I talk about the problems with tying the contents of a book to an online service, using the example of the Tony Robbins Master The Game app.

Welcome to the site! Did you know that I have a course to help you Take Control of Your Money Story? I think you’d be interested in it.

I got on a bit of a rant when I talked about the end of history. If nothing else, it made me want to print out anything important in my life (like this website, which at the time of writing has almost 400 posts)!

But a lot of my argumentation is about what happens in the future. No one really cares right now that they can’t access their information from a decade or two ago. (Though arguably they should. After all, do you really think that all those priceless artifacts that we cherish in museums were thought of as something special in their day?)

What’s even scarier though is when you find this over-reliance on technology spilling over into normally technology-free areas.

Like, say, books.

Table of Contents

Master the game

I just finished Tony Robbins’ most recent book “Money: Master the Game“.

This is not a review of the book. (I could review it, but that’ll be a future post.)

For context though, this is a financial book designed to help the average person gain enough information to be financially savvy (or become “an insider” as he terms it). It starts assuming very little, and ends with some relatively complex topics. It’s a weighty book.

I was interested in this because Tony Robbins is a master (in my opinion) of navigating and effecting personal transformation, which I think is as important as any other goals we have, financial or otherwise. Put him in charge of a book on money, and I was very curious about how that intersection would pan out.

Anyway, let’s fast forward to the middle of book. He touts a method where he can help you determine how much money you need to become financially secure. This certainly piqued my interest, as I don’t feel like people tackle that very often. We tend instead focus on “saving more”, but without any way of measuring our progress.

Master the app

Like most things in the book, he spends a lot of time working up to the event, but eventually he gets to the point.

“[I]t’s time to come up with a plan a create a financial blueprint. The good news is, all you have to do is answer six questions in the It’s Your Money app. Using this wealth calculator, you’ll have a first version of your plan within seconds.”

An app!

An app?

Okay, maybe that makes sense. Online calculators are a useful tool, a good supplement to one’s argumentation.

But it turns out that this app wasn’t merely a supplement. It was in fact mandatory to the argumentation of the book.

“Ready to dive in? Open your app!”

And after a few paragraphs of caveats:

“Congratulations on running your first plan. Are you excited about the results? Concerned? Frustrated? Or encouraged?”

More like confused. There were no accompanying tables and only the barest of sample solutions. Just “Open your app!“

This annoyed me, but I decided to play along. (After all, what choice did I have?) If I needed to go to some website, I’d go to some website.

And let’s be fair, I’ll take a website over a real “app”, which these days means something you have to run on a smartphone or tablet. (Plus, even if I wanted to run the app, how could I?)

So, I wandered over to my computer and punched in the website as directed.

This is what I found:

How frustrating, to be ready to figure out my financial future, only to have the app be temporarily down.

But I’ve worked in technology, so I know how these things go. So I tried again later. It still showed the same thing.

I waited until the next day; same thing. I waited a few days; same thing. A week later; same thing.

I did some research on this and ended up finding my way to the Tony Robbins Twitter feed, where I found this.

And the Amazon reviews:

This was no temporary outage. This looked more like “gone forever”. There were tweets about issues with the app going all the way back to 2014.

The book was released in 2014.

This is what I mean. Forget about the end of history, we’re dealing with the end of the present here.

The apps master us

Now, please understand that I have no problem with online resources breaking or being retired. I’m actually quite fine with that. In fact, I would argue that online resources should be thought of only as a temporary source of information, and not a permanent solution. (Don’t tell Jimmy Wales.)

But the issue is that this is an instance where we have tied a nominally persistent form of information, the book, with an online requirement. Not a supplement, a requirement. While nothing prevented me from finishing the book, there was a large chunk of detail which was missing because I was never able to reference the app whenever it was requested.

Therefore, the book is fundamentally incomplete as it is written.

And this is troubling because books are one of the last vestiges of persistent (technology-free) information source that we still consume on any regular basis. Once we tie books to the internet, we are in effect expiring them, beyond the natural limits of expiration (physical degradation).

The game is winnable

I want you to think about what you’re creating that’s persistent, that will last, that will survive the next software upgrade.

Conversely, I want you to consider future historians: “There are lots of records of their civilization until about their 20th century, and then all the information vanishes.“

“Mike, you write a blog. Don’t you think this is all a little hypocritical?“

Well, perhaps a blog is not the only work that I intend to create. Stay tuned.

—

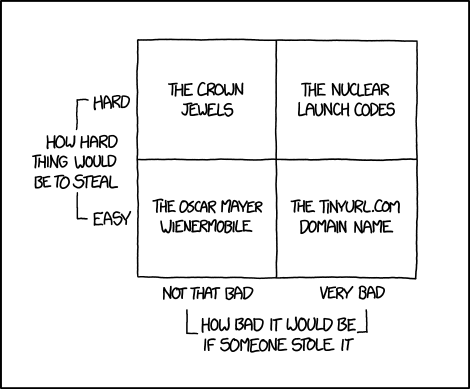

Epilogue: I don’t know about you, but I’ve found the topic this week to be unnaturally heavy. So without veering too far off-topic, I’ll instead quote from the ever-oracular XKCD, who has a slightly more comedic take on the issue of digital impermanence.

And if you need help figuring out how much money you need to be financially secure, I can help you determine that and work toward it. No app required.

UPDATE: As of the night before this post was set to be published, the Tony Robbins app appeared to be back up again. If so, I’m glad to see it, but my argumentation doesn’t really change.

Are you looking for more help with money? Start here with my course: Take Control of Your Money Story.

5 Comments

Yunus Tasliel

Agreed.. quite disappointed with the app not supporting this key part of the book anymore.

Mike Thompson

Just bought the book and while the app is available, under a new name, “My Money” or “Money” depending on where you read it, the content is missing.

The target calculator is in there but not the plan for how to achieve the figures. The book explains the plan behind the calculator so it’s not essential, but the plan gets no information in the book, making it essential in the app.

The app is also only available for ios.

Mike @ Unlikely Radical

Wow. I just looked and you’re right, they’ve replaced the app (which was available for anyone) to something that’s available to you only if you own an Apple mobile product. That’s ridiculous.

I wonder if they’ll update the book at some point. It feels pretty incomplete as-is, and we can’t be the only people who think so.

chris trying to master the game

I was really looking forward to this book and doing everything it said to master the game. Looks like I will not get there this way without those apps to help me out. smh.. I’ll continue and try something else.

Mike Pumphrey

Agreed, it’s unfortunate. Luckily, there are plenty of other good books that have very similar information in them. I can’t really say there’s much in there that’s unique to that book.