WARNING: This post contains math.

How much float do you need? Well, optimally you’d have enough float such that you could cover your entire month’s expenses on day 1, just to be safe. But in general you want to have enough float in your account such that you never need to worry about the “timing” of your bills.

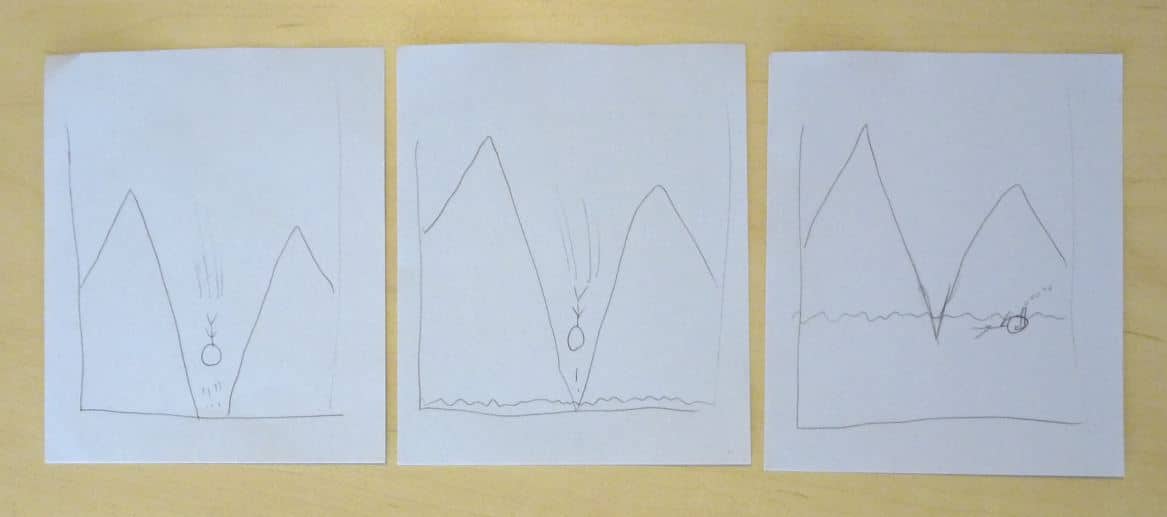

In my post on drawing your money graph, I explain through my (impeccable and unimprovable) drawings the difference between having enough float and not having enough float.

Once you’ve figured out what your float value is, you know that the goal is to start and end your month with your account balance at that value.

But how do you calculate this? It’s actually not as straightforward as you think.

Table of Contents

Why is an account balance not straightforward?

Transactions can vary widely in how long they take to process, so the value at any given time might not be representative of what “happened” in a given month. This means that some transactions for the new month can show up the month before, and some transactions from the month before won’t show up until the new month.

The value of your account when the month turns over won’t take these into account, so you can’t use that value to figure out where your float is.

Can we see an example?

Sure. Consider the following transactions around the end of the month, mirroring what you’d likely see on your account statement:

[table caption=”Account snapshot” width=”500″ colwidth=”50|50|200|50|50″ colalign=”left|left|left|right|right”]

Post date,Activity date,Activity,Amount,Balance

-,-,[Start],-,$1228

9/29,9/28,Grocery store,-$85[attr style=color:red],$1143

9/29,9/29,Restaurant,-$24[attr style=color:red],$1119

9/30,10/1,Pay check,+$1000[attr style=color:green],$2119

10/1,9/30,Mini-golf*,-$14[attr style=color:red],$2105

10/1,9/30,Clothes,-$100[attr style=color:red],$2005

10/2,10/2,Gas,-$30[attr style=color:red],$1975

-,-,[Rest of October],-,-

[/table]

* Don’t judge.

Now, the question is: what was the value of this account at the end of the month?

If your answer is $2,119, that would be understandable, but wrong.

Because what matters is not when things posted, but when things happened.

(Why doesn’t it matter when things post? Remember, if you have adequate float, you never need to worry about your account balance getting too low, so the timing of when things post becomes irrelevant.)

Notice that the “Pay check” posted on 9/30, but it’s dated 10/1, so it’s actually October’s pay check. So you don’t count that at the end of the month. Moreover, the clothes and the mini-golf posted in October, but actually happened in September. So you do count that.

So the answer here is $1,005.

How did you get that?

To calculate your account value at the end of a month, you must count only the transactions that happened in that month, and skip all transactions that didn’t. You in effect create a different account balance as you go

So let’s go through. We start at $1,228.

[table caption=”Account snapshot” width=”600″ colwidth=”50|50|200|50|50|50|50″ colalign=”left|left|left|right|right|center|right”]

Post date,Activity date,Activity,Amount,Official balance,Count for float?,Float balance

-,-,[Start],-,$1228,-,$1228[attr style=font-weight:bold]

9/29,9/28,Grocery store,-$85[attr style=color:red],$1143,√,$1143[attr style=font-weight:bold]

[/table]

Happened in September, so count it. $1,228 – $85 = $1,143.

[table th=”false” width=”600″ colwidth=”50|50|200|50|50|50|50″ colalign=”left|left|left|right|right|center|right”]

9/29,9/29,Restaurant,-$24[attr style=color:red],$1119,√,$1119[attr style=font-weight:bold]

[/table]

Happened in September, so count it. $1,143 – $24 = $1,119.

[table th=”false” width=”600″ colwidth=”50|50|200|50|50|50|50″ colalign=”left|left|left|right|right|center|right”]

9/30,10/1,Pay check,+$1000[attr style=color:green],$2119,X,$1119[attr style=font-weight:bold]

[/table]

“Happened” in October, so don’t count it. Balance remains at $1,119.

[table th=”false” width=”600″ colwidth=”50|50|200|50|50|50|50″ colalign=”left|left|left|right|right|center|right”]

10/1,9/30,Mini-golf,-$14[attr style=color:red],$2105,√,$1105[attr style=font-weight:bold]

[/table]

Happened in September, so count it. $1,119 – $14 = $1,105.

[table th=”false” width=”600″ colwidth=”50|50|200|50|50|50|50″ colalign=”left|left|left|right|right|center|right”]

10/1,9/30,Clothes,-$100[attr style=color:red],$2005,√,$1005[attr style=font-weight:bold]

[/table]

Happened in September, so count it. $1,105 – $100 = $1,005.

[table th=”false” width=”600″ colwidth=”50|50|200|50|50|50|50″ colalign=”left|left|left|right|right|center|right”]

10/2,10/2,Gas,-$30[attr style=color:red],$1975,X,$1005[attr style=font-weight:bold]

[/table]

Happened in October, so don’t count it. Balance remains at $1,005.

[table th=”false” width=”600″ colwidth=”50|50|200|50|50|50|50″ colalign=”left|left|left|right|right|center|right”]

-,-,[Rest of October],-,-,-,$1005[attr style=font-weight:bold]

[/table]

All the other transactions happened in October, so the value of the account at the end of September was $1,005.

So if this person had a target float value of anything from $980 to $1030, I’d say they are on target.

Don’t skip this

Calculation of your float is an important part of closing out your previous month and starting out your next month. But have patience, as the delays in transactions posting means that you can’t figure out your ending account balances until at least a few days after the month ends. You need to wait until everything posts.

But don’t skip this step. Always figure out your balances each month, so you can figure out whether you’re on target.

Just like any journey, even if you know where you’re going, you need to first know where you are.

And if you haven’t played mini-golf recently, you’re totally missing out.

But enough about me. Do you keep track of your account balances each month?