I’ve talked about how to spend money. When you think about it, it’s a surprisingly complex decision, and one that takes place many times a day.

I’ve hammered home the point about the dangers of putting everyday spending on a credit card. You spend more because you don’t feel the money, and it makes budgeting that much more difficult.

Then a faithful reader wrote in and mentioned a danger of using cash, that is to say, what if it gets stolen?

I could refute that argument (and did so in the comments), but it did get me to thinking about a potential hole in my argument. If we assume that one doesn’t feel the money being spent as much when using a credit card, wouldn’t the same thing be true with a debit card?

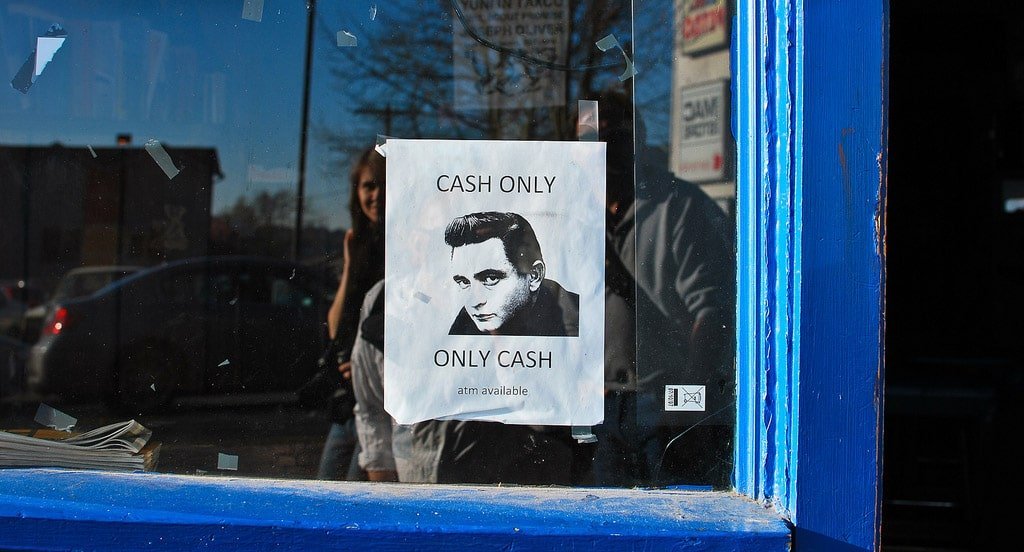

And that got me thinking further: What would happen if I spent only cash for one month?

I’ve decided to find out.

Table of Contents

Rules of the game

The rules that I’m setting for myself are very simple:

- I’m writing this post at the end of June. This challenge will last for the month of July.

- I can use my debit card at ATMs, withdraw money and pay for purchases that way, but I can’t directly pay for any purchases with my debit card.

- I don’t do much purchasing online, but while I will try to minimize it this month, there will be a few situations where not doing so would be more trouble than worth. The point isn’t to self-sacrifice, it’s to reevaluate my everyday purchases.

- And of course, no credit cards.

There will be some exceptions:

- This plan will only apply to expenses. All of my bills that are set up to be paid automatically (which is to say, all of them) will continue to be paid in that manner.

- I have a business trip mid-month, and for bookkeeping and reimbursement purposes I won’t be paying cash for those expenses.

- My checking account reimburses me for ATM fees if I make a certain amount of debit purchases in a month. And since I suspect I’ll probably have more ATM fees than usual this month, I will make sure that I hit this minimum amount.

So many unanswered questions

The fascinating part about this plan is that I truly have no idea how it will turn out.

Will it be a giant pain? Will I lose out on purchasing things because I don’t have the cash? Will I lose out on purchasing things because some places won’t take cash? Will I crack mid-month and abandon the plan? Or perhaps will I find it easier, simpler in some way?

Will I spend less? And if so, why would that happen? Would it be logistical (I can’t spend money if don’t have it on me), or will I spend less because I will feel it more?

Contrarily, could I spend more? I’ve heard more than one of my peers say that they view cash as being easier to spend than using a card, because it feels fake to them, and doesn’t get automatically tracked by their checking account or Mint. Might I feel the same way?

More than anything else: What will I learn?

The envelope system

I’ve talked about using the envelope system in the past, but have never tried it before. I have always used a “notional” envelope system, which is to say, a spreadsheet. Every time I spend anything, I put it in a spreadsheet under the appropriate category, and it tells me how much left I have in that category.

But since I’m using cash, I might as well use the envelope system, at least in part. Perhaps it will be less work to keep track of. Perhaps not. We shall see!

But while I don’t know what I’ll learn through this process, I know I’ll learn something. It will be interesting.

Anyone else want to try this with me? I hear the kids use Twitter, so I’ll be using hashtag #cashonlymonth. Follow along.