Sharing all finances with a partner is a viable strategy, but it comes with the risk of conflict, such that it might not be worth it. I once heard a story about a married couple. They had an “All-In” agreement … Read More … Read More

Blog

Blog

Musings on personal finance and more. Not written with AI since 2012.

Your tech job is not secure

The tech sector has started embarking on widescale job layoffs, which is as unfortunate as it is completely expected. Congrats! There’s a good chance that you’ve been laid off recently. This is especially true in the tech sector, where, according … Read More … Read More

Knowing is better than not knowing

Avoidance is common is personal financial matters, but even though it’s momentarily painful, it’s always better to know where you stand. One of the most common stances that people have toward money is avoidance. It’s so common that I have … Read More … Read More

Past due: What to do when you’re behind on your debts

Getting current with past due debts is one of the most urgent tasks for you to take care of, pretty much before you do anything else. I’ve talked about how to pay off debt. That’s that “debt snowball” thing you … Read More … Read More

What to do when you’re paid biweekly

2022 in review: Best posts of the year

I recap the best posts of 2022, including the ones my readers liked and the ones I’m most proud of. Happy end of the year! It’s been a good year for me. After more than two years of work, I … Read More … Read More

Why not keep your debt and use the cash flow?

There is a school of thought that you can use leverage to create cash flow without ever needing to pay off debt. But there’s a small problem. I was recently listening to a radio show hosted by a real estate … Read More … Read More

The data is in: You can’t beat the market

I look at S&P SPIVA scorecards for mutual funds, which confirm what we already knew about investing: that you can’t beat the market. Note: I’m not a financial advisor. I don’t offer financial (or legal) advice. My job is to … Read More … Read More

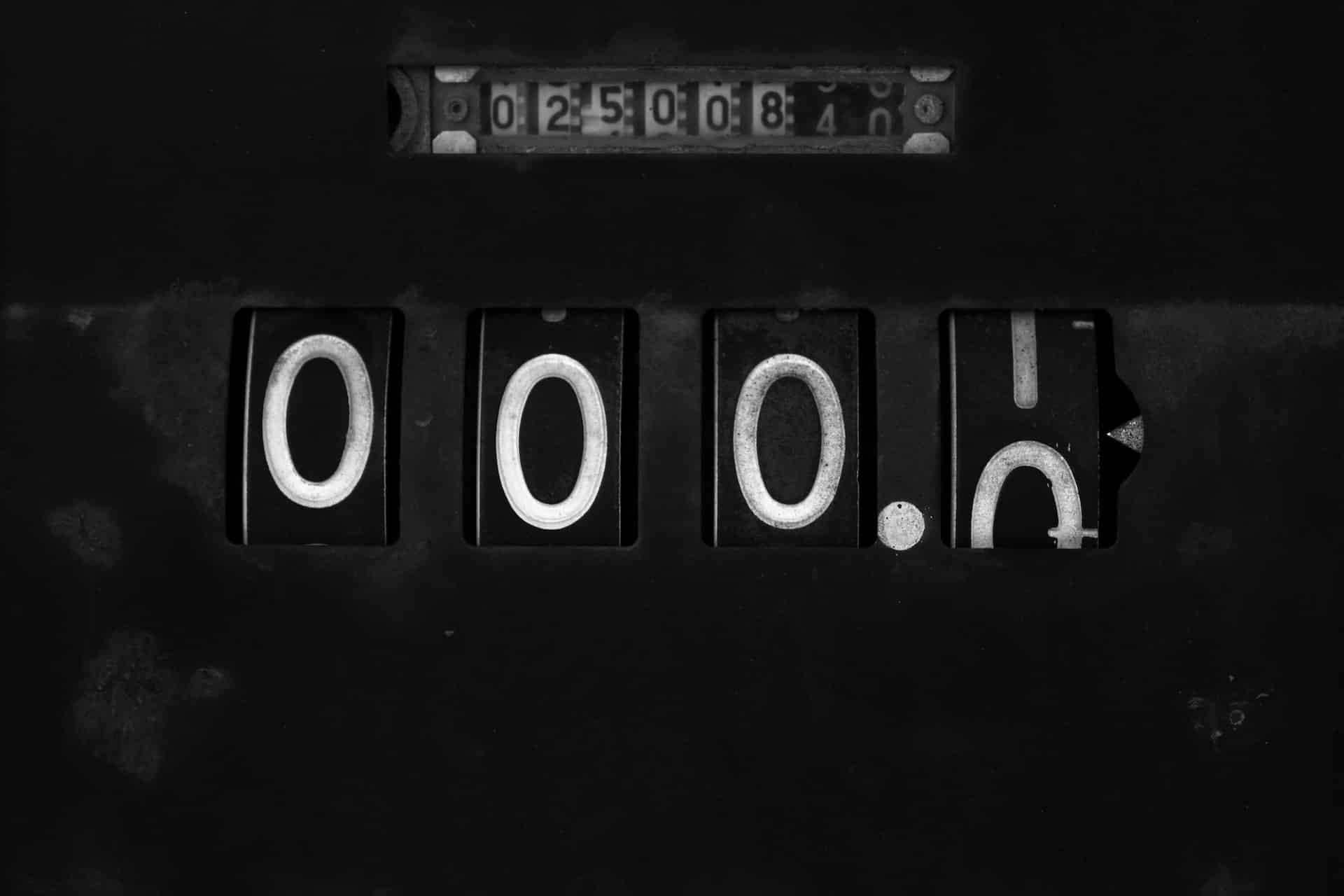

How to stay motivated when paying off a mortgage

Creating little milestones will help you stay motivated and give you a sense of accomplishment, even if your mortgage takes years to pay off. I logged into my mortgage account this month and saw something very exciting: Do you see … Read More … Read More

How to prepare for the next surge in gas prices

Gas prices won’t be lower for long. Here’s how to handle what happens the next time there’s a surge in gas prices. Gas prices are up. Then they’re down. Then they’re up. Then they’re down up down. At the very … Read More … Read More