You may think that by paying off credit cards that the only one that loses is the credit card company. But interchange fees say otherwise.

I spend a lot of time trying to convince people to not put their everyday spending on a credit card.

And it’s pretty much the hardest thing to convince people of.

There are a whole host of reasons. The people I encounter see it as a way to get one over on the system. Whether it’s airline miles (free travel!) or cash back (free money!) there’s a sense that by using credit cards in this way that they are outsmarting the credit card companies. After all, if you’re paying off the card each month, then there really is no downside, right?

Now, I’ve gone into many of the downsides, especially in my accurately-titled post “How can I convince you to not put your spending on a credit card?“.

But there’s a new reason, one that I hadn’t adequately realized up until this point.

It’s that using these rewards credit cards ends up negatively affecting lower-income consumers, who aren’t (typically) getting any value from these same credit cards.

In other words, you’re taking those vacations on the backs of those less well-off than you.

Let me explain.

Table of Contents

Fees are passed on

The New York Times ran an article recently detailing a lot of the ways that this works. I’ll be quoting from this source throughout.

First off, let’s acknowledge that credit card companies aren’t stupid. They know exactly what you’re doing when you use the card but pay it off every month. They aren’t just sitting there, waiting and hoping that you’ll rack up a large debt and start paying interest on it.

Annual fee aside, they are still making money because you used their product, just not from you.

But where do they make their money?

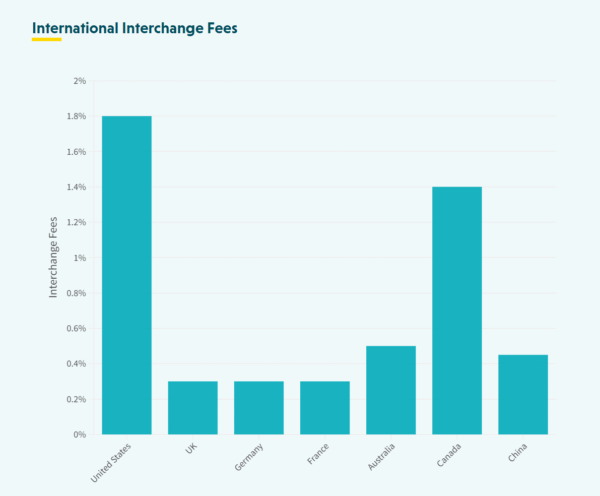

The answer is “interchange fees”, the cost of doing business with the credit card companies. They are, apparently, the highest in the world in the United States and 8-9 times higher than in Europe.

Oftentimes, these interchange fees are paid by the merchant, which is why you may not know about them. But if you’ve ever seen a sign saying “$1 surcharge for transactions under $5” or seen gas be a different price for cash and credit, that’s why.

So what, you may ask?

Fees hit those with lower-incomes harder

Credit card interchange fees are baked into costs. Merchants will pass on this cost to the consumer.

And, when these fees rise, the consumer pays more.

And, according to a paper at Stanford (referenced in the above NYT article), when credit card rewards increase, interchange fees increase as well.

As the article summarizes it:

“Put another way, credit card rewards are essentially a tax on less affluent consumers, who are much more likely to pay for their goods with cash, debit cards or standard credit products that accrue no such rewards.”

Those with lower-incomes use credit less

Something that seems obvious in hindsight but surprised me, was the extent that the use of credit cards is directly proportional to one’s income. In other words, the more money you make, the more you use credit cards.

This seems to fly in the face of conventional wisdom. Isn’t it the less well-off who are maxing out their credit cards to get by?

Not really, because those people are less likely to even have credit cards.

It’s kind of like the red herring argument that people bring up when cities try to reduce parking, or add bike lanes, or other road-calming tactics. “What about the poor people who need to drive to get to work?” the argument goes. But the argument is specious, as the less-well off don’t generally have cars. It’s the temporarily embarrassed millionaires who are the ones complaining.

Your daily driver

As always, I’m not saying to cut up all your credit cards. I’m not Dave Ramsey. There are a few limited reasons to use a credit card, at least periodically.

What I’m talking about is your everyday spend, your “daily driver” card, the one that you pull out by default. There are many reasons to have that not be a credit card. And now you have another.