If you’re experiencing a financial situation where you’ve ever thought “I can’t pay my bills,” here is how to start to manage the situation.

It’s a scary time in our economy right now, at least if you’re not in the top 10% percentile of income earners.

Unemployment is relatively low, but hiring is almost at a standstill. Because of this, there is a pervasive feeling that if you lose your job, you’re not getting one for a while.

Moreover, there’s a justifiable fear that even if you don’t lose your job, costs will become untenable. For those of you on the (Obamacare) marketplace, premium subsidies are set to expire unless those in power can be bothered to try to extend them, which in some cases would make payments more than double for some people.

And don’t forget that they just cut over $180 billion from the SNAP (food stamp) program, so if you’re out of work, you’re not going to get much help there.

Everything has gotten more expensive over the past few years, from car insurance, to rent, to groceries. We can debate the causes of these things, but we can’t debate that the people in charge clearly aren’t going to do anything to make any of this more affordable.

And eventually, you may reach a breaking point and not be able to pay your bills.

I’m here to tell you what to do if this happens to you.

Table of Contents

Know what’s important (and what is not)

You’re never really behind on a single thing. This is because if you’re behind on one bill, you may decide to not pay other bills in order to not miss that one bill. So a hole in your finances can (and maybe should) move around to other places.

So it’s important to look at all of your bills to know what is important (and urgent), and what isn’t.

Keep the lights on

You have regular bills, but they are not all the same. Some are for ongoing services, and some are for debts.

And if you can’t pay everything, you need to organize them by priority. And the first priority is “keeping the lights on”.

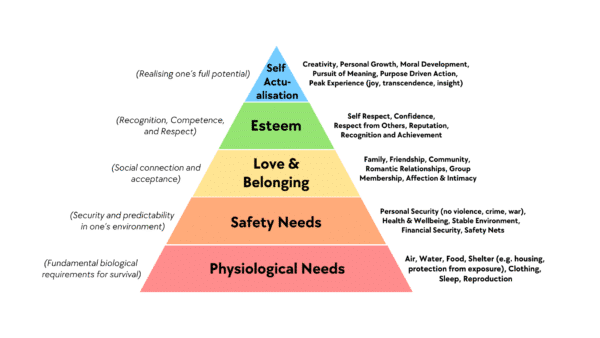

Here’s what I mean. Look at Maslow’s Hierarchy of Needs, specifically the bottom.

Fundamentally, this is what we all need to survive: air, water, food, shelter, clothing. So to my mind, the first, most important payment not to miss is your rent/mortgage payment. If you don’t have shelter, literally everything becomes a lot harder.

Now, I know that rent is too damn high but that’s why you need to make choices. If you have the choice between paying rent/mortgage versus basically any other bill, pay the rent/mortgage. (Leave the credit card alone.)

Next up, I would put utilities and food. For utilities, I’m talking the electric bill and the gas bill, whichever you have. A cold home (or a hot home) can be unsafe, so I would prioritize those next. Remember, these take priority over almost all other bills.

And food isn’t a bill, but still needs to be paid. And basic clothes to get you through. These are all what I consider “keeping the lights on”. They are more important than anything else, even if you’ve heard otherwise.

Secured debt

Now we move on to debts. These are bills, but instead of to pay a service, it’s to repay something you owe.

We need to break up debts into two categories: secured debt and unsecured debt.

Secured debts are debts that can be tied to a thing or service. A car loan is a good example of this. The car secures the loan. If you don’t pay the loan, the car itself serves as collateral for the loan.

To put it bluntly, secured debts have something attached to it that can be repossessed. And that’s why they’re next on the list.

After you’ve “kept the lights on”, if you have money left over, pay your secured debts.

Now granted, if you have a $50,000 car loan, the best bet might actually be to sell the car and buy something cheaper, but I’m assuming that’s not your situation.

Unsecured debt

Every other debt is considered unsecured debt: Credit card debt, student loans, even medical debt. Unsecured debts are debts where no one can repossess anything of yours.

This is not the time to be worried about your credit score.

And even though they may seem important, and of course they are, they don’t have the same priority as other debts.

Note that the important bills don’t always correspond to the ones where the lender is the most aggressive in getting you to pay. In fact, it’s often the opposite. A credit card that goes unpaid and goes to collections can sometimes be dealt with in the most aggressive and obnoxious ways, with collections people calling you and maybe even threatening you. But that’s not a measure of strength, it’s a matter of weakness.

Unsecured debt collectors don’t have any leverage over you, which is why they’re so aggressive. The lender for your car doesn’t need to be so aggressive, as they can (eventually) repossess your car.

Due diligence

If you can’t pay all of your bills, then you want to make a list of all your bills, and order them by priority. Pay what you can with what money you can, and then stop when the money runs out. Don’t try to pay half of every bill, because then you’ll have lots of angry creditors. Try and reduce the number of delinquent bills.

Eventually, if you’re going to be delinquent for an extended period of time, you may want to talk with your lenders and see if you can come to an arrangement. A lender has no interest in you paying nothing, and sometimes will accept a deal where you pay less than you owe. (But if you make any deal with a lender, make sure to get it in writing!)

This is a larger topic, but I just want you to know that there are options, even if it seems like there aren’t any.

Don’t panic

Ultimately, this is where I’d start and end if you’re unable to pay your bills.

It feels terrible to not be able to pay what you owe, and this shame can lead to panic.

But, like Douglas Adams said, don’t panic!

The reality check is that nothing is going to happen if you don’t pay your bills in full or on time, at least not immediately. No one is going to come right to your house to take your stuff (or your house) away, and you’re unlikely to get any collections calls for a while.

All that will probably happen is that you might get a letter in the mail and some (heavily ironic) fees or charges on those accounts.

You’re safe. Legally, you’ve got time to figure out a plan. It varies by service, but it won’t happen immediately.

And if you’re experiencing an extended period of not being able to pay bills, you may want to reach out to a credit counselor. Contact your local credit union or contact one of these credit counseling organizations. These are non-profit organizations and they are here to help you.

If you’re struggling with food, find your local food bank. If you qualify for unemployment or SNAP benefits, sign up. Even if you think you don’t qualify, try.

Remember, this may feel bad, but it’s not a personal deficiency that you are in this situation. Moreover, there is a way out. You can do this.

2 Comments

DJ

Thank you, this is very timely. I recently had the idea to reduce credit card payments to the minimum due, rather than the “plus extra to pay it off” so we can weather the increase in health costs. My husband and daughter are both disabled, I am diabetic, and we all require medical care. Making this a priority over clearing debt seems to be imperative to me. Your newsletter outlines a wise approach and I appreciate your wisdom.

Mike Pumphrey

Thank you so much, DJ. I’m sorry you’re dealing with so many challenges right now. I think in the short term, paying the minimums on credit cards is a totally fine action to take. As I see it, when faced with an emergency, debt reduction isn’t important; managing the emergency is. And the debt will still be there afterward!

Wishing you the best in your medical struggles. Please remember that it’s okay to ask for help.