Think you have to use credit cards to get miles and points? Think again. Here’s how to do it without using credit cards. … Read More

Radical Finances

It’s now cheaper to rent than to buy

For most people in most places in the U.S., it is less expensive to rent a home rather than buy it. Will it be this way for the long term? … Read More

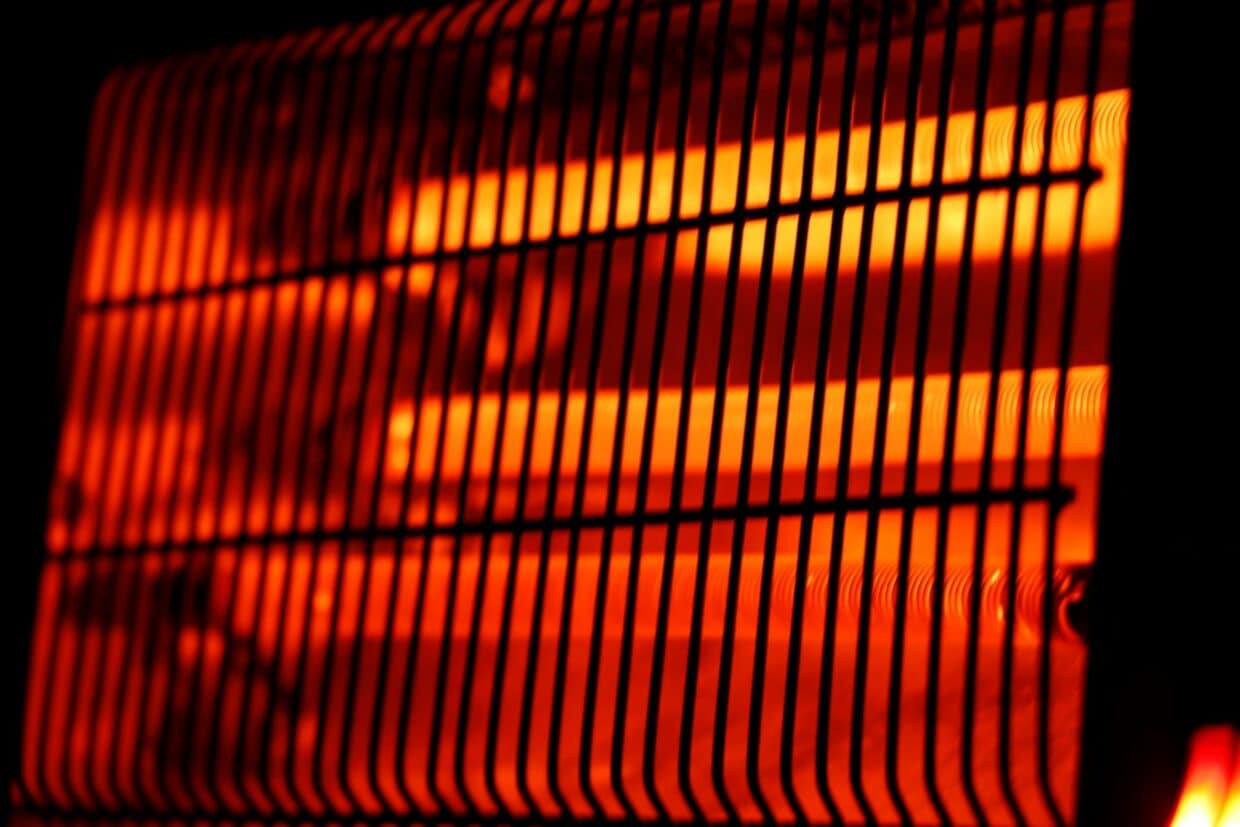

One year later: Can you save money with peak/off-peak energy pricing?

I’ve spent the last year with peak/off-peak pricing on my electric bill. I dig into the data to see whether it can save you money. … Read More

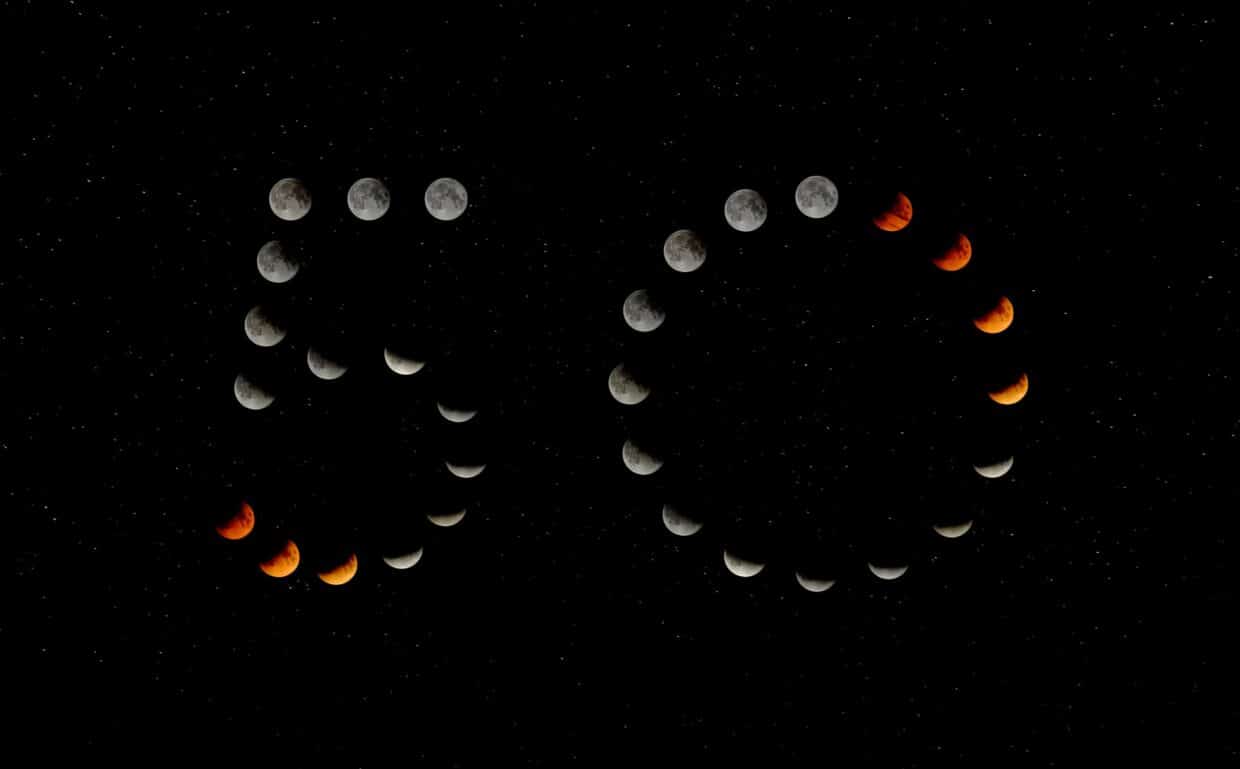

Year in review: The best posts of 2025

I review the best posts of 2025, including the posts you clicked on the most and the ones I liked the best. … Read More

The three financial challenges, and how to know which one you have

There are three types of financial challenges, and each one has a different solution. Let’s look at which one applies to you. … Read More

Why it’s time to plan for next Christmas

Christmas is expensive. Here’s how to make it more affordable without necessarily holding back from what you want to do. … Read More

Why you really don’t want a 50 year mortgage

A 50 year mortgage promises affordability, but won’t deliver what it promises, and will make costs higher for everyone. … Read More

Can you withdraw money early from your 401(k) or IRA?

Many people don’t know that you can make early withdrawals from your retirement accounts like your 401(k) and IRA. But should you? … Read More

Should you contribute to a Traditional IRA or Roth IRA?

There are two types of IRAs (Individual Retirement Arrangements): Traditional and Roth. Which one is right for you? … Read More

What to do with your money during stagflation

Stagflation is where a stagnant economy also contains rising inflation. It’s bad, but you can take steps to protect yourself and your money. … Read More