Creating little milestones will help you stay motivated and give you a sense of accomplishment, even if your mortgage takes years to pay off.

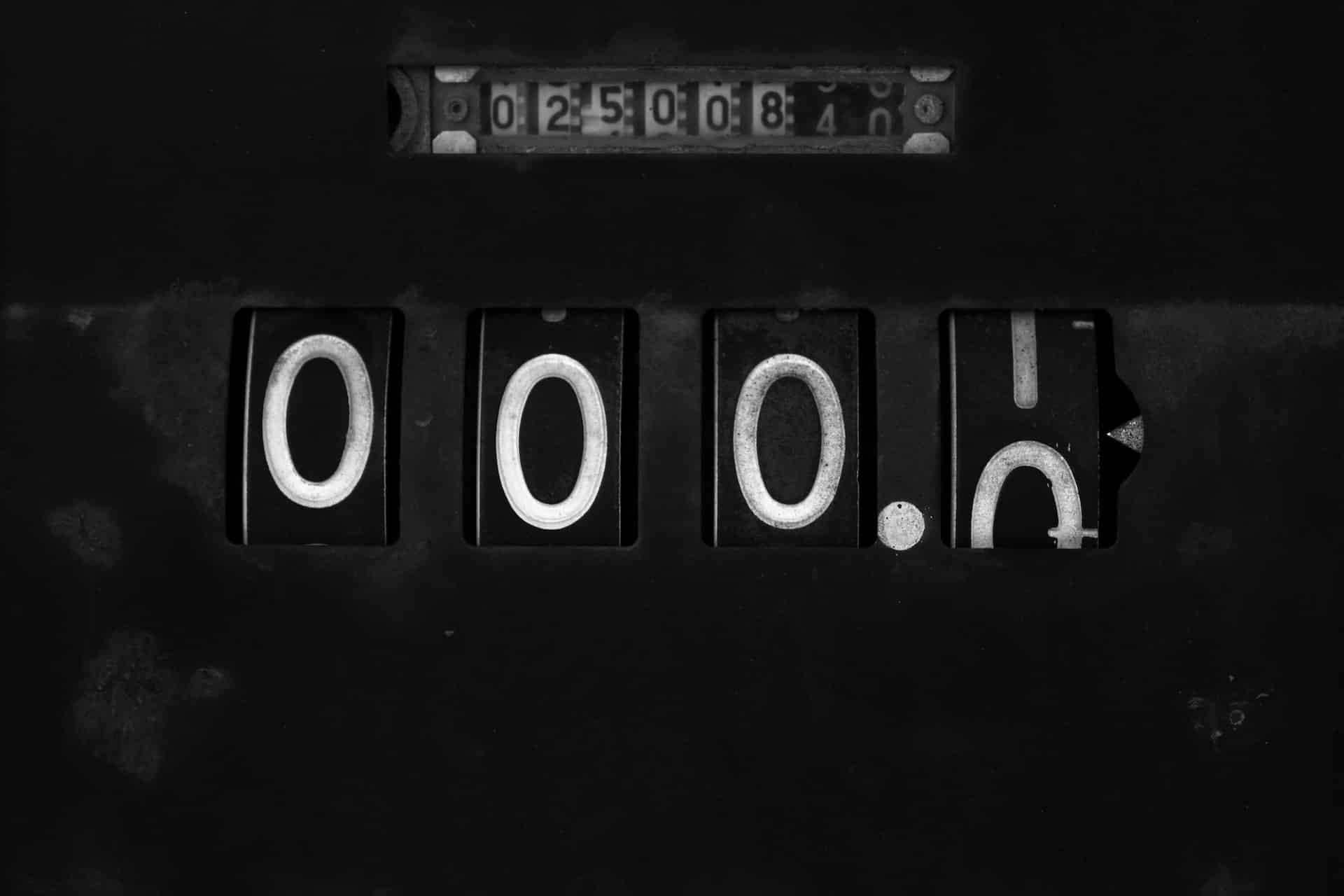

I logged into my mortgage account this month and saw something very exciting:

Do you see that? It means that my mortgage balance has dropped below $100,000. After years of paying down my mortgage, I’ve managed to shave off a digit! 🎉

These things don’t totally matter, of course; the difference between $99,000 and $100,000 isn’t that consequential. And I still have some years to go before I’m finally free from the final boss battle of debt.

And yet, when you have a large debt, such as a mortgage or a student loan debt, it’s vitally important to celebrate whatever small milestones you can, as it will keep you motivated and less despondent as you work on such a daunting task.

One of the reasons I like the Debt Snowball method of paying off debt is that you get some quick wins—a small debt paid off here, a less-small debt paid off there—such that you can eliminate some bills and feel like you’re accomplishing something reasonably quickly.

But with a single giant debt like a mortgage, you can’t do that. It’s just one debt, and you have to pay it off, bit by bit.

So with this in mind, I came up with a few fun ways that you can get some of the feeling of accomplishment of paying off some debts, while applied to a single large debt.

Table of Contents

Celebrate every 10%

Your mortgage is big, but you can think of it being divided into smaller chunks.

With a $300,000 mortgage, every $30,000 would be a milestone of 10%. Celebrate each 10% when you hit it. Plot out when it’s going to happen on the calendar and have a mini-celebration.

This could also be a little practical when tracking loan-to-value, or LTV.

Let’s say you had a 10% down payment, and so your $300,000 mortgage represented a 90% LTV.

Getting down to a 80% LTV would certainly be a cause for celebration. And not only that, but it would mean that you could get rid of PMI.

And every 10% LTV beyond that could be a new milestone, and another cause for celebration.

Celebrate every $10k (or $100k)

Paying off each $10,000 of principal on a mortgage may take you a year or two, depending on your situation. So that’s a cause for celebration.

And the same is definitely true for each $100,000. Just like an odometer on a car (in reverse), seeing that first digit rollover to another is a cause for a celebration.

This was especially true for me, with my $100,000 rolling over to $99,999, losing that sixth digit entirely. So cool.

Celebrate anything

These are just my ideas, so I invite you to come up with your own.

And I admit that they are arbitrary. 10% or $10,000 is just a trick of our number system, a by-product of having ten fingers.

But no matter. The important part is that you focus on milestones along the way, little bits of progress, so that you can feel a sense of accomplishment, even though you still have a ways to go.

That will help you stay motivated as you pay off your large debts. It’s not easy, but it is possible.