So there are definitely some reasons where refinancing a mortgage could be a good move. Rates too high? Terms no good? Not going to be moving for a while? It could make a lot of sense, and save you money. … Read More … Read More

Radical Finances

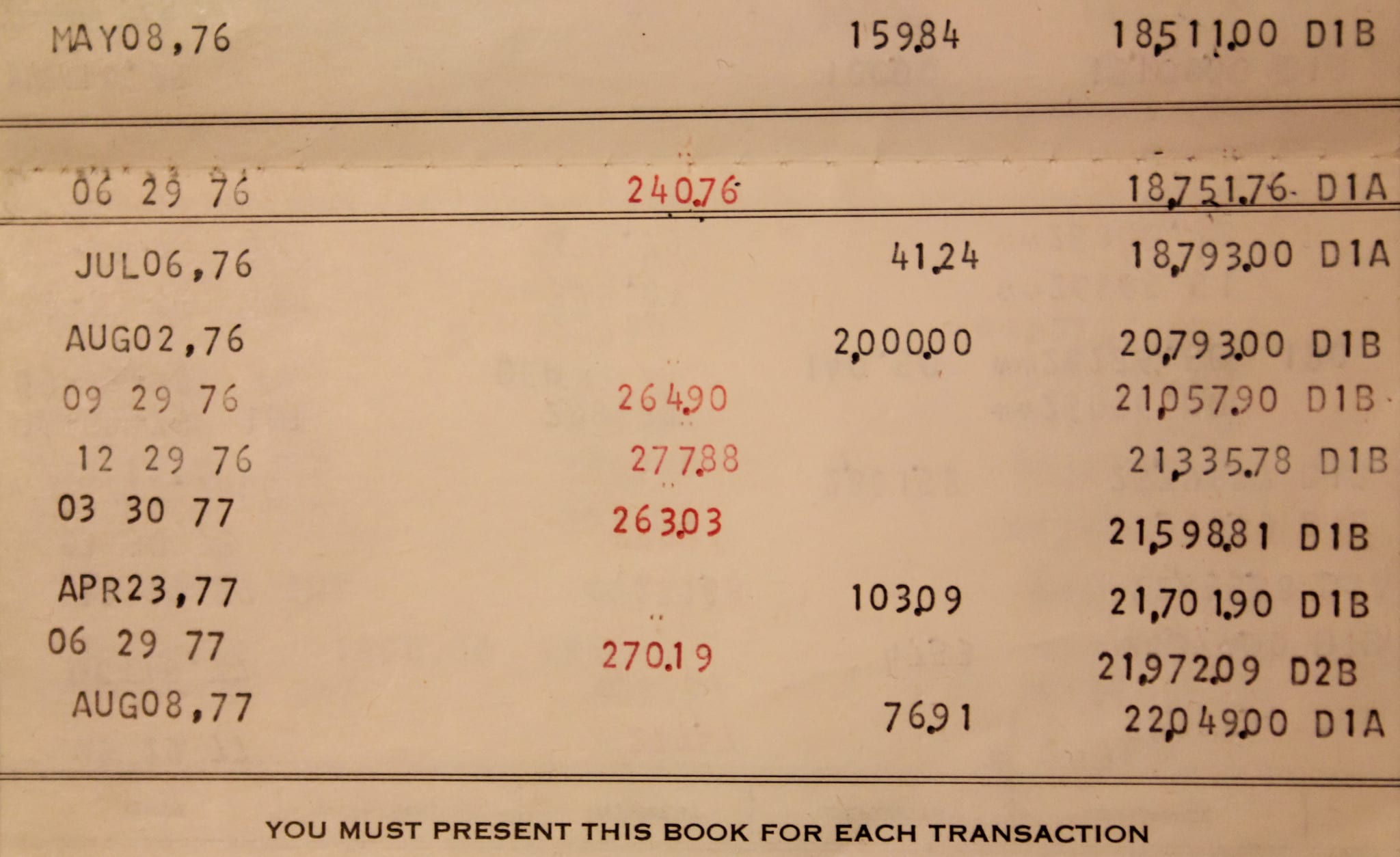

Is it time for me to refinance? My mortgage origination company thinks so

What’s a mortgage refinance?

What about Bitcoin?

A few years ago, the online dating site OkCupid added a new payment option. It said: “Civilization Collapsed? Pay with Bitcoin” This was the first time that I saw Bitcoin being taken (somewhat) seriously as a payment method. Bitcoin is a … Read More … Read More

What about gold?

I love talking about investing. A slow and steady plan that can enable almost anyone to ensure a comfortable future for themselves and their loved ones? Yes please, sign me up. When I talk about investing, I speak exclusively of mutual … Read More … Read More

Why is the budget monthly?

Our system of budgeting is pretty arbitrary. I recommend that everyone make a spending plan based on the calendar month. Twelve months a year: twelve plans a year. Could we do things another way? And are any of them better? … Read More

The arbitrary nature of a month, or does it really matter when you spend?

Last month was a little challenging for me, money-wise. While every month I separate my allotted spending money into categories ($300 for Groceries, $60 for Transportation, etc.), it’s really just a best guess. The month had a number of expenses … Read More … Read More

Past performance is no guarantee of future results, or is it?

Any time you read any financial prospectus or ad, or watch a commercial about any investment opportunity, or really, ingest any financial media at all, one phrase will always show up in one form or another: “Past performance is no … Read More … Read More

Keep a list of bill payment methods

What payment method(s) to use for bills

Choosing your method of payment for things isn’t as straightforward as you might think. That’s why I created a short guide called “How to spend money“. But I was really just talking about expenses in that post. What about bills? … Read More