I propose an allegory and model for thinking about how to deal with irregular income in a way that will help you reduce risk and uncertainty.

When you’re a therapist in private practice or other practitioner working on your own, you may be in a situation where your income might vary from week to week or month to month.

This can be a stressful situation, not just during the lean times when not enough money is coming in, but also in those times when you have an excess. How much should you allow yourself to spend?

In thinking about this and discussing with clients, I’ve come up with not only a way to handle this situation in the best way possible, but also a good mental model on why it makes sense.

It begins with a jug.

Table of Contents

The jug

Let’s start with a jug.

The jug is your bank account, and the water in your jug is your money. If you have an empty jug, you have an empty account, so that’s something we want to avoid.

The regularly-filled jug

Those with steady income get a fill-up of their jug at the beginning of the month (or every two weeks), and they pour out the jug as the month goes on. Those who live paycheck-to-paycheck have to ration their water at the end of the month so that they don’t run out before they get their next fill-up.

This is the easy case. But it’s not always so simple.

The irregularly-filled jug

What if the amount of water added to the jug is different each time? Sometimes you get a whole deluge, and other times you only get a drop.

That’s the situation for people who have irregular income.

How do you best handle this? You can’t just have a party when you get tons of money, while scraping by when the checks aren’t coming in.

The solution: A steady pour

The solution is to use the jug to your advantage. Always have a reservoir of water in the jug, such that you can pour out water at an even, dependable rate, regardless of how much water is coming in.

That way, you can plan for your life as if you had a regular income, even though you don’t.

You need to have water

The secret to this is to separate in your mind your income from your allotted spending. A month where you make a lot of money can’t mean anything anymore in terms of how you live. All it does is fill up the jug.

And for those months were water is scarce, you’ll have water still left in the jug.

This means that you need to have water in the jug for this to work!

An example

Jaime is a therapist who gets reimbursed from the insurance companies at widely varying intervals. Sometimes the checks come quickly, but other times it may take months for a particular session to clear.

Jaime has allocated $5,000 to be the “water” in the jug. This was taken mostly from savings, but the rest was saved up for over time.

Now, Jaime has decided that it’s totally possible to live on $3,000 a month. So that’s the rate of “pour” from the jug. And as for the filling up of the jug? Here’s how it panned out.

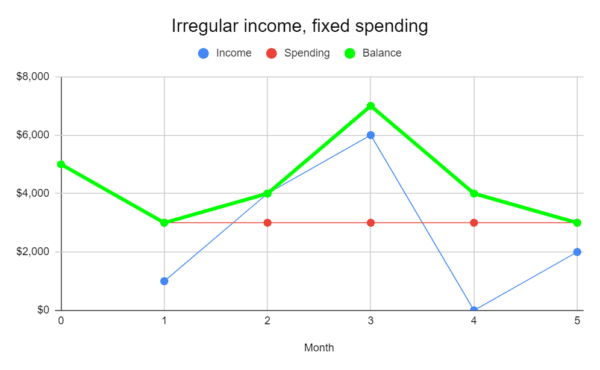

Over the course of four months, Jaime made the following incomes:

- Month 1: $1,000

- Month 2: $4,000

- Month 3: $6,000

- Month 4: $0

- Month 5: $2,000

Given her regular spending, would this be a problem? Let’s see.

The green line is the amount of water in the jug. And as you can see, even though Jaime’s income was less than spending for three of the five months, it didn’t matter at all, as there was always enough water in the jug.

So we can see that while Jaime’s income varied wildly, the constant pour of the jug meant that life could go on, dependably planned, and without any major headaches.

(In effect, Jaime is doling out a “salary”.)

Irregular income is manageable

Irregular income can be stressful, but it doesn’t have to be.

All you need to do is to set yourself up a system that will allow you to smooth out the uncertainties of your income, such that you in effect create a regular income out of an irregular income.

It’s totally doable. And it’ll keep you hydrated too.