Not every deal necessitates the hassle of moving your money or accounts around, but the 1% Rule is a good threshold to keep in mind. … Read More

mortgages

How not to be house poor

Home ownership can be a financial disaster if you’re not careful, and one of the ways to prevent this is to not be “house poor”. … Read More

40 year mortgages are here (maybe). Would you want one?

To help more people afford homes, there is talk of a new 40 year mortgage product. This of course would not help who it is supposed to. … Read More

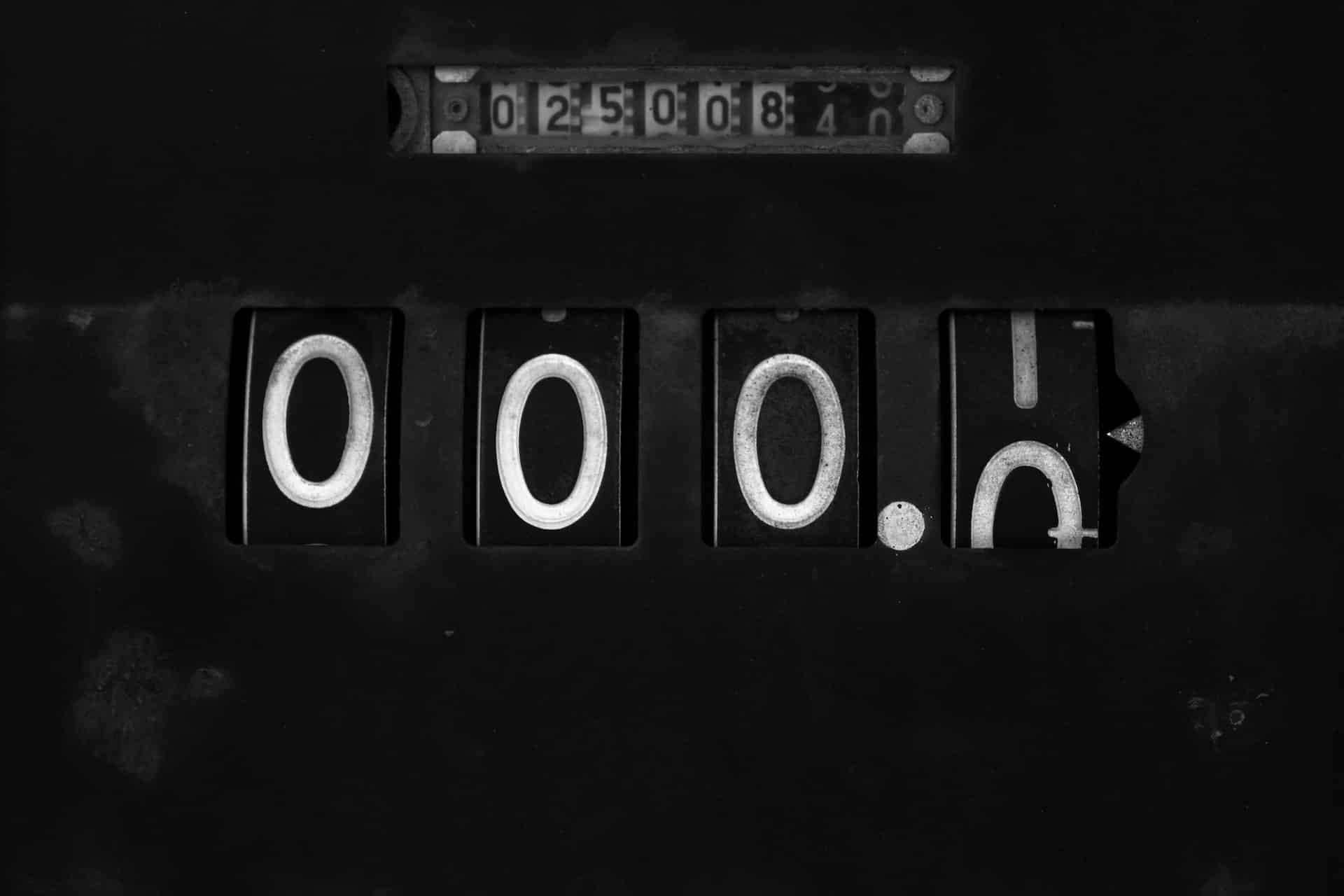

How to stay motivated when paying off a mortgage

Creating little milestones will help you stay motivated and give you a sense of accomplishment, even if your mortgage takes years to pay off. I logged into my mortgage account this month and saw something very exciting: Do you see … Read More … Read More

Why the 30 year mortgage is actually uncommon

The U.S. is an outlier in offering a 30 year mortgage. Here’s why that is, and why you still want to be able to pay it off faster. It’s official: 30 year fixed-rate mortgages in the U.S. have reached 7%. … Read More … Read More

Is it too late to buy a home?

With rising mortgage rates, some people may be wondering if it’s too late for them to buy a home. I believe that is the wrong question to ask. You’ve doubtlessly noticed how everything is getting more expensive, whether it’s food, … Read More … Read More

This is why you don’t want an adjustable rate mortgage (or private student loans)

An adjustable rate mortgage seems like a good idea, but when interest rates start to rise, you’re going to regret your choice. This past week, the Federal Reserve raised its benchmark interest rate by three-quarters of a percent. The last … Read More … Read More

How to know if a large purchase is affordable

People often think only of the per-month cost when determining what they can afford, but that can be an expensive mistake. Can you afford it? It’s a simple question on its face, but the more you dig into it, the … Read More … Read More

Why you shouldn’t panic when mortgage rates rise

Mortgage interest rates are rising, but rushing to buy a home before prices rise further will lead only to worse financial challenges. I’ve always thought of homeownership as a kind of train. As renters, you’re running behind it, trying to … Read More … Read More

Can you imagine life without debt?

Being able to envision what it would be like to be free from debt can help motivate you to take the steps necessary to make it a reality. For many, debt is a way of life. Or rather, it has … Read More … Read More