Paying off debt requires drive, focus, patience, and accountability. In this post I show how you can pay off a large debt.

In a recent YouTube video, I talked about a hypothetical $10,000 debt.

Now, for many people, this sort of thing isn’t hypothetical at all. In fact, it’s painfully present, in the form of your monthly payments.

In fact, one reader on my mailing list where I tackle some of these questions, wrote me and asked how one would start paying down such a debt.

Indeed.

Now, I wish I could say that by the end of this post you’ll be all paid off, but I can say that by following the steps below, you will have all the tools you need to get there.

(And these tools apply no matter the size of your debt, too.)

Table of Contents

Get mad

$10,000 is a lot, and it’s big enough that you can’t be neutral about it. You can’t just say, “oh, paying that off would be nice.“

You need to get mad.

You need to stand up and say, “no more! I hate this weight on my shoulders. I want it gone, and I want it gone now!“

Getting fired up allows all the other steps to become more easily accomplished. This is a big project, and you’re settling in for a big fight.

And yes, it is a fight. It’s a fight between your conflicting behaviors, the one who wants things now, and the one who wants to have bigger and better things later.

If you’re not fired up, nothing else is really going to make a difference.

You can help yourself get fired up. Think about how much money goes to debt payments and interest each month. Think about how that money is being taken from you, month after month,

No more. That stops now.

Stop accruing debt

It seems like such a cliché to trot out the phrase “you can’t dig your way out of hole” but it’s never more accurate than here.

You can’t pay off $10,000 in debt if you’re still pulling out your credit card.

So that needs to stop right now. You need to take your credit card out of your wallet. Put it somewhere else. Encase it in a block of ice and put it in your freezer.

Is your credit card number stored in your Amazon account, or where you pay your bills? Well, that stops too. Remove your credit card number from all of your online sites. Replace it with a debit card.

I don’t care if this one credit card is one you pay off at the end of each month. You’ll already have paid it off if you never use it.

Know how much you spend

Some people use credit cards because they’re not sure if they’ll have enough money to pay for all the things that they buy.

But what if the answer is that they don’t? Then they are just going to accrue more debt. (See the point above.)

So you need to learn how much you are spending. You know your income (most likely), and you can figure out your monthly bills with a little bit of effort, but how much are you spending on Postmates? Gas for your car? How much do you spend with Amazon? It’s time to find that out.

Sign up for my list and you’ll get my free worksheet on how to figure out your spending. Follow the instructions and you’ll be all set.

Take control of your income

All of your spending power comes from your income.

And so, you must use it wisely.

Once you’ve determined how much you spend, you have the power to make changes.

You want to pay off that $10,000? Then you’re gonna need to throw some more money at it. That money is going to have to come from somewhere. You’re going to have to spend less in some areas.

Luckily, just by knowing how much you spend, you will spend less. So this isn’t as hard as it seems.

This debt isn’t going to pay itself off. You need to make some choices.

Make a plan

Figure out how long it’s going to take to pay off your debt.

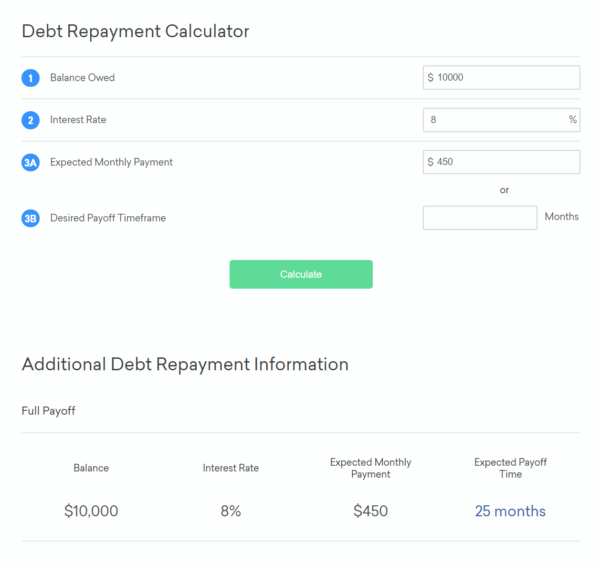

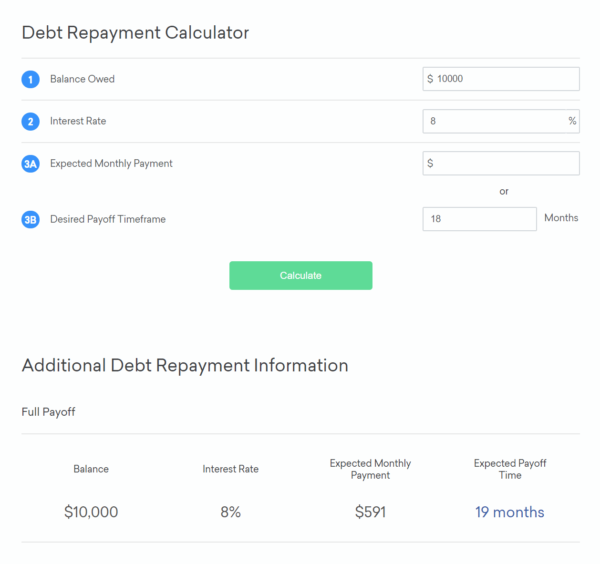

There are some good online calculators out there. Here’s one.

If you have an 8% interest rate and have $450 each month, it will take you just north of two years to get rid of it.

Or you could do it the other way: envision when you want to be done with the debt, and figure out the required amount from there.

Want to be done with the debt in 18 months? That’s $591 you’ll need.

Now go find it.

If your $10,000 is divided into multiple debts, I recommend the “debt snowball” method, paying the smallest debt down first and then repeating with the next highest one.

But no matter which way you choose, don’t try and pay everything down at one. Stick to one at a time.

Stay focused on the goal

Why are you bothering?

Why go to all this trouble? You could just keep rolling over the balance forever, right? Just keep one-click ordering from Amazon and kick the can down the road.

You need stay focused on the goal. And the only way that you can do that is by knowing why you’re doing it.

It’s not just the sheer raw pleasure of seeing a zero balance.

It’s how being debt-free feels.

You may not ever have experienced that relief and lack of anxiety before, not in years.

Well, it’s amazing. You’ll see that you’ve been holding onto stress so long that you didn’t even realize you had it.

And as a bonus, once you have that debt out of your life and you’re able to use that money for other things, that’s when the fun starts.

All that money going toward debt and interest? Now it’s yours. Put it away, spend it on fun, buy a car, take your family to Hawaii, whatever. You’ll have so much more money at your disposal that the sky will be the limit.

Think about it: in the examples above, you could have $450 or $591 extra each month when you’re done. Could you think of something to do with that money? I bet you could.

Remember the why. Stay focused on your goal. And every day you’ll get closer. You can do this.

Be accountable

Big tasks are hard to do alone. It’s very easy to let yourself slide and slack off on the task. That’s why I recommend getting some accountability. If you have a partner, they could be a good person to enlist. Or a friend. Or me. I’ll keep you on task, for sure.

But however you do it, know that big things are possible. They take time, but they’re worth it.

Now get to it!