I argue that for most people, you can choose to buy a new car or own a home (if you can have either of them at all), but not both.

To be honest, I really dislike those “would you rather?” questions. Would you rather eat nothing but Jell-O pudding for one meal for a month or stand in a lake for eight hours a day for three weeks? I don’t know!

In “Sex, Drugs, and Cocoa Puffs”, the essay collection by Chuck Klosterman, it includes 3 (or 23, depending on the version) questions he asks everyone he meets to find out if he “can really love them”. It includes head-scratchers like:

Let us assume you met a rudimentary magician. Let us assume he can do five simple tricks…These are his only tricks and he can’t learn any more; he can only do these five. However, it turns out he’s doing these five tricks with real magic. It’s not an illusion; he can actually conjure the bunny out of the ether and he can move the coin through space. He’s legitimately magical, but extremely limited in scope and influence. Would this person be more impressive than Albert Einstein?

I don’t find these questions illuminating; I find them vaguely irritating.

However, when the questions are of a more practical and actionable nature, I like the questions much more.

So I ask you, if you could have one or the other, which would you pick:

- A new car

- Own a home

I ask because in most cases, if you can pick either of them at all, you can only pick one.

Table of Contents

Buy a new car

It is generally possible to buy a new car these days.

They are expensive. As of November 2023, a new car will run you approximately $48,247 these days.

But financing is available, and with generally okay interest rates too. The APR on a new car loan will run you between 5-9%, sometimes much lower.

The average term of a new car loan is six years (72 months) so you’ll be spending somewhere in the ballpark of $800 per month of the purchase.

You can do this. It might not be easy, but you can theoretically do it.

Own a home

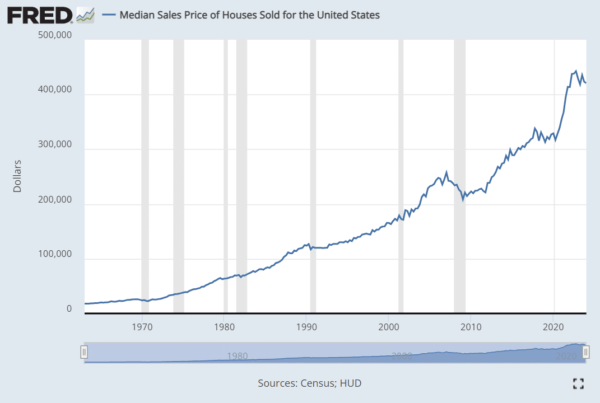

Home prices are a little ridiculous right now. Just take a look at this chart.

That’s the average price of houses sold in the US. Now look at this chart:

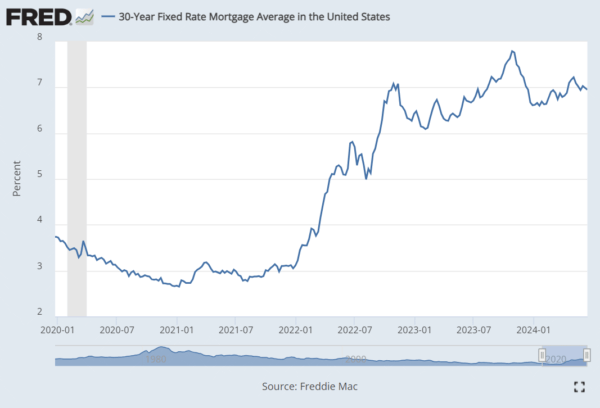

This is interest rate on a 30 year mortgage.

The average monthly mortgage payment right now is $2,300. And let’s not even talk about the down payment. If you’re able to afford a home, it’s going to “just barely”.

But not both

Look at the average monthly price of a car loan. Now think about years and years of this payment, taken out of your pay.

You are not going to be able to afford to buy a home as long as you have this car payment, knowing what mortgage payment prices are too.

But what if you decide that you just will save up for a new car, and eliminate the car payment? You’ll pay less in the long run, for sure, but you’re still years out for being able to afford to buy a home, unless you have all that money now.

And, of course, a new car doesn’t stay new forever. If you want one now, why wouldn’t you also want one later?

For most people, at the moment, you can’t both buy a new car and buy a home, so you need to choose one or the other. If you want a new car, then you must value it more than owning a home. If you want to own a home, then you must value it more than buying a new car.

What I value

I credit my purchase of each of my (used) cars, and especially my first, as one of the single most deterministic factors in me being able to afford a home.

I bought my first car, a 1990 Geo Prizm, when it was already 12 years old, for a whopping $1,200. I then proceeded to keep it going for a decade, well beyond when most people thought was wise.

But as much as I had to do maintenance on it (especially muffler repairs, which seemed to happen every winter) I saved so much money when compared to buying a newer car, and massively when compared to buying a new car. That money went into building my net worth and reducing my debt.

So when the time came and I had the option of buying a home, I was able to take it without it being an undue burden. Sure, it’s expensive, but it would have been impossible had I spent more money on cars.

But that’s just me. If buying a new car is important to you, then feel free to go on renting. There is nothing wrong with renting after all. Just make sure that you make this intentional choice.

Neither

You also don’t need to do either. And perhaps you can’t do either.

That’s okay. New cars are expensive, and not any safer than used cars. They also aren’t necessarily going to require less maintenance than a used car. (I’m not going to get into brand loyalty, but buy a Toyota. Enough said.)

And homes are expensive too, beyond just the mortgage payment. There are appliances (and repairs to same), windows, roofs, lawns, and I could keep going. Moreover, it is perfectly possible to build wealth as a renter, so it’s not like it’s your only key to financial wellness.

Bottom line

If you’re wanting that new car smell, you may want to say goodbye to your dream of owning a home.

If you’re wanting a home that’s yours, be prepared to buy a used car.

So, which would you rather?