day flight change rules to save on airfare

I think Alaska Airlines is pretty much the best domestic airline out there right now. Bold claim, I know, and there are many different criteria that go into such a rating, but I say this based on a combination of … Read More … Read More

There is no glory in poverty

Henry Rollins, who I’ve previously mentioned as being an honorary Unlikely Radical, perhaps the one that I aspire to be like the most, once joked at a spoken word show about a fictitious performance art piece, one with the pretension level amped up to … Read More … Read More

The problems with airline loyalty

More confessions of a nerdy kid, or I dare you to get excited

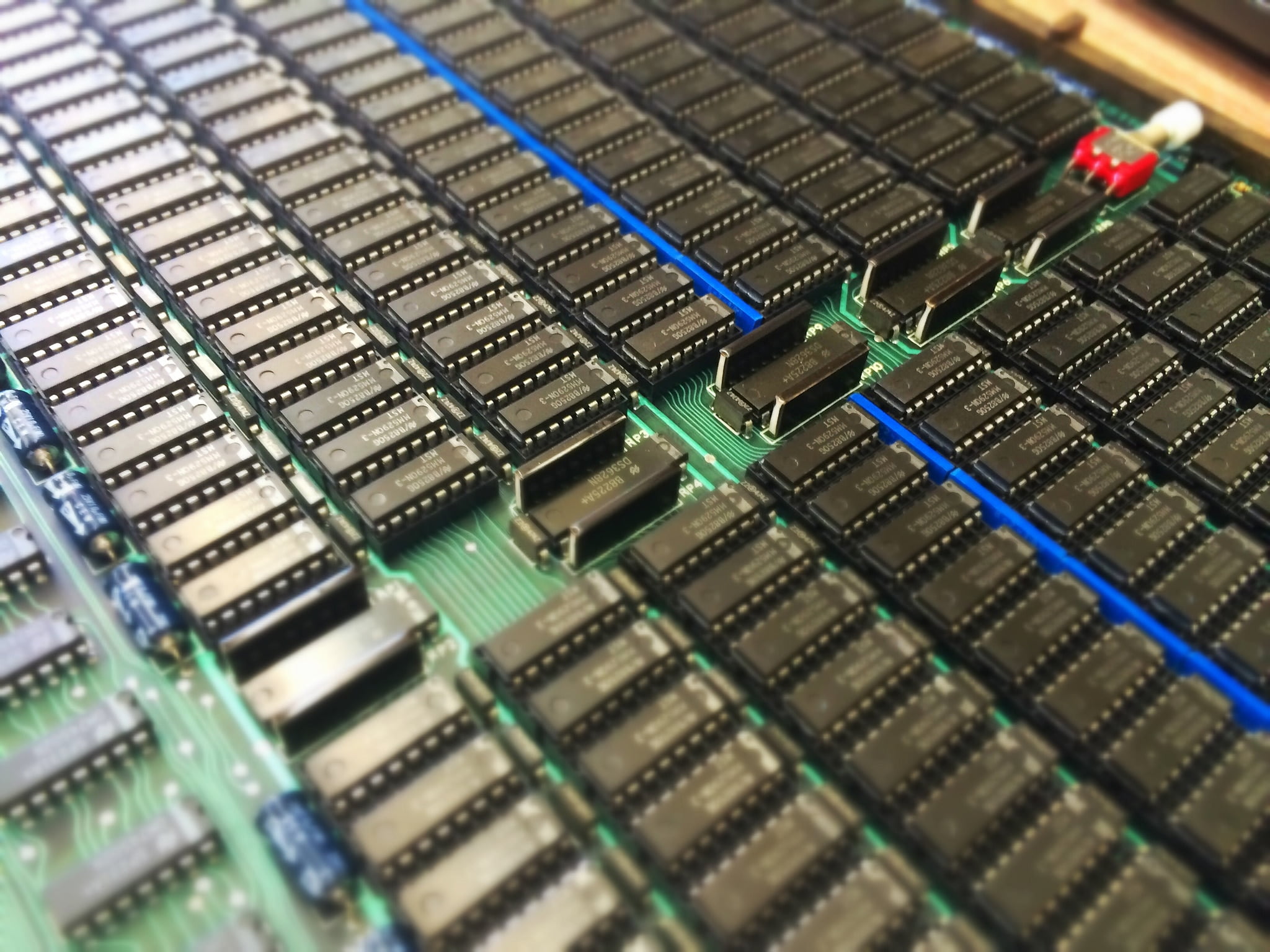

Last time, I talked about the pleasure of the anticipation of purchasing…a modem for my computer. This was back in middle school, a time of general emotional trauma for all. I was a bit young for my grade, and so … Read More … Read More

Confessions of a nerdy kid, or the pleasures of saving up for things

I was a super nerdy kid. If you doubt this, this story will confirm it. When I was in middle school, I became very interested in Bulletin Board Systems (or BBSs). These were computer networks that allowed you to communicate … Read More … Read More

How to decide whether to keep a credit card with an annual fee

I mentioned that there is only one reason to keep a credit card that carries an annual fee: The benefits you get from holding the card that you would have paid for anyway must be greater than the annual fee. … Read More … Read More

Conferring with the enemy (Part 5): Finishing the deal

All posts in this series: Conferring with the enemy (Part 1): A credit card for a travel plan Conferring with the enemy (Part 2): Fulfilling minimum spend requirements on a credit card Conferring with the enemy (Part 3): The waiting (for … Read More … Read More