I consider myself pretty hard to incite, but our collective focus on our “credit score” can be very frustrating. I think we focus way too much on our credit score, and it leads us to make decisions for the wrong reasons.

Table of Contents

Partial credit

To define terms: the credit score is a number that defines your self-worth. It is a numerical measure of how successful you are, how good-looking you are, how much people like you, and how happy you will be in life…

Oh sorry. Let me start again.

If Nietzsche had a numerical score when discussing good versus evil, it would closely resemble the credit score…

A bit too hyperbolic? Well maybe not for some.

Full credit

Okay, let’s start again for real. The credit score, is a numerical value that is given to a person’s financial situation and designed to imply “creditworthiness” of that person. There are many different companies that come up with a credit score, but the most well-known is probably the FICO Score (named after the company that started it).

What does “creditworthiness” mean? To be credit-worthy means that an entity believes that you are worth extending credit to. So it’s a measure of confidence in your ability to pay back a loan. Or perhaps a measure of “financial trust.”

That’s all. It’s not how wealthy you are, it’s not your IQ, it’s not an indication of success. It’s just a value that indicates whether if someone or something lent you money, whether you’d pay it back. And it’s not even necessarily correct.

Your FICO score (maybe):

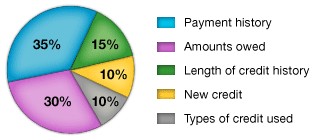

Some may not know this, but here’s what goes into the FICO score:

- 35%: Payment history: Have you paid your bills on time? The more you have, the better, apparently.

- 30%: Credit utilization: The ratio of credit used to credit extended. Lower is better, apparently.

- 15%: Length of credit history: How far back does your credit history go? The farther back the better, apparently.

- 10%: Types of credit used: The different kinds of credit used (loans, credit cards, etc.) More is better, apparently.

- 10%: Recent searches for credit: Applying for new lines of credit will trigger a “pull” on your account, which is a bad thing, apparently.

Notice I appended all of these with “apparently.” This is because this score is a hidden algorithm. This is what they say goes into a FICO score, but really, we have no idea. We can’t get a derivation of our credit score, we can only get an “indication” of why it is the way it is.

So right off the bat, I’m not happy. FICO is basically asking me to trust them. But who watches the watcher? But what’s FICO’s FICO score?

You can still buy a house

The FICO score only refers to loans and credit. If you’re out of debt and blinding up a big reserve of money, you won’t likely need to borrow money, so that’s not important. If you want to get a mortgage, it is true that it may be advantageous to have a good credit score, but by no means necessary. If you have years of paying your rent, utilities, phone, on time, that will count for something. It’s called manual underwriting, and while I have no personal experience with this, I know it’s a real thing. (People did get mortgages before the advent of the credit score, after all.)

The point I’m trying to make is that there are very few instances in your life when your credit score becomes truly important, and as far as I can tell, in all of those situations there are alternatives.

The good ideas in the credit score

The other point I want to make is that many of the suggestions made to improve your credit score are actually worth listening to, with only minor modification.

- Pay your bills on time. Be honorable. Do what you said you would do, not just because FICO told you to.

- Do this over a long period of time. What’s a good idea today will be a good idea tomorrow.

- Show dependability in multiple ways. Give your word in all aspects of your life, both financial and other.

- Don’t run out your “personal line of credit” (in other areas of your life too).

How to improve your credit score with almost no work

Okay, so you’re still not convinced? Still think that your life will be ruined and you’ll never be able to buy a house if you don’t use credit cards all the time?

Fine. You can get a credit card, put a medium-sized purchase on it once every few months, and then immediately pay it off. The rest of the time, keep your credit card in a drawer. This is basically what I’ve done for years, and I’m pretty sure my credit score can beat up most people’s credit score.

But I don’t brag, because it doesn’t really matter to me. And I don’t want you to care either. People live in fear of FICO, like it can make or break your life. But it can’t. Thwarting FICO could make it more difficult (but not impossible) to buy a house and loans if you’re in a position where you need that sort of thing. I can’t really see how else can it affect you, aside from of course, living with the fear of what it can do to you.

But when that company won’t even open up about how it determines your score, that is a capricious master indeed. So I say forget it, and you’ll be much better off. And if you’re diligent and honorable, I bet you’ll get a pretty good credit score in the end, regardless. Das ist gut.

But enough about me. How does your credit score affect how you live?