The Supreme Court has cancelled student loan cancellation. Here’s what to do now that that particular plan is dead.

You have every right to feel disappointed.

I know that when I heard about the Biden Administration’s plan to cancel upwards of $20,000 of student loans for borrowers, I was excited.

And I don’t even have student loans anymore! So this plan wouldn’t have done anything for me.

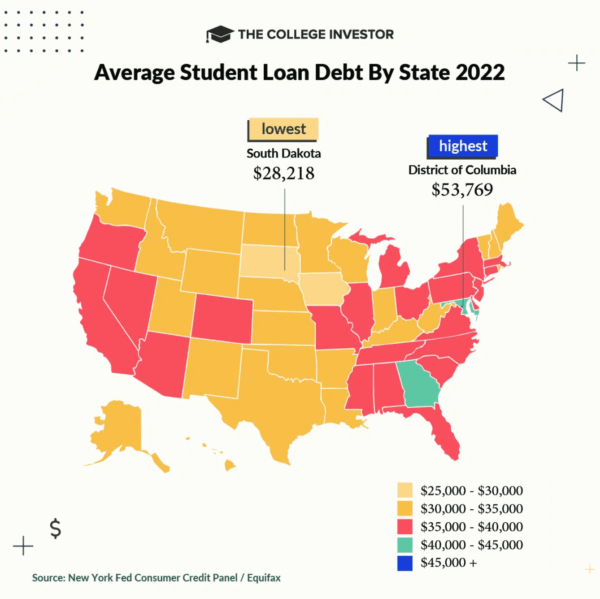

But for the 43 million or so borrowers who still had a balance, it could have been game-changing.

Alas, it was not to be. The Supreme Court, whose chutzpah seems to know no bounds these days, has decided that the Biden Administration did not have the legal standing to outright cancel student loan debt.

Let me take this opportunity to point out that those who originally brought this suit were from a collection of six states: Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina. How they might be “harmed” by this cancellation and not, say California or New York, is beyond me. (And beyond Elena Kagan too.)

So, if you’re a borrower, what do you do now?

Table of Contents

It’s okay to be disappointed

It’s okay to feel your feelings on this one. You may have been hoping that this cancellation might allow you to get on better financial footing.

And this combined with the imminent restarting of student loan payments certainly doesn’t help matters.

I have nothing but compassion for people who were counting on this. Student loan payments are huge, wages are low, and it’s harder than ever to get ahead. This could have been a big deal.

We counted our chickens

Admittedly, I didn’t see this lawsuit coming. Who would be against student loan cancellation?

Maybe all those red-blooded Americans who think colleges are woke? I don’t know, the Pacific Legal Fund just couches their defense under “abuse of executive authority“, which seems like a convenient excuse to me.

But anyway, if there’s one thing to take away from this fiasco it’s this: Do not expect any financial benefits until they arrive. Until something actually shows up in your bank account, it’s theoretical and not actual. And because of this, you shouldn’t count on it.

The only people who truly lost out over this failed relief plan were the people who spent money as if the cancellation had already happened.

Start again

Student loan repayments are starting up again in September. Interest will start to be charged against your balance too.

What this means is simple: it’s time to start paying back your loans again.

Unfortunately, if you were enrolled in autopay, it won’t automatically start up again. So you’ll need to contact your servicer and reenroll in autopay. And maybe make your first payment manually, just to be on the safe side.

As a way of easing people back in to payments, the Department of Education has decided that borrowers won’t be penalized for the first year after payments restart if they are delinquent. But this should only be relevant to those who have trouble getting in touch with their servicers for some reason. Everyone else: Pay what you owe.

If you don’t know who your servicer is, you can log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-433-3243. More info here.

A new hope?

All hope is not lost.

While I was writing this post, I got an email detailing the new tactics the Biden Administration is taking to try and do an end-around of the Supreme Court.

Instead of relying on the HEROES Act, which gives the Secretary of Education the power to “waive or modify” federal student loan provisions after national emergencies (like COVID), they are now trying to use the Higher Education Act of 1965, which gives the very same Secretary of Education the authority to “compromise, waive, or release any right, title, claim, lien, or demand.”

It’s dense stuff, and it’s likely to be subject to tons of legal challenges, and the enmity of the screw-’em-if-they’re-not-rich-oops-I-mean-abuse-of-executive-authority Supreme Court.

So again, don’t count on it.

More worthy of paying attention to is a new repayment program called Saving on a Valuable Education, or SAVE (ugh, more terrible acronyms). This is slated to accomplish a few things:

- Allow for student loan forgiveness after 10 years instead of 20 in some cases.

- Prevent balances from growing when only paying the minimum balance.

- Monthly payments are capped at 5% of discretionary income (10% for graduate loans).

This plan would replace the Revised Pay As You Earn (REPAYE) plan (ugh, I can’t handle it).

As always, use the Loan Simulator to find out your options.

Keep climbing

It’s a total bummer that student loan cancellation isn’t going to happen, at least not any time soon.

I’m not claiming that this was a solution to the cost of higher education in general. I’m not claiming that it would or would not make sense, financially, for the country as a whole. I’d like to think it would have been a net benefit, but I’m not an economist.

I’m just saying that it would have been nice, on a purely personal level, for anyone who has student loans.

So take some time to feel (and voice) your disappointment. And remember to vote in every election. While the Supreme Court is not an elected body, they will eventually cycle out and be replaced by newer blood. Consider who you’d want in the White House when this happens.