For most people in most places in the U.S., it is less expensive to rent a home rather than buy it. Will it be this way for the long term? … Read More

mortgage

Why you really don’t want a 50 year mortgage

A 50 year mortgage promises affordability, but won’t deliver what it promises, and will make costs higher for everyone. … Read More

The 1% Rule: How to know when to move your money

Not every deal necessitates the hassle of moving your money or accounts around, but the 1% Rule is a good threshold to keep in mind. … Read More

How not to be house poor

Home ownership can be a financial disaster if you’re not careful, and one of the ways to prevent this is to not be “house poor”. … Read More

40 year mortgages are here (maybe). Would you want one?

To help more people afford homes, there is talk of a new 40 year mortgage product. This of course would not help who it is supposed to. … Read More

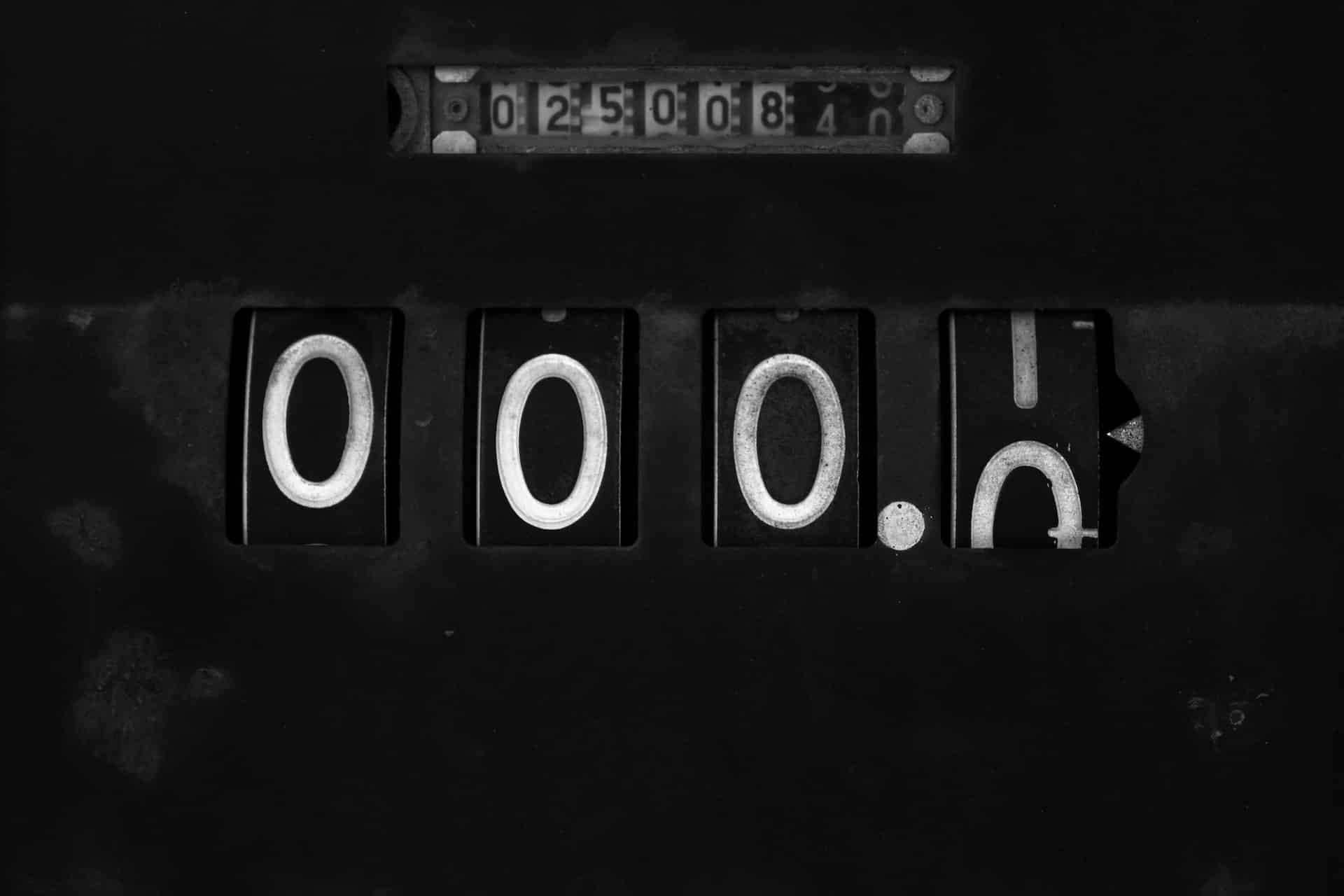

How to stay motivated when paying off a mortgage

Creating little milestones will help you stay motivated and give you a sense of accomplishment, even if your mortgage takes years to pay off. I logged into my mortgage account this month and saw something very exciting: Do you see … Read More … Read More

Why the 30 year mortgage is actually uncommon

The U.S. is an outlier in offering a 30 year mortgage. Here’s why that is, and why you still want to be able to pay it off faster. It’s official: 30 year fixed-rate mortgages in the U.S. have reached 7%. … Read More … Read More

Is it too late to buy a home?

With rising mortgage rates, some people may be wondering if it’s too late for them to buy a home. I believe that is the wrong question to ask. You’ve doubtlessly noticed how everything is getting more expensive, whether it’s food, … Read More … Read More

This is why you don’t want an adjustable rate mortgage (or private student loans)

An adjustable rate mortgage seems like a good idea, but when interest rates start to rise, you’re going to regret your choice. This past week, the Federal Reserve raised its benchmark interest rate by three-quarters of a percent. The last … Read More … Read More

Why you shouldn’t panic when mortgage rates rise

Mortgage interest rates are rising, but rushing to buy a home before prices rise further will lead only to worse financial challenges. I’ve always thought of homeownership as a kind of train. As renters, you’re running behind it, trying to … Read More … Read More