Opportunity cost can be defined as “the value of the choice of a best alternative lost while making a decision.” Or, more colloquially, it’s “what you could have done if you had chosen differently.” I’ve talked before that one should consider … Read More … Read More

Radical Finances

How my 1990 Geo Prizm helped me buy a home

I kept my first car, a 1990 Geo Prizm, for years longer than anyone said I should. But that decision later enabled me to buy my first home. … Read More

How to calculate your true account balance at the end of the month

How float can help you track your expenses more effectively

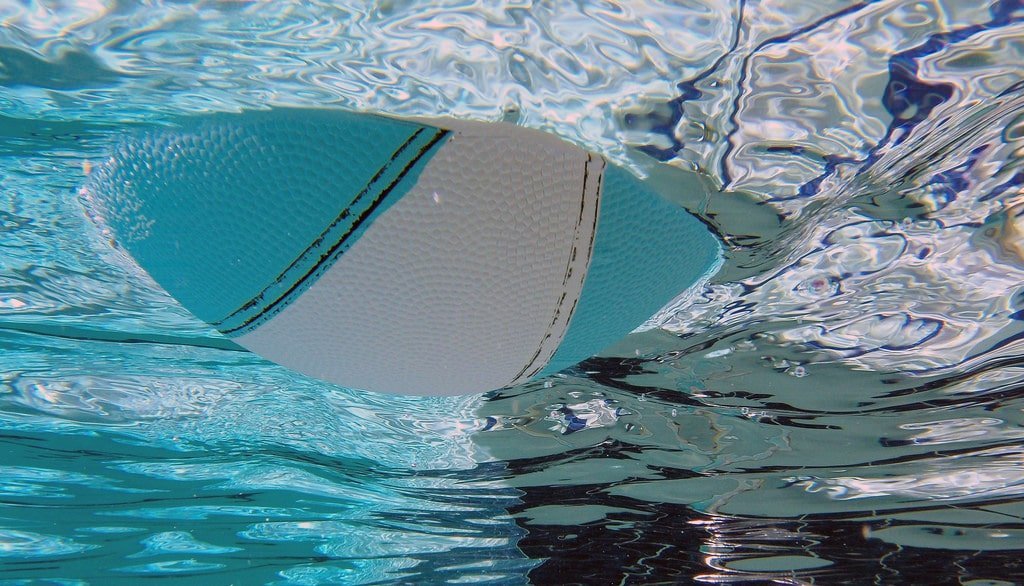

Getting rid of PMI (part 2): The M stands for “misdirection”

Getting rid of PMI (part 1): The P stands for “parasite”

Year in review 2016: Your top 10 favorite posts

I wrote about my favorite posts for this year. But what about yours? Just like I did in 2015, 2014, and 2013, I ran a report and came up with the ten most-read posts for this year. … Read More

Year in review 2016: My top 10 favorite posts

What a year it’s been. This site has now been humming along for over four years now. As I continue to post twice per week, that means that there are over a hundred posts on this site over the past … Read More … Read More

Avoid any mortgage company whose sales pitch involves misunderstandings of basic physics

Sometimes, I see something that is too boneheaded to go unchallenged and un-poked-fun-at. (That’s a phrase, right?) It’s related to the post where I talked about the reverse mortgage, and why it’s a terrible idea. It also has to do … Read More … Read More

How homeowners can go back into debt, lose their home, and pay for the privilege

I’ve long said that if they are advertising something, you don’t need it. This was one of my very first blog posts from years ago, and I stick by it. Now “need” is different from “want”, of course. You may … Read More … Read More