To make the purchases feel more real, and thus add some more intentionality, why not pay off the charges in just the way that you put them on?

If you are willing, you can benefit financially from not using a credit card for everyday spending.

Yes, I know that you can earn cash back and airline miles and all that. But credit cards add risk, make you spend more, make things more expensive, and turn paying for things into a two-step process.

But I’m not here today to debate that. Even I use a credit card occasionally (here’s when).

And when you use a credit card, it’s a known fact that it can more easily feel like you’re not really doing anything. You don’t feel the purchase. If the purchase has a bunch of zeroes, who cares? It doesn’t hurt; you’re just putting it on a credit card. And then dealing with it later.

The process of paying off a credit card, by contrast, is also divorced from the big feelings that go along with a big purchase. It becomes just another bill you pay off, which feels more like a dull annoyance.

But what if you could bring the feeling back to the purchase? What if you could repair the connection between buying something and paying for it? That would make the purchase feel more real, and allow to payoff to feel real too, which could allow you to reap some kind of satisfaction from the buying of the thing itself.

Table of Contents

Pay off each purchase separately

My idea is as follows: Make payments on your credit card that are equal to the purchases themselves.

This way, you’re not just “paying off your credit card”, you’re paying for the things you purchased.

Have a $300 car repair bill? Then you make a payment that’s $300.

Spent $240 at Target? Make a payment for that amount.

Got gas for $75? Ditto.

The normal way

Now, contrast this with the “normal” way that people pay down their credit card bill.

If they pay down their balance each month, then it’s an automatic, almost thoughtless move. Paying off the balance is obviously preferable to paying interest on the purchases, but you still don’t make any connection between what you bought and how you paid for it.

And if you make regular, non-full payments (some amount per month), then it becomes just another random bill, divorced from the fact that you bought things with this card and are now paying for them.

But with paying off each purchase separately, you can feel a sense of connectedness to your purchases, to say nothing about a greater sense of accomplishment when you pay things off. This may help you be more mindful about what you spend too.

Example

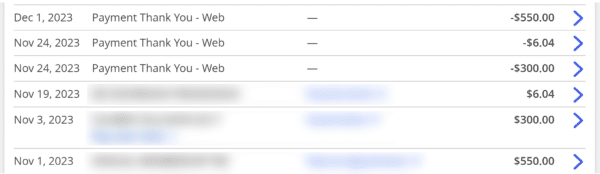

Here’s a small visual example, taken directly from my own credit card statement.

I could have just paid the entire balance off. I also could have set up an automatic monthly payment.

But what I did was to pay each purchase off individually, and when I tracked my expenses I noted that the day I paid for the purchase on my credit card was the day that I actually paid for it.

Caveats

Now, if you put a million little things on a credit card, then perhaps this might not work for you. And if you have giant purchases on your credit card that you can never pay off at once, then this also might not work for you, but that is an argument for using buckets instead of a credit card for large purchases.

At the end of the day, I just want you to be intentional about your spending. And when you use a credit card, the spending doesn’t actually happen until you pay the credit card off.

If this still seems like too much work, then I have another suggestion: don’t use a credit card as often. It’s not as crazy as it seems.