The New York Times calculator showing whether to rent or buy a home is more cost-effective has a lot of wisdom, even with unhappy news.

Is it better to rent or to buy?

That’s a tough question to answer. After all, what does “better” even mean? Is it just about affordability? And if so, is it total cost versus cost per month? And what of the emotional aspect of owning a home?

You can go down a rabbit hole very quickly, and the answers are at the end are going to be subjective. After all, some people value homeownership (in a non-financial way) more than others.

The New York Times has, since 2014, stepped in to put their spin on the matter, creating a “Buy/Rent Calculator” on their site.

They just updated it “to reflect current tax law“, and you can see the redesigned interface on the New York Times site.

Let’s look at this calculator in detail and see what it has to say

Table of Contents

The NYT calculator

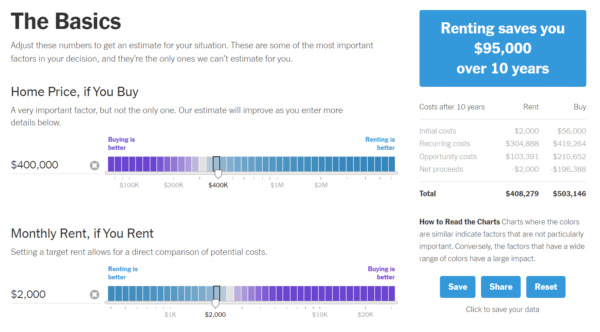

At its heart, the Buy/Rent Calculator takes as inputs the monthly cost of renting and the purchase cost of buying, adds in a few details such as the mortgage details and how long you would be staying in the home, and then calculates whether you would spend more or less from buying or renting.

An interesting sophistication that the calculator adds in is that it calculates “opportunity cost”. In this case, this refers to the money you could have earned by investing your down payment (while renting) as opposed to, well, using it as a down payment.

A quick test

Let’s try out some figures. I’m not saying that my numbers will work for everyone (hello, NYC and San Fran!), but these are not unreasonable numbers.

Assumptions:

- $400,000 home price

- $2,000 monthly rent

- Staying in the home for 10 years

- 7% mortgage rate

- 10% down payment

- 30 year mortgage

Here are the results:

So in the above situations, renting will save you $95,000 over 10 years. And also, note well the box on the right which shows the breakdown of initial, recurring, and opportunity costs.

And it turns out that pretty much every reasonable scenario ends up like this. Unless mortgage rates come down to the 3% realm, not particularly likely right now, and unless you have wildly expensive rent or wildly cheap housing stock, renting is always more affordable. Even a large down payment, if you happen to have it, isn’t going to change the numbers. Buying just doesn’t make as much financial sense right now.

Gulp. That’s probably not what you want to hear.

Worse does not mean “unaffordable”

Now, let’s recognize that there is a difference between “renting will cost you less money” and “you can’t afford a home”. Perhaps in the above case, even though you’ll spend almost $100K more over 10 years than you would if you rent, that’s okay by you, and it’s still worth it.

This calculator isn’t, after all, a “can you afford to buy a home?” calculator. Only you (and your financial coach) can figure that out.

Home buying may be out of reach for now

But for many, whether it’s the down payment or the monthly payment, buying a home is out of reach right now.

And I want to acknowledge the disappointment you might be feeling. Buying a home is an intense emotional decision, and it’s a big goal for many of us, for lots of reasons.

Maybe you’ve been evicted before, or had someone try to evict you. (I’m in that club.) Maybe you want to build generational wealth for your family. Maybe you just want to be able to paint the walls whatever color you want without having to ask permission!

Make space for these feelings, and then, also make space for some relief.

I say relief because if you can’t do something, it must also mean that you don’t have to. And if you can’t afford a home, and renting is more affordable, then you don’t have to buy a home. You can put that particular idea away and simplify your life.

Moreover—and I can’t stress this enough—if something is a bad idea now, it doesn’t become a better idea because it’ll be worse idea later.

By this, I mean, if you can’t afford to buy a home, but you’re worried that it’s only going to get more unaffordable, that doesn’t make it a better idea to buy a home now!

Renting has advantages

If anything, the Buy/Rent Calculator should actually be a salve for those who want to buy a home but are unable to for whatever reason. After all, what it is saying is that, in the most overwhelming majority of cases, renting is a better financial deal than buying, even over a decade or longer.

And it is possible to build wealth as a renter. I wrote a post about how to be a permanent renter recently, and the same tips hold if you become a home buyer later on.

So if you can’t buy a home right now, at least you can be building wealth. That’s not a bad consolation prize if you ask me.