Not everyone can or should buy or own a home, and that’s okay, because you can still build wealth as a renter.

So much of the conversation around wealth building in this country involves buying a home. Your duty, it seems, is to get to a place where you can buy a home, and then if you wait long enough, wealth will somehow happen.

This may have been true in the heady days of pre-2007 when everyone was using their homes as piggy banks, buying and flipping them for massive profits in short order.

But assets don’t increase in value at a massive rate forever. (People who bought bitcoin at $60,000 a few years ago know this the hard way.) And it’s never a good idea to assume that your home will increase in value.

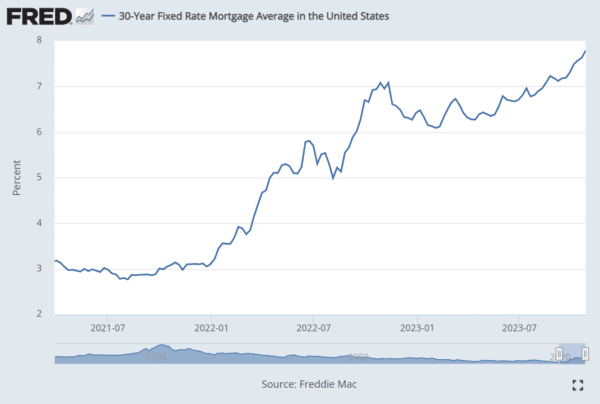

So in these days of higher interest rates and massively inflated home prices, buying a home can seem out of reach for many.

And to be honest, I don’t disagree. Assuming your financial situation hasn’t appreciably changed in the past few years, it’s very possible that while you could have bought in 2020, you may not be able to buy today.

But that’s okay, because you don’t need to own a home to build wealth. And building wealth is way more important than owning a home.

Table of Contents

Enforced savings

A recent report about homeownership was very interesting to me. It basically said that it wasn’t the “ownership” in homeownership that helped homeowners build wealth, but in fact the “enforced savings” that happens when you own a home.

Since most people take out mortgages, a certain amount of your mortgage payment goes to paying down the mortgage principal. Assuming your home doesn’t change in value and that you get the same amount back when you sell, that means that you are, in effect, putting a few hundred (or few thousand) dollars away each month in a “savings” account that is your home.

That leads naturally into the discussion of what to do if you don’t have a home in which to put this “enforced savings”.

Unenforced savings

When you’re a renter, you can think of your monthly rent payment as a mortgage payment in which the mortgage will never be paid off.

So, in order to match the above benefit of being a homeowner, you need to, in effect, “enforce your own savings”.

If we assume (as we should) that a home won’t necessarily increase in value, then it’s nothing more than a savings account.

So if you might pay down $500 (say) in principal every month, you can get the same savings benefit by putting away $500 into savings.

While it may feel different, mathematically, it’s the same thing.

All that you don’t need to pay for as a renter

Now, if you’re thinking, “but my rent payment is the same as a mortgage payment would be”, let’s talk about all that you don’t need to pay for as a renter.

Which is, basically, everything.

In most cases, as a renter, you don’t need to fix the roof, shingle the sides, repair the sink, replace the toilet, change the boiler, or any of the other myriad maintenance issues that a homeowner needs to handle on their own.

So while your rent payment may technically be the same as an equivalent mortgage payment, in actuality, you’re paying far less.

But what else can you do to make your renting situation as advantageous to you as possible?

Find a human landlord

If your landlord is a person or family, they are less likely to raise your rent, and when they do, they are less likely to raise it as much.

Contrast that with a property management company, which usually has contract details such that they will raise your rent by 2.2% each year, or something.

I lived in New York City for almost a decade, and in that time, I lived in two different apartments. Both were owned by Polish families, one a merciless tyrant with a daughter to match, and one a sweet middle-aged woman who liked me so much that I think she may have wanted to set me up with her daughter.

In both cases, neither one of them ever raised my rent in all the years I was there.

If you can find a landlord that isn’t a property management company, you will likely start underpaying rent relative to the equivalent place with a management company eventually, and then you will have more money to put away in savings.

Stay in your place

Even if you have a property management company that raises your rent on a strict schedule, it’s true that if you stay in a place for a long time, your rent will tend to be lower than if you switch apartments frequently.

And that’s not even mentioning the cost and hassle of moving.

So if you can, find a place you like and then stay there for the long term. Over time you will start having more money to put away in savings.

Invest, invest, invest

You might have an actual advantage as a renter compared to a homeowner.

Remember, the homeowner is using “enforced savings” to build wealth. But if the home doesn’t rise much in value—and this can never be assured—then the homeowner is effectively just putting money in a big savings account.

Whereas you, not tied to any mortgage, can invest this money anywhere.

I can’t offer financial advice here, but investing in good low-cost index funds from Vanguard, Fidelity, or any other similar services will likely net you the most returns you’re going to find anywhere, probably around 8% over the long term, if past history is anything to go by.

So take your enforced savings and invest it in all the ways that a homeowner can’t, because they are too busy paying off their mortgage.

Live within your means

It’s not always true that an owned home is going to be larger than a rented home. There are small apartments for rent, and there are small condos for purchase.

The difference is that you have the flexibility to live within your means as a renter, and to change that more easily if the need arises.

When I left New York City, I called my landlord up and told her I was leaving. Then I rented a van, got my stuff packed away, and drove off into the sunset (actually snow, but that’s a different story).

Try that if you own a place.

The flexibility of renting means that you can more effectively right-size your living arrangement, which can make your situation more affordable.

And that can give you more money to put away.

You don’t need to own

I hope you see that owning a property is just one way of building wealth.

In almost all cases, what builds wealth is the act of making lots of little decisions that improve your financial situation, consistently, over a long period of time.

So if buying a home isn’t in the cards for you for whatever reason, don’t fret: you can build wealth and never own a place at all.

Happy renting!