I recap the best posts of 2022, including the ones my readers liked and the ones I’m most proud of. Happy end of the year! It’s been a good year for me. After more than two years of work, I … Read More … Read More

Decisions

Why not keep your debt and use the cash flow?

There is a school of thought that you can use leverage to create cash flow without ever needing to pay off debt. But there’s a small problem. I was recently listening to a radio show hosted by a real estate … Read More … Read More

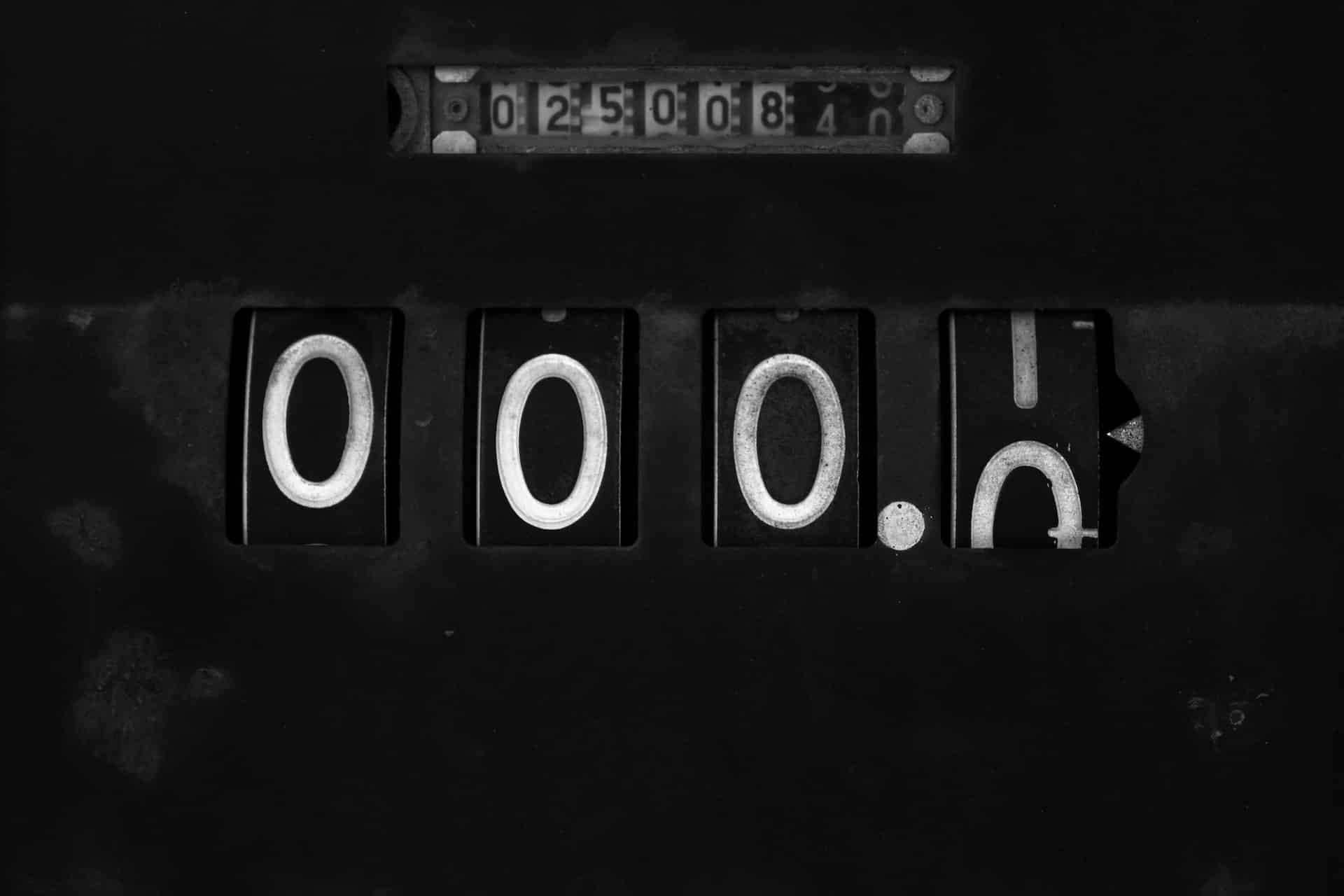

How to stay motivated when paying off a mortgage

Creating little milestones will help you stay motivated and give you a sense of accomplishment, even if your mortgage takes years to pay off. I logged into my mortgage account this month and saw something very exciting: Do you see … Read More … Read More

How to write 750,000 words: 10 years of Empathic Finance

Sign up for student loan debt relief right now

Is it too late to buy a home?

With rising mortgage rates, some people may be wondering if it’s too late for them to buy a home. I believe that is the wrong question to ask. You’ve doubtlessly noticed how everything is getting more expensive, whether it’s food, … Read More … Read More

Why you don’t charge what you’re worth

As a therapist or other private practitioner, you may struggle to charge enough for your services, but here’s why you should raise your rates. I’ve been enjoying giving my continuing education class for therapists on financial wellness in the therapeutic … Read More … Read More

Are you ready to lose your job?

Most of the important steps you need to take to handle a job loss happen before you lose your job. Here are those steps. A few years ago, I was let go from my full-time job. It had nothing to … Read More … Read More

Is it safe to put your money in stablecoins?

I look at cryptocurrency stablecoins and how they are used, and compare them to the original stablecoin, the U.S. dollar. I don’t know if you know this, but I’ve started syndicating all my content over on Medium. You can subscribe … Read More … Read More

Worried about the markets? You need to HODL.

I use the HODL meme from Bitcoin to show how it’s actually more widely applicable to your investments with real money. Things aren’t looking too good for the economy right now. Inflation is up, and gas prices are so high … Read More … Read More