I propose an allegory and model for thinking about how to deal with irregular income in a way that will help you reduce risk and uncertainty. … Read More

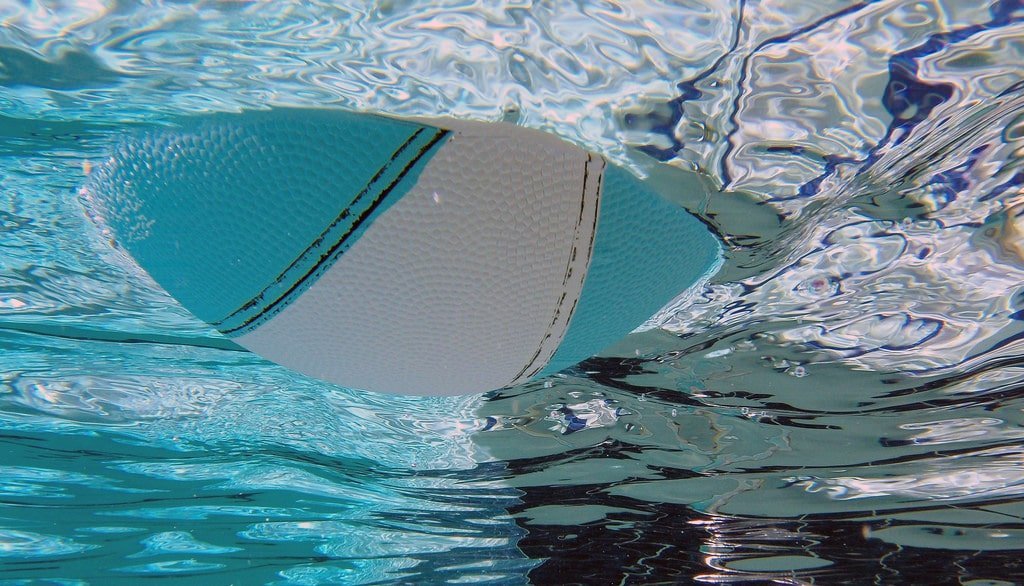

float

Do you spend your account down to zero each month?

If you plan your spending in a given month by checking if your balance is zero, you’re missing out on some wealth-building strategies. How much money do you have in your bank account? Obviously that’s a thing that varies over … Read More … Read More

Why Ally’s Surprise Savings is terrifying

I explore the Surprise Savings product from Ally and suggest a different way to achieve the exact same results. Last night, I was logging on to Ally to adjust some of my automatic transfers between my checking account and my … Read More … Read More

It is possible to have too much float

It’s important to have enough money in your account to not have to worry when your bills are paid, but too much float brings problems too. … Read More

Surprises, or Why you need more float in your account

In my last post I talked about very nearly overdrafting my account. It would have been more embarrassing than anything else had it happened—I haven’t overdrafted an account in over two decades—but it wouldn’t have caused any big problems. I … Read More … Read More

That time I almost overdrafted my account

The idea that once you become intentional about your finances you’ll never make any mistakes is, frankly, ludicrous. When I was training for the Seattle to Portland bike ride a few years ago, amidst all the rushing around and buying … Read More … Read More

In defense of rounding

What to do when your account balance is different than expected

How to calculate your true account balance at the end of the month