I’ve long railed against debt. Debt slows you down from achieving what you want, and forces you to pay companies that don’t have your best interests in mind.

I paid off my last debts four years ago, and I felt an immediate and lasting sense of intense relief. It was like there was an anxiety I had been carrying around that I never realized I had until it was no longer there. It just felt so good to have have no bills to pay aside from regular day-to-day life things like the electric bill…

…and rent.

And that’s the thorny part of the story. Because although I was technically out of debt, in some ways it felt like a false reprieve, because there was this giant payment each month that I still had.

Was I really out of debt when I was still paying rent?

Table of Contents

The phantom debt

Rent isn’t technically a debt, as you’re not really paying anything back.

But yet at the same time, it kind of feels like it. And it’s a big one; what other payment do you have that is 25-50% of your take home pay? (I hope you don’t have an answer for that.)

After a while, it does get one to thinking: “Wouldn’t it be nice if I didn’t have to pay that much money each month?”

Now, there are ways to live rent-free. But for me, the most viable way to live rent-free for the long term is to buy a home. (Not a house, a home. The two are not the same thing.)

Which means, ironically, that to get truly free of rent, I will need to go back into debt.

The giant debt

And what a giant amount of debt it is. Like a joke-fantasy, how-many-zeroes-is-that? debt.

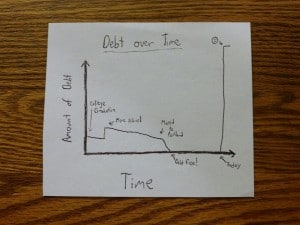

Because I feel like charts are important for visualization, here is a well-researched, accurate graph of the amount of debt that I’ve carried in my life, starting from when I graduated from college, to when I went back school again, all the way to now.

You get the point. Unless you’re a post-doc or a lawyer, you’ve never seen debt like this until you go to buy a home.

Thinking long-term

But if I hate debt so much, why would I take out so much of it?

In short, because I’m thinking long-term as well as short-term.

It’s not enough to just think about how much you’re spending in a given month, you also need to look at how much you pay over the long term. You can pay hundreds of thousands of dollars in interest on a mortgage, but how does that compare to the years of your life without any home payment at all?

(That’s not a rhetorical question. You would be well served to calculate it and see.)

A cautionary tale

But even if you’re not swayed by math, here’s a tale that has haunted me for over a decade.

It regards the parent of someone I used to know. Although he (the parent) lived in a modest apartment, he lived in some style. Stories were told of years of lavish living, of always having the latest technology and gadgets.

But I knew him in his late middle age, and for all his extravagance, I knew that he had built very little for the future. When I knew him, he had become acutely aware that he had very little saved for retirement, and his home, which he had lived in for over two decades, was rented.

So on top of not having much of a retirement fund, he also didn’t have any benefit to all that renting. He still had to pay up.

Imagine this is you. Say you’ve paid rent each month for the last two decades. Next month you’ll pay rent too. And when you move out, you won’t have earned anything beyond the (admittedly huge) ability to live in the space.

Now imagine that you bought 20 years ago, and paid your mortgage every month. Next month, you could be paying nothing. And you still get to live there. And when you move out, you’ll have banked a serious amount of equity, regardless of how much your home is worth.

I know where I’d rather be in 20 years.

Debt/relief

As mentioned, I felt a huge sense of relief when I paid off my final student loan. It was relief from an anxiety I never knew I existed until it was gone.

Which leads me to wonder: what kind of relief will I feel when my rent payment and my soon-to-be mortgage will be gone from my life? How will I feel when I am totally, completely, unequivocally out of debt?

Time to find out. Eventually.

But enough about me. What was it like for you when you paid off your debts?