So the papers are signed and the move is complete. I’ll be living out of boxes for what feels like forever, but that doesn’t matter. I’m a homeowner now. I’m also back into debt, as I have a mortgage now. … Read More … Read More

Blog

Blog

Musings on personal finance and more. Not written with AI since 2012.

The best time to travel is coming up soon!

It’s getting to be my favorite time of the year in the US for flying! Planes will be empty, fares will be cheap, airports will be a breeze to get to and around in. I’ve already booked a flight, and … Read More … Read More

One surefire way to pare down your possessions

There’s a lot of talk these days about minimalism. Apparently, we’ve all gotten so good at acquiring stuff that there now is a trend toward pairing down. It used to be that whoever had the largest house, the biggest amount … Read More … Read More

The mortgage: debt’s final boss character

My friend Rami talks about many facets of life from the perspective of certain video games. And certain video game tropes do occassionally leak into other forms of art and even real life. For example, can anyone really read … Read More … Read More

The homeowner’s “garden”: a little equity grows

Have you ever bought a home? Well, if you only have a single full time job, and want another one on top of it, well, this is the plan for you. Everything in this process seems to have resulted … Read More … Read More

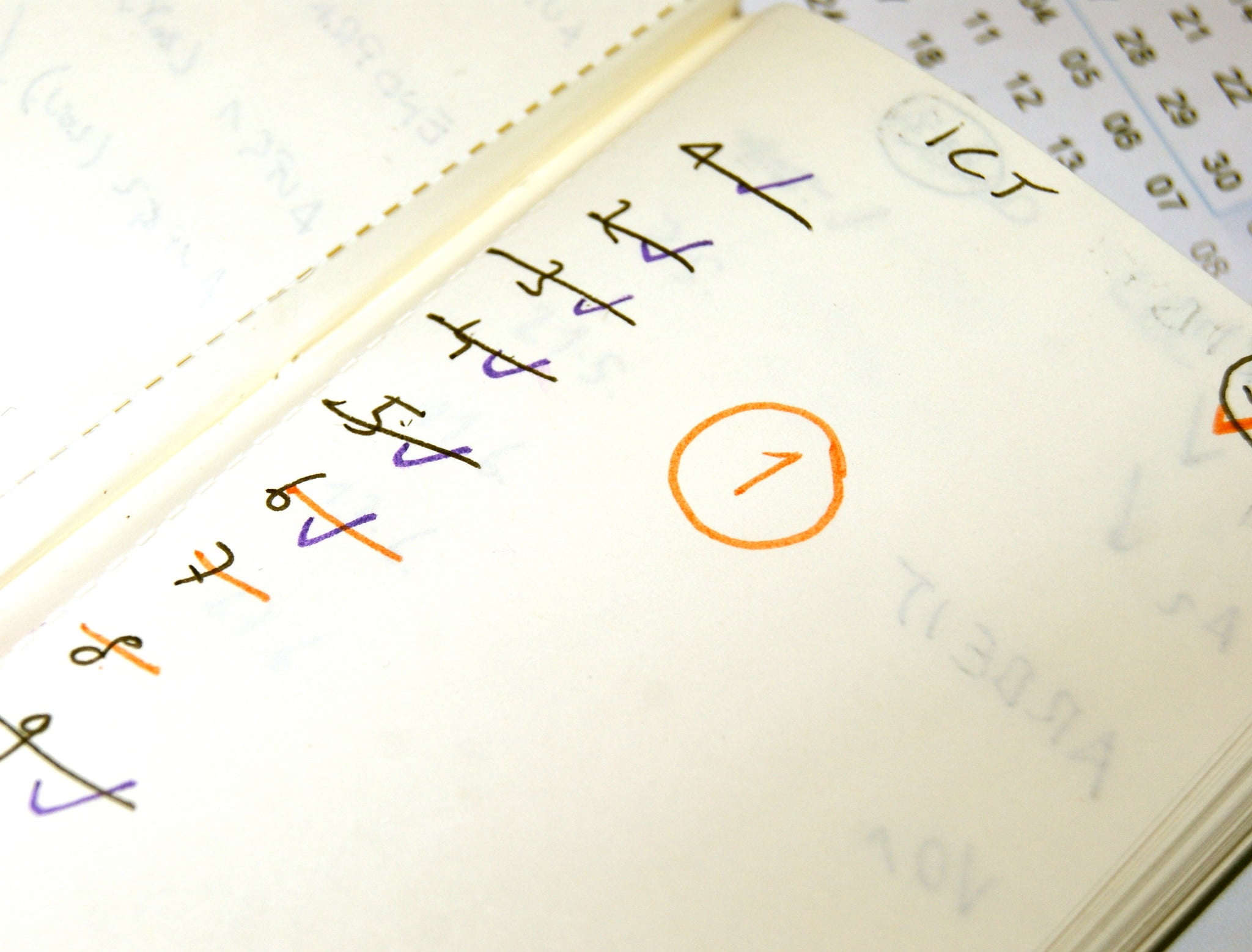

Important versus urgent: Applying the Eisenhower Decision Matrix to your finances

I’ve increasingly found it important to determine whether something is important or whether it is just urgent, as I think that we all (myself included) tend to confuse the two. I just recently learned that the matrix of the … Read More … Read More

What to do first when you get an unexpected windfall

How to have an emergency fund when you’re still in debt

Some of you have already paid off their debts and are well on your way to becoming wealthy enough to feel safe, live easy, and accomplish anything. But some of you are knee-deep (or neck-deep) in debt, possibly living … Read More … Read More

When your life changes, change your emergency fund

An emergency fund is a vital tool, not just in your financial situation, but also for your sense of emotional grounding. But no kidding. I like to joke that a fully-funded emergency fund is like anti-anxiety medication, but without … Read More … Read More