I wade into popular economics to interpret recent higher inflation rates, to see if there is any merit in being concerned.

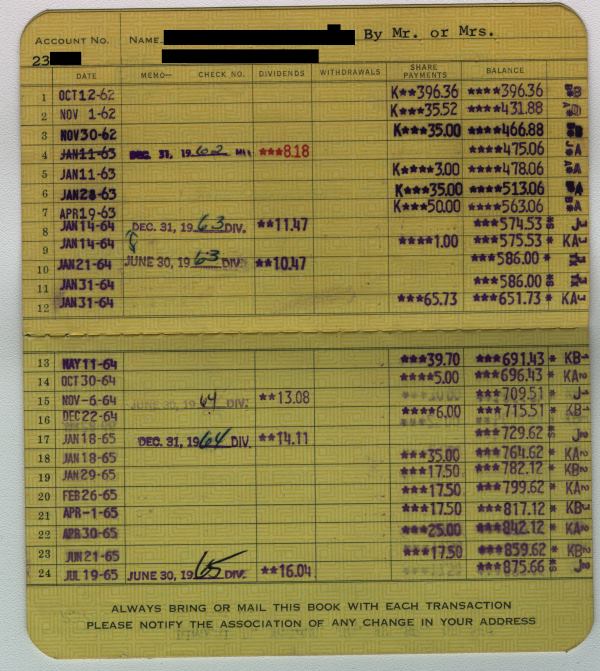

I remember my first savings account that my parents opened for me when I was a kid.

It was with my local bank, a five minute walk from my home, in a little main street shopping area that hadn’t changed much in half a century.

I got what was known as a “passbook” savings account, meaning that my balance was printed on a little passport-sized booklet. When I made a deposit or withdrawal, the passbook was updated with the appropriate amount.

And what was the interest rate on my meager childhood savings account?

6%. No joke.

Meanwhile, the current bank savings rate today is 0.06%, one-hundredth of the interest rate in my childhood.

Why the difference?

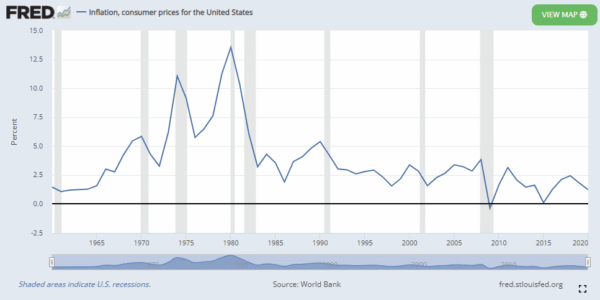

Because I grew up in the 1980’s, when the United States was undergoing a period of very high inflation.

We haven’t had inflation like that in our economy since then, and many adults have never had to deal with an economy where purchasing power changes so drastically. Myself included!

Now, with inflation in the news almost daily, and the phrase “supply chain disruptions” being something we talk about in polite conversation, it seems to merit asking whether this is something we should be worried about.

Table of Contents

It’s the supply chain, stupid

The answer to why most things are in this economy, can be traced back to the pandemic.

Factories shut down. People stayed home. People shifted their purchases from traveling and experiences to Pelotons and Disney+.

This meant that there were shocks to the system in all sorts of weird ways. Huge demand from across the world in certain sectors, zero demand from across the world in others.

As things became hard to get, whether it’s computer chips for cars or packets of ketchup or whatever, prices rose.

And as demand outstrips supply, prices will continue to rise. You don’t need to be an economist to understand that.

The Great Resignation

Also, people are either quitting their jobs in record numbers, or just not getting jobs like they once did.

This is causing labor costs to rise, meaning that jobs are offering higher wages.

This is great if you’re a job seeker, as clearly there are more and better opportunities than there have been in the past. (Hey, maybe we can build an economy that’s less reliant on the predatory gig economy!)

Wages rising isn’t so good if you’re a business owner, but unless you’re a small business owner, I think we can all agree that businesses don’t require a whole lot of sympathy now.

Prices going up

I’d wager that most people don’t care about whether inflation is going up; instead, they care about prices for things going up.

And it’s not hard to see that prices of many things are going up.

If you’re a meat eater, meat prices have gone up by something like 20% over the past year, by one estimate.

I’ve noticed inflation the most in the local food cart scene, where even a simple veggie stir fry, once $8 (pre-pandemic), is now $13.

Prices at the gas pump have gone up in many places too. And this one has a strange emotional fixation of the population, in a way that I confess I’ve never quite understood.

Yes, it sucks that prices are higher at the pump. But when you “read the comments”, you don’t see people railing on about the price of meat or milk. It’s always gas prices.

And this despite gas prices being lower than they were during the Great Recession! It doesn’t make any sense.

The problem with worrying

I’ve been reading a lot of Paul Krugman, the Nobel Prize winning economist who writes a rather wonky column for the New York Times.

And from this, I learned that a fascinating aspect of inflation is that so much of it is psychological, even within companies and policy makers.

I’m no economist, but I think the way it works is this:

When you don’t fear inflation, you don’t build it into your financial models. You assume prices and costs will remain relatively stable. This has a cascading effect around the whole economy.

But when you believe that inflation is going to be a big deal, you will build that into your financial models. You’ll want a greater financial cushion, you’ll want to raise prices, you’ll want to increase margins. This too has a cascading effect around the whole economy.

This is why it’s incumbent upon all of us to not worry, because worry and perception about inflation can affect the reality of inflation!

Luckily, it appears that the institutional worry level is not that high.

Apparently, the pulse of our economy seems to be that we have accepted a certain amount of medium-term inflation, but we haven’t decided that 1980’s style inflation is in our future.

Also, once the pandemic ends, presumably some of those supply chain disruptions will start to ease as well, which could drive down prices, or at least stem the increase. So even though prices are rising faster than wages right now, there’s nothing saying that this trend will continue.

Bottom line

So while higher inflation is generally not desired, I wouldn’t worry about it too much, at least in the long term. There’s nothing saying that it will continue in this way for long, and remember that we’re still in a global pandemic, so things are likely to be a little off.

I certainly wouldn’t change any of your financial plans based on inflation. The fundamentals remain the same.

I’m not saying that there’s no hurt out there right now. But I don’t want you to compound your current challenge with fears of a Weimar Germany-style hyperinflation period. Nothing I’ve read seems to merit this fear.

At the same time, now might not be a bad time to look for a new, higher-paying job. If you can take advantage of one sliver lining to the current situation, that would probably be it.