I detail how I met the 1,000 Experience Hours requirement to become an Accredited Financial Counselor (AFC).

Two years ago, I decided to get my Accredited Financial Counselor (AFC) certification. While I believe that you don’t need official credentials to be a successful coach (and you can look at my testimonials to see this), I wanted to expand my reach, learn more skills, and be a part of something greater than myself.

Now, two years later, I have achieved a very important milestone in this process: I now have 1,000 Experience Hours, the requirement for the certification, officially approved.

So, let me show you how I climbed Mt. 1,000 Hours.

Table of Contents

Background

There are three main requirements to become an AFC:

- Education: For most people, this is self-study, with books and other learning materials.

- Experience: 1,000 hours of documented experience in the field

- Exam: An official proctored examination

(Yes, technically there’s also an “Ethics” component, but that’s less a task than it is an attestation, and for me, an obvious one.)

The biggest hurdle for me, and therefore the one I started with, was the 1,000 Experience Hours requirement.

Now, 1,000 hours is a lot of time: almost 42 straight days if you track 24 hours a day. But though sometimes I feel like I eat and sleep money wellness, that doesn’t mean that I can count those hours!

Moreover, there are only certain activities that count toward this 1,000 hour requirement, and all of the specific tasks have to be approved. Even if you work at a financial firm 40 hours a week, not all 40 hours can be counted, since hours need to be directly related to counseling or education.

One year in

I wrote about my progress last year, and at that point, I hadn’t made much. I believe at the time of writing that I was sitting only at a little over 200 hours.

That was a problem. You only have three years to hit the 1,000 hour mark, and while there are extensions that can be granted, it was clear that I needed to speed things up.

Easier said than done, of course, but what I found was that when you start looking for relevant experience hours, you can find them everywhere.

And that’s what started happening. Once I got serious, I began to see everything as a potential Hours Acquisition Target™.

And so, from the time when that post went out, it took me seven months to acquire the final 800 hours, to get a total of 1,000.

Experience categories

There are ten categories under which your experience hours can fall:

- One-to-One Counseling (Maximum: 1,000)

- Develop Financial Education Classes/Curriculum/Educational Content (Maximum: 700)

- Related Webinar(s) (Maximum: 100)

- Teach Financial Education Class(es)/Workshop(s) (Maximum: 1000)

- AFCPE Symposium (Maximum: 75)

- Related Training, Conference, Meeting, Seminar (Maximum: 100)

- Book Review (Maximum: 50)

- Website Review (Maximum: 50)

- Related Coursework (Maximum: 100)

- Supervising Financial Counselors or Programs (Maximum: 1000)

Below, I’ll go through each of these categories and tell you how many hours I got, and how I got them.

One-to-One Counseling

Hours acquired: 279

This is the bread and butter of the AFC certification: actually doing financial counseling.

You are allowed to count the hours in a session, as well as the prep before and recap afterward. I got the majority of these hours through my own private practice. Each session ended up counting for around 3-4 hours.

I did do some other coaching through an online platform which, frankly, the less said the better, but it did give me a small chunk of hours there too.

There are also numerous other volunteer coaching options which, for one reason or another, never quite worked out for me, though I do know that many coaches get their hours that way.

I feel very proud that over 25% of my hours were in the service of directly helping others.

Develop Financial Education Classes/Curriculum/Educational Content

Approved hours: 600

I create a lot of educational content. A lot. From blog posts to courses to videos, the bulk of my output over the past decade has definitely been educational content.

As much as I’d like to go back and count all the work I’ve done since 2012, the certification process only allows to you look back two years from the date of sign up.

So, I became a detective in Mikeology. I scoured every historical piece of personal work I could get my hands on, and if there was any way I could justify tying it into relevant experience hours, I submitted it. I also made sure that as much of the content I was creating going forward could be approved under the requirements.

And as you can see, 60% of my hours were approved under this category, much higher than any other category by far.

Related Webinar(s)

Approved hours: 21

Go to every webinar you possibly can. That became my mantra. Every webinar was One More Hour™.

There are many sites that offer webinars. I found the Consumer Financial Protection Bureau (CFPB) to be a great source of useful events. After all, if I was going to spend my time getting these hours, I wanted the material to be as worthwhile as possible.

The AFCPE, the organization that administrates the AFC, also puts on periodic webinars. I am an AFCPE member, so these webinars were all free for me, so I signed up for all of them. On the whole they were good, but I can’t say they are worth the $50 per hour rate that non-members typically have to pay. If one is going to attend any of them, it makes obvious sense to become an AFCPE member (which is only $150 a year).

Teach Financial Education Class(es)/Workshop(s)

Approved hours: 20

Right before the pandemic, I started teaching a workshop on financial wellness. I got as far as giving it once, and never converted it to an online workshop.

But once again, the ability to find hours prior to my sign-up date was invaluable to me, as this was five months before.

AFCPE Symposium

Approved hours: 15

This one is a little awkward.

The AFCPE is both a membership organization and a certification provider. This presents an obvious potential conflict-of-interest. And while they claim that the two arms of the organization are separate and don’t interact, it’s sometimes hard to see that in practice.

Case in point, the AFCPE Symposium, a conference for financial professionals. As an attendee of the conference, you are allowed to claim 15 hours toward AFC certification. I attended (and gave a presentation), and fully paid for my ticket.

I got plenty for my money, so it’s not like I just paid a bunch of money to the organization to get the hours that the organization would accept.

It’s not payola, and I’m sure it’s above board. It just feels a little awkward when I’m not only paying the AFCPE to be a candidate, but also paying to be a member (in part) to make getting hours easier, and also attending the symposium (again in part) to make getting hours easier.

Related Training, Conference, Meeting, Seminar

Approved hours: 12

This category was for professional trainings and seminars I attended. Specifically, a course I took on Motivational Interviewing (a counseling approach on eliciting behavioral change), and a book club with a book on behavioral economics.

I wouldn’t say that this would be an easy one to get lots of hours on, as many of these seminars are likely to cost money. But once I got in the habit of remembering that Everything Can Be Related To Hours™, I was able to submit a training that I had attended before I had ever thought about the AFC.

Book Review

Approved hours: 12

This one is pretty self explanatory: I reviewed some financial books I read.

I think eventually I started tracking these under the “Develop Financial Education” section, as it didn’t really matter so much which category it was under. (There are maximums hours for each category, but I was never really in danger of hitting any of those.)

Website Review

Approved hours: 11

Similar to the Book Review category, this was me reviewing financially-related websites. I didn’t feel like this was a particular interest or strength for me, so I didn’t pursue this avenue very far.

Related Coursework

Approved hours: 0

This is relevant for you if you take a college or university course on personal finance or financial counseling. I didn’t this though.

Supervising Financial Counselors or Programs

Approved hours: 0

As I work as a solo practitioner, I never found an opportunity to do this kind of supervision work, and it also didn’t feel like a core interest of mine, so I didn’t pursue this either.

Total hours: 1,000

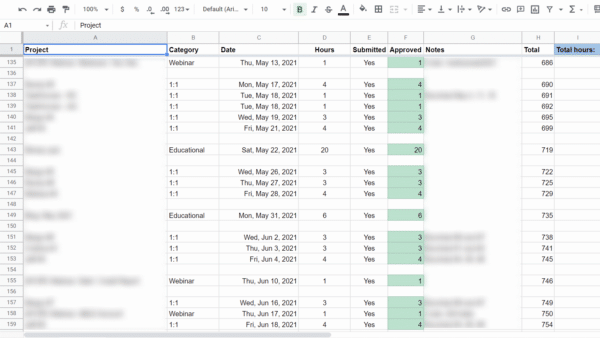

Tracking 1,000 hours

I tracked every single hour I could reasonably submit, and whether I had submitted yet, and what the response was. I would highly recommend everyone in my situation keep detailed notes as well, otherwise it’s just too confusing to keep everything in your head.

Next step: Exam

The next big step, and arguably the only other step that remains, is the Exam.

I decided at the onset that I wasn’t going to even think about the exam before I completed my hours. Part of this was that I wasn’t entirely sure that I ever would hit 1,000 hours, and so the time spent studying for a big exam would be wasted. Also, I feel pretty confident about my ability to take standardized tests.

But I’m not getting cocky; I’m going to do this by the book. The AFCPE has a 16 week study plan, as well as an e-learning study guide, and I’ve started to go through it, week by week, chapter by chapter, module by module.

And I’ve made a tracking sheet for that too. 😁

At this rate, I should be ready to take the exam in just a few months, at which point, I’ll have another big update for you.

So I’m feeling pretty pleased, as you can imagine. I have succeeded in what I have always believed was the hardest part of the certification process. If all goes well, in just a few months, I should have some letters after my name.

If you’re an AFC Candidate, I’d be happy to answer any questions you have about the process, though I can only speak from my experience, and your mileage may vary. In addition, while the details of the certification were true at the time of writing, I can’t vouch that there won’t be a future revision to the certification process that makes all of this irrelevant. In the meantime, keep climbing!

16 Comments

Minnie

Thank you for some reason the AFC Canada website is lacking so much information, this is extremely helpful. I was starting to wonder if getting the AFC Canada is worth it.

I can find almost NO information AFC Canada. and their website is poorly done it’s like they don’t even care.

Mike Pumphrey

You’re quite welcome! I don’t know anything about AFC Canada, so I can’t say if the information I have matches what’s going on there, but I hope it’s at least in the ballpark.

Perhaps it’s worth getting in touch with the AFCPE and asking them there? I’ve always found everyone I’ve talked to extremely helpful.

Best of luck to you!

Robert A. Calkins

Thank you very much for this article. As someone who just started on gaining experience hours towards their AFC certification, this was an excellent resource for my way ahead.

Mike Pumphrey

You’re so welcome Robert! I’m glad you found this helpful. I wish you all the best on your quest for certification.

kathy

Thank you for posting your experience. I am getting close to finishing the curriculum and after reading this I have decided to put my focus on getting experience hours over studying for the exam. As you put it, if I don’t get my experience hours within the time deadline, then there really isn’t a point to have taken the test. Your website is fantastic- so much good information. I hope to be able to have this kind of impact on people some day.

Mike Pumphrey

Thanks so much Kathy! I’m glad you’re finding the site helpful.

Good luck getting those hours! I believe they have relaxed the requirements since I originally wrote this, and now you have a longer window in which to go back and find relevant experience hours. So you might have all you need already!

Tamika

Great article on your experience! I completed education and exam. I wanted to take it closest to when I finished. I’m work on experience hours and haven’t been doing a good job tracking especially around content creation. Are you open to sharing your spreadsheet as a blank template?

Mike Pumphrey

Hi Tamika. Congrats on getting through the exam! I’d be happy to share my hours tracking spreadsheet. Shoot me an email or a message through my website and I’ll get you a copy.

Timothy Hanke

Mike, good stuff! I have bookmarked this page for future reference.

I am 64 and retired from doing other things, most recently working as a federal auditor of classified defense contracts.

My modest pension and modest investment portfolio are barely enough for my wife and me to live on, and inadequate to deal with large unexpected expenses, so I am looking at getting into personal financial services. I really enjoyed moonlighting as an H&R Block tax preparer a few years ago, so I have started work on the Enrolled Agent certification.

However, tax prep is mostly seasonal, so I am thinking the AFC might be the way to go, for year-round work. For some reason I feel it more compelling to me than the CFP. I suppose I am a bit old to start something new, but I do have a financial background as an auditor, and even sold mortgages for a couple of years in the ’90s. Also I am comfortable learning new things.

So we’ll see how it goes! I look to people like you to show me the way. 🙂

Thanks.

Tim Hanke

Newburyport, MA

Mike Pumphrey

Thanks for writing in, Tim! That’s wonderful that you’ve found a passion for helping others with their financial situation. I’m no business expert, but I think the most important thing next is to seek out the people you want to work with, and make sure they know that you’re in business! Being a financial coach isn’t a straight-line path to full-time work in my experience, so any business acumen you can pull on will help you out greatly.

I wish you all the best in your journey!

Sandra

Do you think this certification could be completed within 6month?

Mike Pumphrey

Hi Sandra. Good question. I think if you already have your hours already from work in the recent past (or are close to 1,000 hours), then I think it’s perfectly fine to study for the test in a 6 month timeline and get the certification done.

But if you’re starting with zero hours, I think it would be close to impossible to get all of your hours in that timeline. That’s a full-time job’s worth of hours!

Wendy Coop

Thank you so much for detailing your journey. I have a YouTube channel, blog, and podcast on personal finance and would love to count those hours.

Did you ever take your exam? How did it go?

Mike Pumphrey

Hi Wendy! Thanks so much. I did take the exam! I wrote all about it here: http://empathicfinance.com/going-for-my-afc-taking-the-exam/

I think there are plenty of reasonable ways to count hours toward certification, and am confident you’ll find a way to get to 1,000. If unsure, I recommend reaching out to the AFCPE folks and asking if a particular task would count. They’re very helpful.

Best of luck to you!

Michelle

Great article. 🙂 I am looking into starting this process from scratch. No experience but I love helping people with budgeting and how to pay off debt. So I feel like this is up my ally. Do you think it is something worth getting into? I am currently a Veterinary Technician exploring new career path to be able to work more remotely yet also help Spay and neuter organizations thrive. I would love to hear any advice you have. There is a class starting soon that I am wanting to sign up for.

Thank you much in advance.

Michelle

Mike Pumphrey

Hi Michelle. Thanks so much for writing. While I can’t of course tell you what you should do, I can say that it’s probably a good idea to get clear on what your wider goals are first. While a certification is intrinsically beneficial (you learn a lot), it’s not going to magically get you a job or anything. If you have a passion for helping people with budgeting and paying off debt, then you should start offering that as a service in your community. Get a website, send some emails, and start to network. The certification can come over time, and plus you’ll be getting experience hours as you go.

Best of luck to you!