You should decide your own categories based on your specific situation. Also, your bank will always be wrong.

Most people aren’t ready to do the work to change or improve their financial habits. I understand that, and if that’s you, I only wish to say that when you’re sick and tired of not getting anywhere, come talk to me.

You have to track your spending if you want to take control of your cashflow. People don’t want to do that. “It’s stressful,” they often say, curiously forgetting that running out of money before the end of the money is stressful too.

Moreover, it’s not enough to just track your spending. It’s vital to categorize your spending too. After all, not all spending is the same. And that way, you know how much you’re spending on, say, groceries versus gas, restaurants versus pet food, etc.

People don’t want to do that either. And the most common reason I get why people don’t is that they say that they don’t need to. “My bank does that. It has a record of all my transactions, and it automatically categorizes them for me.”

This is technically true, and wrong for all sorts of reasons.

So here are 3 reasons why you don’t want to rely on your bank’s (or, god forbid, your credit card’s) automatic categorizations of your spending.

Table of Contents

The bank categories will be wrong

Getting the mortgage payment categorized correctly is easy. But a lot of the purchases you make are going to stump even the smartest AI.

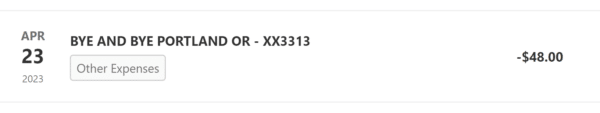

I just did a quick swing through my checking account online, and found that a recent trip to Bye & Bye, a fantastic vegan restaurant in Portland, was categorized as “Other Expenses”, not Restaurants & Dining like it should have been.

Yes, I could go in and change the category, but now we’re fixing mistakes that we wouldn’t have had to fix if we hadn’t let someone else decide them in the first place and just did it ourselves.

And there are lots of these mistakes.

Also, if you ever use PayPal or Venmo to send money to a friend who bought something for you, now you need to do even more digging to get that information to be correct, and rather than the unhelpful category “Transfers”.

Purchases don’t always fall into a single category

Raise your hand if this sounds like you: you go into Target, intending to pick up shampoo and laundry detergent, and end up with a 12 pack of some energy drink, holiday candy on clearance, a t-shirt, a stuffed animal, and a whole cart of unexpected purchases.

Now tell me: what category should this purchase be?

My bank puts Target under the “Shopping” category, which is probably the most pointless category name in existence. Why not just the “Spending Money” category? Why not the “Everything” category?

Purchases like these cannot (and should not) be put in a single category, and should instead be divided up into multiple categories. You spent some on Groceries, some on Beauty, some on Clothes, etc.

In order to truly understand and take control of what you spend, you need to know exactly what you spend in each of your spending categories. Not the useless “Shopping” category.

Your bank, being beholden only to its transactions, can’t do this for you.

Your bank only knows what it knows

This is a small point, but it’s worth mentioning: any transaction that doesn’t go through your bank will not be tracked or categorized.

So any cash transactions for example, won’t be tracked. Also, if you have multiple accounts across multiple financial institutions, they won’t be able to talk to each other, and you won’t be able get a holistic picture of your spending.

Not proactive enough to be useful

Looking at and relying on your bank’s categories and spending breakdowns is a reactive process. You spend in whatever manner you choose, and then, later, you look up your spending and see whatever the bank chose for your categories.

But what does that really tell you, aside from “what you did”?

A better, much stronger financial position to take, is to intentionally decide what you’re going to spend, and in what categories, in advance, and then stick to those. This allows you to allocate your money to exactly what you want, whether it’s spending, saving, investing, or anything else.

This is why active tracking of spending is so powerful: instead of wondering where your money went, you decide where you want your money to go.

And once you’re following my I.B.E. Method, you’ll eventually create targets for your spending categories, which allows you to be even more intentional, and to eventually have more money for what matters to you.

But your bank’s categories are easy to get wrong and ignore, which is not a recipe for success.

Thanks but no thanks

It’s nice that your bank has this feature, and I do appreciate what they’re trying to do with all these features. I happen to use the Memo feature on my transactions, so that Future Me can remember what Past Me was doing.

But your bank can only go so far; it’s not designed to be a financial wellness app. And in the end, they want you to use their products so that they can make more money off of you.

Meanwhile, tracking your expenses, and dividing them into categories so that you can decide how you want to spend your money, is 100% free. And you’ll make more money from doing it, too.