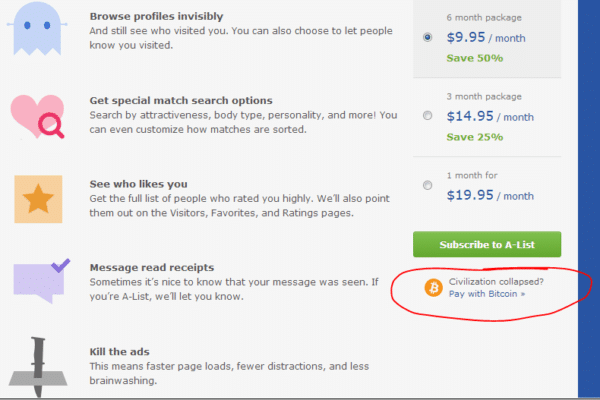

A few years ago, the online dating site OkCupid added a new payment option. It said: “Civilization Collapsed? Pay with Bitcoin”

This was the first time that I saw Bitcoin being taken (somewhat) seriously as a payment method.

Bitcoin is a sprawling topic, and I won’t even begin to do it justice here. I think the system that underlies the exchange is fascinating and has potentially wide-ranging ramifications for lots of different types of transactions.

But here I want to answer a much smaller question: is Bitcoin worth your attention from a personal finance perspective? Can Bitcoin help you in any way?

Follow me as we climb down the blockchain.

Table of Contents

Conservation of money

When I pay you in cash, I give you bills or coins, and then I don’t have them anymore; you do. It’s pretty easy to verify that the transaction happened.

When I pay for something via my bank account, it’s just numbers in a database somewhere. We accept the veracity of the transaction because we put our faith in the bank. We trust that it will successfully lower our account number by a certain amount, and raise the payee’s account by an equal amount.

There’s a lot of trust involved in this setup. We trust that no one at the bank will be will be like Ferris Bueller changing the number of days he’d been absent, doing the same with our account balance.

I personally think the trust is warranted. I’ve had thousands of transactions over the years, and the number of incorrect transactions I can peg confidently at zero.

And this is coming from someone who’s no fan of big banks. But my objection isn’t that they are going to make off with my money, just that they aren’t a good deal. (Okay, I guess in that respect they are making off with my money, but it’s a slightly different thing.)

No cat

Einstein (apocryphally) was asked to explain how radio works. His response is recorded as something like this:

The wire telegraph is a kind of a very long cat. You pull his tail in New York and his head is meowing in Los Angeles. And radio operates exactly the same way: you send signals here, they receive them there. The only difference is that there is no cat.

Bitcoin is an exchange system that takes away the bank (the cat) from the system of exchange. The system itself is self-balancing. You can’t just say that you have a zillion bitcoins, because the rest of the system will dispute this.

No bank needed.

Why Bitcoin?

Reasons for being interested in Bitcoin are varied: an interest in untraceable transactions, a pan-national monetary system, anonymity, and, of course, the fear of a collapsed civilization.

(Tell me folks: with civilization collapsed, how exactly are you going to verify the SHA256 hashes in a blockchain? With an abacus?)

But one area that’s excited people immensely is the prospect of becoming very very rich.

If you had bought Bitcoin just two years ago, when the price per USD was around $250, you would have cleared a 1,000% return.

You can buy Bitcoin just like you would exchange dollars for pounds or euros or any other currency. (You can also “mine” it, but that’s way beyond the scope of this article.)

But don’t go cashing out your 401(k).

Investing vs. speculation

Do you know the difference between investing and speculation?

I admit that it’s not an easy question to answer. It could come down to a level of relative risk. Investing has a reasonable level of risk and a reasonable level of return. Speculation can swing much wider.

But we can disagree on level of risk. It’s harder to disagree on intent. Are you looking at a financial product because it offers a reasonable expectation of return over the long run, or are you looking to get rich quick?

Putting money in Bitcoin feels pretty strongly like the latter.

Unfortunately, a big rule of speculation is that by the time people talk about how good a deal it is, it’s too late.

I fully expect Bitcoin, or something like it, to be around for the long haul. But over the long term, it’s going to resemble a currency, not an investment.

Do you “invest” in yen or euros, or (heaven forbid) pounds? No. True, their relative values change over time, but not enough to make it an investment.

If you must play around

My feelings about buying Bitcoin are similar to gold: it’s fine as “play money”. An expense. If you have that money to burn.

But you have to have your plan in order first. Otherwise, you’ll take away precious momentum to building wealth.

Oh, and in case you were wondering, OkCupid stopped accepting Bitcoin last year. Draw any lesson you’d like from that.

But enough about me. What do you think about Bitcoin?