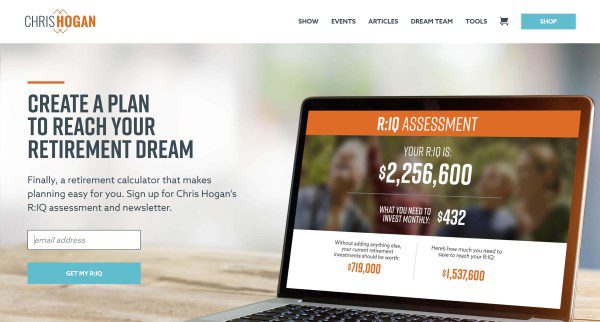

I discuss the online R:IQ assessment test by Chris Hogan, which seeks to determine how much money you need to save up for your retirement.

Hello there! Stop spending so much time searching online for answers to your money questions. Work with me and I’ll get you on the path to financial success. Find out more.

As mentioned in my review of Chris Hogan’s Retire Inspired book, a tool called the R:IQ assessment test is referenced many times in it.

The R:IQ assessment test (stands for Retire Inspired Quotient, and yes there is no colon, and no it’s not a quotient) is a website that determines the amount of money you need to save in order to have the retirement that you want.

Is this a useful service? Read on…

Table of Contents

Know how much

Every one of us needs to know how much we need to save for retirement. If you don’t have a goal, how will you know if you’ve achieved it? It’s not just a matter of saving “more“.

But determining what is enough is difficult, and for lots of reasons. There is the uncertainty of the markets (since we’re not putting cash under the mattress). There is the uncertainty of taxes. There is also even the uncertainty of knowing what you’re going to need when you enter retirement.

That last part might seem like it should be obvious, but it’s not. You’re not going to need to commute to work anymore, but you might want to travel more. Your medical costs will likely increase too, but by how much? How do you know what your life will be like then?

It’s all a bit of a muddle. I’ve argued that at the very least, we all need to be millionaires. It’s rough estimate, but I believe it’s a good one.

The R:IQ tool reviewed

The R:IQ aims to go deeper. Much deeper in fact. It asks you a number of questions, namely:

- Your retirement dream (travel, family, recreation, etc.)

- Current annual income

- Desired monthly income

- Years until retirement

- Amount already saved

With those five questions, the website spits out your R:IQ number:

Welp, there you go. Get to work folks.

Digging deeper

But wait a second. Where does this number come from?

The first problem is that the calculation appears to be totally opaque. There is no explicit description of the methodology at all.

There is, thankfully, some additional levers you can tweak. By pulling down the edit menu (the little pencil icon), you can change some numbers like Interest % and Withdrawal %. Which is a good thing, as I would not assume 12% growth and a 6% withdrawal rate. (I suggest 7% and 4%, respectively, to be safe.)

For me, depending on what values I input, I got results between $2-5 million. Which, granted, is a pretty wide variance, but that’s the problem with these measurements: they rely on so many assumptions as to be of dubious accuracy.

But ultimately, I don’t think it matters whether the website suggests $2 million or $5 million or even $10 million. I think having any figure as a starting point is important. Once you have a figure, you can start to ask yourself questions like “what do I need to do to get there?” And that’s a positive, actionable shift.

Otherwise, we can all too easily get stuck in the treadmill of just trying to save “more”, without knowing whether we’re approaching any goal. And we want a goal.

Give Chris Hogan’s R:IQ a try, and let me know what you think in the comments below!

Everyone struggles with money, but most will try to muddle through on their own. Will you be different? I help people from all over the world reach their financial goals. Let’s talk.