The American Rescue Plan signed by Joe Biden makes student loan forgiveness tax-free, which has huge implications for millions of people.

Boy, it’s nice to have adults running this country again, isn’t it?

Paul Krugman of the New York Times recently said that “the era of ‘the era of big government is over’ is over.”

I love that. But can I play too? How about this?

The nineteen most terrifying words in the English language are “The nine most terrifying words in the English language are, ‘I’m from the government, and I’m here to help.’“

Okay, moving on…

You’ve all no doubt heard about the historic passage of the American Rescue Plan, signed by President Biden on Thursday, March 11th, the date notable as a the same day in 2020 the World Health Organization declared COVID-19 a pandemic.

Everyone is talking about the $1,400 checks, the unemployment benefits, and the aid to businesses.

But I want to talk about student loans.

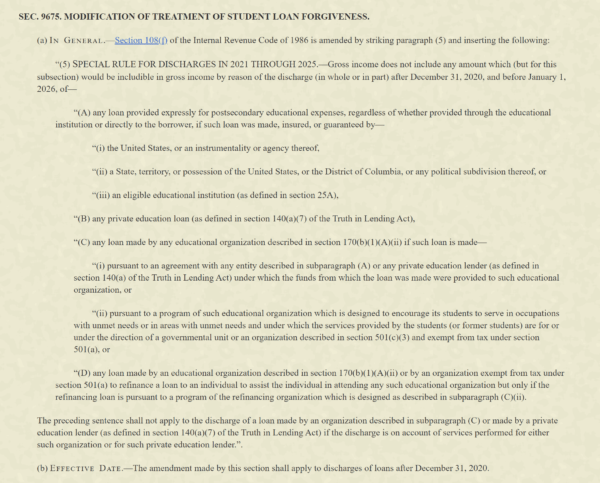

Because hidden in plain sight in the bill—Section 9675 to be precise—is not a bombshell, but the opposite: a defusing of a bomb for anyone who has student loans.

Who has student loans? About 44.7 million of you. So you definitely want to know about these changes.

Table of Contents

What’s the big news?

I won’t bury the lede any longer. One of the provisions in the American Rescue Plan makes any student loan forgiveness a non-taxable event. This provision, which even has its own name, the Student Loan Tax Relief Act, eliminates a tax bombshell that many student loan holders are not aware of.

This is huge, certainly much larger than those one-time $1,400 checks.

The bombshell hidden in student loan forgiveness

What if I told you that up to this point, if you got your student loans forgiven through an income-driven repayment plan, it was considered taxable income? You might not have known that. (In my experience, many people do not.)

What does that mean? Well, let’s say that you earn $50,000 a year, you have $50,000 in student loans, and you’ve been on one of those repayment plans that allow for forgiveness after 25 years. And let’s say that, unlike basically everyone, you successfully qualify for student loan forgiveness.

Wham! That $50k loan is struck from your books. But in its place is a record of $50,000 in income.

So the year that this happens, you would be said to have earned $100,000 in income instead of $50,000.

That would result in an increase of somewhere around $12,000 in your taxes for the year.

Let me repeat: by getting your $50,000 of student loans forgiven, you would be charged $12,000.

And this isn’t a low interest loan. It’s due April 15th at tax time. You will have, in effect, shifted a large loan to pay off over a long period time to a large tax bill that you need to pay off right now.

And let me ask you: if you’re going for student loan forgiveness, you probably don’t have the money to pay it off right now. So if you don’t have the money to pay it off over the long term, why in the world would you have a large chunk of money to pay it off now?

Now, this tax bombshell wasn’t true for all student loan types. (Here’s a list of what used to qualify.)

But now, this new legislation appears to cover all student loans, both originated by the government and private lenders.

Wow.

Time-limited

It gets trickier though. This tax-free status is not permanent. It is set to expire at the end of 2025. So if you qualify for forgiveness between now and then, you’re golden. But if your eligibility comes up in, say, 2030, you’re out of luck.

Asa an example, those who qualify under the Pay As You Earn (PAYE) program, established by President Obama in 2012, won’t qualify for this, because the program was established in 2012 and has a 25 year forgiveness period.

Not time-limited?

The reason for this time-limited situation is because of the budget rules that governed the reconciliation process of the bill, which Democrats used to avoid Republican obstructionism. Basically, the bill had to be budget neutral, and because of this, many of the clauses had to have built-in sunset clauses.

It’s the same reason why tax rates changed in the 2017 tax law, but only for 10 years.

However, a temporary provision can become a permanent one, or if not permanent then at least an extended one. Once something is enacted (and popular) there may be pressure to keep it from expiring.

So while no one knows what the country will look like in 2026, it is certainly possible that treating student loan forgiveness as non-taxable may become politically untouchable, like how protecting those with preexisting conditions is now (but wasn’t for a long time).

What this might pave the way for

There has been much talk about whether Joe Biden might elect to “cancel” a certain amount of student debt for each borrower.

While progressives have been pushing for $50,000 of canceled debt, Biden seems to be more amenable to a $10,000 level.

This legislation, then, paves the way for our government to be able to do this cancellation without saddling every poor soul with thousands of dollars in unforeseen tax bills.

This makes total sense. Because, can you imagine? The Biden administration cancels thousand of dollars of debt and then all these poor would get a giant tax bill at the end of the year because of it? There’s no way.

So if (and it’s still an if) mass student debt cancellation is going to be a thing, this is a vital step in preparation for that.

Will it happen? No idea. But it’s certainly more possible.

So should you stop paying off your student loans?

As of this writing, if you have certain student loans, you are not required to make any payments on them. Plus, interest isn’t being earned, so in effect, your student loans are frozen.

Recently, I argued that this was the best time to pay down your student loans. After all, 100% of your money is going to pay down principal. If you have the money (and I recognize that not everyone does), do it!

But what about now? If student loans are going to be canceled, then isn’t it just wasting your money, especially if you have less than $10,000 in debt?

The problem here is that we don’t know what’s going to happen. Student loan debt may be canceled. It might not.

(And frankly, I wouldn’t put it past the next Republican administration to find a way to reinstate the debt out of spite for the college “elites” or something. But I digress.)

Yes, it certainly seems likely that something is going to happen, but we can’t say that it’s a certainty. After all, it would be an unprecedented step. Unless I’m mistaken, I don’t know of any other mass canceling of this kind of debt in our modern history.

So I would keep paying on them if you can, until we know more.

What about if your loans will soon be eligible for forgiveness?

Erm. Errr. Well. Hrmmph. Ummmmm.

I don’t know.

I’ve always used the tax issue as the main argument against advocating for going for student loan forgiveness. It’s not a great deal for most people.

But if that tax bomb goes away, why not just go for it? Why not just pay the minimums required for income-based repayment for 20ish years, and then having it wiped clean? Why not use that money for other purposes?

I’ll come clean and say that I have some resistance to the student loan forgiveness route. After all, I believe that we should pay what we owe. You took out the loans, and you knew that your degree might not pay off.

But on the other hand, while we knew what we were doing, we didn’t know what the social contract would be on the other end. What the job market would be like. What tax rates would be like. What income would be like. What income inequality would be like. None of those things are in our control.

And it’s becoming very obvious that the labor market is not coming through for the vast majority of Americans. Wages aren’t going up, but costs are, and this isn’t changing.

So why not take advantage of a deal that’s legal and available to you? Why bother standing for moral rectitude when the system is rigged against you in so many ways?

I have to admit: this is starting to change my mind, and I’m leaning toward saying that going for student loan forgiveness is a valid course of action.

But you have to do your homework. Way too many people are paying minimums for years, only to find out that they weren’t in the right program, and that they aren’t eligible for forgiveness. Don’t be that person.

What if you’re upset that you paid off your student loans while others are getting them forgiven?

How about you instead focus on all the ways that you got ahead through your own privilege?

And practice a little more compassion. Come on, instead of being butthurt, be happy for other people. You’ll live longer.

Final thoughts

I want your student loans gone. However you can figure out how to get rid of them, whether it’s forgiveness or payment, get them gone.

Some people think that student loans are just a part of life, that you’ll never get rid of them, that you’ll have them forever! I disagree. I paid off my student loans, and you can too. For once, you’ve got an extra benefit on your side this time. Thanks, Joe.