For most people in most places in the U.S., it is less expensive to rent a home rather than buy it. Will it be this way for the long term?

The rent-vs.-own question is one of those “to be or not to be” moments for any household. It feels both existential and also ephemeral, like something you both need to know and also can’t ever figure out.

As we all know, home prices have been rising for years now, and interest rates, which a few years ago were at historic lows, are now sitting at just above the comfort level for a lot of people. It’s not a great time to be a first-time buyer in the market.

And new data has come out showing a potentially even unhappier statistic: it is more expensive to buy than rent basically everywhere.

That’s the top line, but there is a lot of details worth digging into, which hopefully will help you bring peace to your decisions, both past and future.

Table of Contents

Study #1: Metropolitan areas

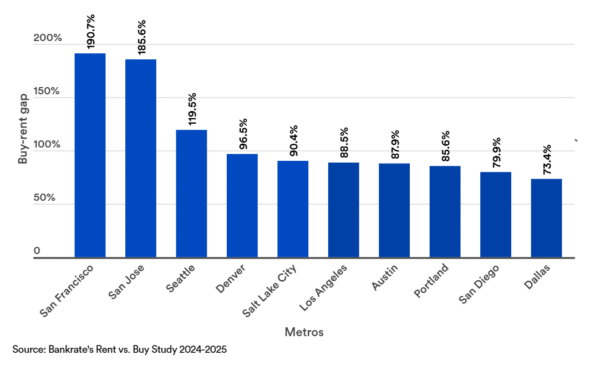

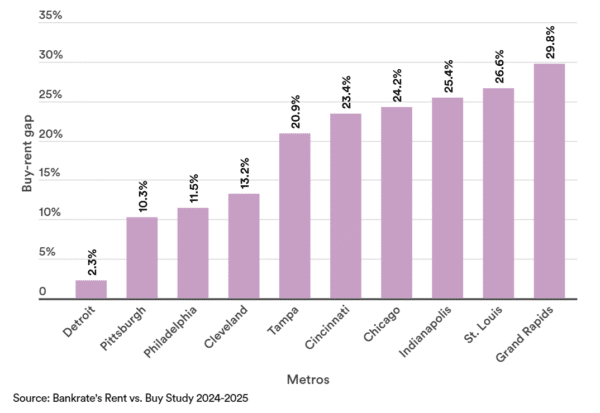

Bankrate came out with an analysis less than a year ago, where they looked at the costs of renting a home and the monthly costs associated with owning a home.

And they found that in all 50 of the largest U.S. metropolitan areas, the cost of owning was higher.

Now, this varied based on which areas were being talked about. For example, west coast metro areas had the biggest gap, with places like San Francisco and even Portland being 191% and 86% higher, respectively.

Meanwhile, metros like Detroit and Philadelphia were only 2.3% and 12% higher, respectively.

Now, methodology matters, and in the fine print, they say that they estimated owning costs by assuming a 20 percent down payment, and frankly, that alone seems suspect. For that reason, I’m assuming the true costs of owning are even higher here.

Study #2: The U.S. market as a whole

The Economist also recently referenced a different study. It noted that from 2015 to 2021, the average cost of renting were higher, but since then the picture has flipped, with the cost of owning being higher (paywalled, sorry), on average $400 more a month, but in some places, thousands of dollars.

So what changed? In two words: interest rates.

Despite what you may have heard, mortgage rates don’t rise and fall directly due to the interest rates the media is always talking about. That rate—the federal funds rate—is for short term loans.

A mortgage is definitely not a short term loan. And the 30-year mortgage rate is related to the 10-year Treasury note, which is itself determined by investor expectations regarding monetary and fiscal policy, economic growth, and inflation. So they’re related, but not directly correlated.

Interest rates still hold the key (maybe)

Despite the weak link between interest rates and mortgages rates, that Economist article notes that the long-term future of home ownership is related to the long-term outlook on interest rates.

And that’s not good for people who are looking to buy:

“[D]espite recent interest-rate cuts, five- and ten-year government-bond yields mostly sit where they did three years ago. In America 30-year mortgage rates remain above 6%…Picking a likely victor in the battle between [renting] and ownership therefore means taking a view on the future of long-term interest rates. Your columnist would suggest that they look worryingly sticky. Concerns about government debt and long-term inflationary pressures are not going anywhere.”

So, it seems that we may be stuck with renting being the cheaper option for quite a while.

Why renting is better

I know there’s a strong emotional attachment to owning one’s home. And as someone who has been booted out of my rental before, I’m very happy to have a mortgage and not be “bootable” anymore.

But if I were still renting today, I probably wouldn’t change it, and I’d be not too terribly unhappy about it either.

Let’s look at some data from the first study. In the “Portland-Vancouver-Hillsboro, OR-WA Metro Area”, the average monthly rent is $1,846, while the Average monthly mortgage payment is $3,426.

Let’s say that I had $3,426 to spend on housing in a given month, but decided to rent instead. That would mean that I would have $1,580 a month to do with as I pleased.

If I invested the difference between renting and owning each month, and made an 8% return, in 20 years, I’d have over $900,000 to my name.

Now, obviously there are a lot of caveats to this calculation, but I hope you get my point. If owning isn’t in the cards for you, you are not shut out from building wealth. You’re just shut out from mortgage payments.

Don’t hold your breath

I have no idea whether interest rates are going to go up or down; nobody does. I would suggest that if we bet on anything, that we bet on things more or less staying the same for the time being.

So if you’re really wanting to buy a home, then I say just keep socking away money for that down payment. You’ll be hoarding cash for now, and if you decide down the road that home ownership isn’t for you, then you’ll have a pile of cash to invest for the future. Could you work with that? Indeed, that is the question.