I respond to the recent announcement of student loan forgiveness by the Biden administration.

By now you’ve all heard the news: the Biden administration announced a $10,000 reduction in the balances of student loans for some borrowers, and $20,000 reduction for some other borrowers.

This is seismic, and has, as far as I can tell, no precedent in U.S. history.

Because of the historic nature of the announcement, of course people have some strong opinions about it, and I’m of course no different.

But while I hail this announcement as being a net positive for borrowers and the wider economy as a whole, I can’t help but feel like it’s also a little futile, at least from a macroeconomic perspective.

But first, let’s make sure you understand what’s going on.

Table of Contents

The student loan plan

I’ll be brief, because you can find this information in lots of other places (such as here or here).

You are eligible for up to $10,000 in student loan debt relief if you:

- Have that much or more in federal loans (not private)

- Earned under $125,000 a year (single/head of household) or under $250,000 (married) in either 2020 or 2021

- Had your loans disbursed by June 30 of this year

You are eligible for up to $20,000 in student loan debt relief if you:

- Qualify for all of the above

- Received a Pell Grant

I’m assuming that there will be a phase-out situation, meaning that you’re not totally screwed if you earned $125,001/$250,001 last year, but I’m unable to get confirmation on this.

This plan is supposed to go into action in October 2022. If you want to know more, sign up at the Department of Education subscription page.

The DoE may not know your income level, and so they will have an application for you to fill out. If you think you might be eligible for student loan relief, make sure you fill this application out immediately:

Why this student loan forgiveness is great

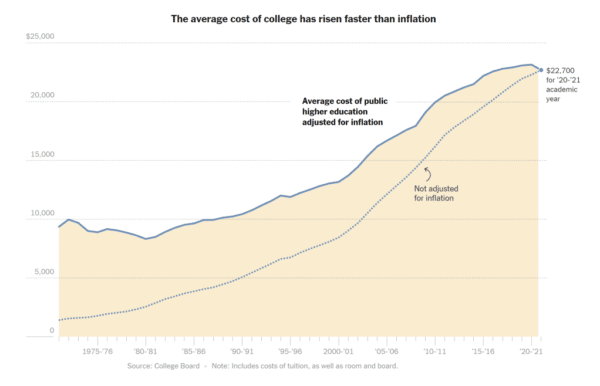

If it’s been a while since you’ve been in higher education, you may not have noticed that costs have gotten a teensy bit higher over the years.

Forget about our recent inflation situation. Historically, inflation has grown by 1-3% a year, while tuition has grown by 8% a year.

That may not seem like a big difference, but it adds up.

In 20 years, at a 2% rise each year, the cost of something will be about 150% of what it was. but at 8% a year, the cost of that same something will be almost 4700%.

Put into numbers, a $10,000 cost at a 2% yearly rise would be around $14,900 after 20 years, but would be an astonishing $46,600 at 8%.

So if you’ve been out of college or higher ed for more than a decade, and you think student loan cancellation is somehow unfair because they should just “pay what they owe”, shut up. You have no frame of reference, and your perspective is not relevant.

And that’s why this student loan debt forgiveness initiative is great: it gets today’s student loans slightly more in line with the cost of student loans of yesteryear.

Some other ways that student loan forgiveness is great:

- It could address and lessen the racial-wealth gap, according to FiveThirtyEight.

- It targets the middle class, unlike, say, the 2017 tax cuts. For example, one estimate from the Penn Wharton Budget Model finds that 75% of the benefit would go to people earning $88,000 or less, while the White House estimates that 85% of the 2017 tax cuts went to people earning more than $75,000.

- When people have less debt, they have more money to spend in the economy. I have no references for this, but this seems a self-evident fact.

Why this student loan forgiveness is futile

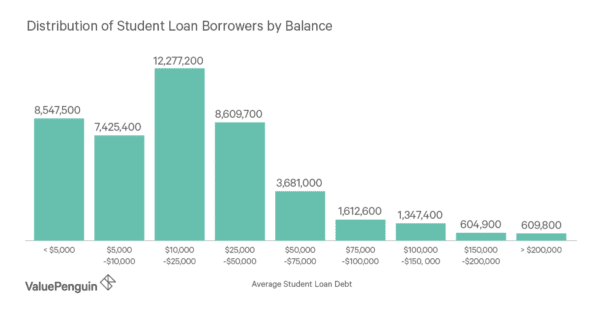

The average student loan debt per borrower is around $32,000.

But millions of people have way more than that, including over two million with over $100,000 in their balance.

So if you lop off $10k or even $20k, I ask you: what the hell’s the difference?

There is a difference, of course, but in many cases, this might not make a student loan massively more affordable than it was.

Plus, how does this help a 16 year old who’s about to enter college now? They can hope for debt forgiveness in the future, but they shouldn’t expect it. And worse, this may encourage borrowers to feel more comfortable borrowing, because they may believe that forgiveness is coming one day.

Which would make the whole student loan situation worse.

Finally, this does nothing to address the out-of-control rise in tuition prices (and might even exacerbate them).

Is it fair?

Some people are upset that they paid their student loans off, and now other people won’t have to.

And for reference, I paid my student loans off, and didn’t get any help.

Oh wait, I had massive amounts of help, from being a white male in America working in a lucrative field, having supportive parents, and without any medical or emotional complications.

You had help too, and if you can’t see it, that doesn’t mean that it wasn’t there.

Feel free to whine about how you worked hard while others don’t. And all you’ll sound like is petulant, selfish, and myopic. It’s not a good look.

Instead, how about you cheer on those who’ve had good fortune? Or, is there something in who in particular will be getting most of the help that you don’t like?

Perfect vs. the good

So, in short, student loan forgiveness is a sizable bandage on a massive wound, but does nothing to stop future people from being cut.

I’m not so cynical to think that it was just a political tactic though. Given the alignment between higher education and voting Democratic, I’m not sure Biden picked up any new voters here.

And I don’t have the answer to what should be done next. Ongoing loan forgiveness? Prevent colleges from charging the prices they do? Universal tuition?

All I know is: student loan forgiveness is not enough, but it’s a good start.

2 Comments

Jim

“So if you’ve been out of college or higher ed for more than a decade, and you think student loan cancellation is somehow unfair because they should just “pay what they owe”, shut up. You have no frame of reference, and your perspective is not relevant.”

Seriously? College is absolutely overpriced. People are paying for degrees that aren’t worth what they’re being charged. If they were, they’d be easier to pay back. The problem is that people who are smart enough to realize this and go into a blue collar job…maybe start their own business and buy tools and a truck, what do they get? Now that blue collar business starter (that now has debt of their own) that was smart enough not to borrow more than he could pay back is stuck paying taxes to pay back someone’s student loan they couldn’t afford. Of course that’s not fair. So, you, “shut up”.

I would have no problem with this, if the colleges were on the hook. But they’re not. The American taxpayers are. It’s ridiculous.

Mike Pumphrey

Thanks for sharing your thoughts, Jim!

I agree that the cost of education is rising unsustainably, and that, as far as I can tell, nothing is being done about it. And that of course needs to change.

But I have to disagree about the idea that we shouldn’t pitch in for other people’s life choices, even if they turn out to have unintended negative consequences. I don’t have kids, and my property taxes fund schools, but it would be ridiculous for me to say that my tax dollars shouldn’t go to kids’ educations.

Also, those people who made “bad choices” by taking on too much debt are an untapped resource for the economy. If they were to have less debt, they would have more money to, say, spend money at your business, or start a successful business of their own. So I’d like to think that our tax dollars are supporting that.

I know it’s challenging to think about one’s tax dollars going to something that you disagree with (I have plenty that I disagree with). But I think that’s just the cost to live in our society. And plenty of people have taken their tax dollars and used it on something that doesn’t benefit them at all: namely, us.