I recently got some pushback about using debit cards.

I always appreciate this. I want ideas to be battle-tested, and I welcome the opportunity to think critically about decisions I’ve made and suggestions I’ve given. I don’t need everyone to agree with me.

I’ve long felt that debit cards are an appropriate way to spend money. It’s more convenient than cash, and unlike credit cards, you’re actually spending the money at the time of purchase.

For what it’s worth, my debit card is what I use to spend money in about 80% of all cases.

So here’s the pushback. Paraphrasing:

“What about theft and fraud? My credit card protects me in ways that my debit card doesn’t.”

This is a common complaint about debit cards, and one that deserves a discussion. Could it be that using a debit card is risky?

Table of Contents

Credit card fraud

Let’s lay the argument out.

If some bad actor (insert your favorite bad actor here, I don’t play favorites) gets access to your credit card, say by harvesting stored numbers from a retailer (cough, cough, Target) or just by guessing correctly, then they may indeed be able to purchase something with your card.

But because it’s a credit card, it doesn’t actually pay for anything with your money. So when your account is used fraudulently, you haven’t lost anything.

Most cards these days come with relatively sophisticated fraud protection, so your card will likely be frozen, and you will be notified of suspicious activity. The credit card company will almost certainly reverse the charge, but it doesn’t really matter to you, because you never paid for the fraudulent purchase in the first place.

I’m not going to lie; that is pretty compelling. The credit card acts as a protective layer against your money.

Debit card fraud

In contrast, if that same bad actor (or a different one, there are plenty to choose from) gets access to your debit card, then they might be able to take out money directly from your checking account.

This isn’t academic, as this has happened to me before. A few years back, I was on a business trip, and I tried to use my card and was declined. I then received a phone call and an email warning me that there was a potential fraudulent charge on my account, and as a precaution, they had temporarily froze my card.

Sighing, as I really didn’t have time for this, I called my bank, and we went over the charge (it was indeed fraudulent), and they immediately reversed the charge. It took 2-3 days for the transaction reversal to clear, though the charge itself took about as long to clear.

At any rate, the charge wasn’t for a Ferrari, and I have sufficient float in my account, so I wasn’t out of pocket for any of this.

Worst case scenarios

I can foresee a circumstance where a really bad actor (like worse than B-movie bad) might remove the entire balance of my account, and perhaps the bank decides to be recalcitrant for some reason. What then?

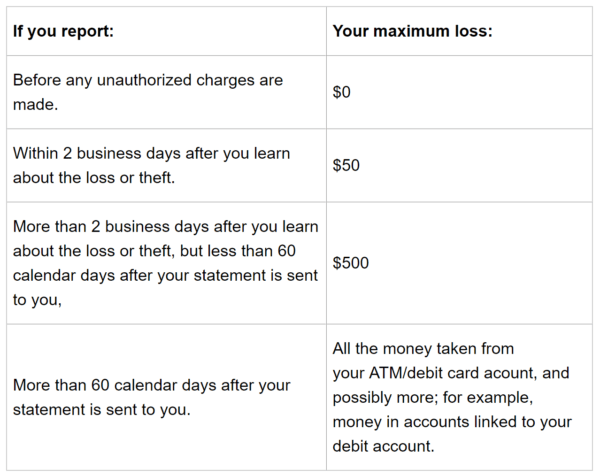

The FTC has a nice page on just this circumstance. In the section titled “ATM or Debit Card Loss or Fraudulent Transfers” they have a handy table:

So, in short, if you notice quickly that something is amiss (and remember, your bank often does this for you), you will not lose anything. If in the first two business days you report it (and if your bank doesn’t have any special rules in place), you’re out a max of $50. More than two business days but less than two months is $500. Beyond that, you’re out of luck.

Technically, since you’re never liable for a fraudulent charge on a credit card, and you’re potentially liable for a fraudulent charge on a debit card, on this point the credit card is technically safer.

Bigger picture

But this is not the whole story, because it makes a general argument (which type of plastic is “better”) based on a single criteria (response to a fraudulent charge). For the argument to be more persuasive, we need to include more criteria, such as:

- How often you check for unauthorized charges

- Likelihood/frequency of fraudulent charges

- Other risk factors not related to fraud

The first two are related. If you’re with a reliable financial entity, they usually check for you, but if you’re a hawk with your online accounts, you’ll never go more than two days without noticing something is amiss. So worst case scenario, you’re out $50. How often might this happen?

Now, let’s talk about credit card spending. The New York Times cites a 2000 paper titled “Always Leave Home Without It: A Further Investigation of the Credit-Card Efect on Willingness to Pay“, which states in its abstract:

“In studies involving genuine transactions of potentially high value we show that willingness-to-pay can be increased with customers are instructed to use a credit card rather than cash. The effect may be large (up to 100%)…”

The assertion is that in using credit cards (in your desire to accrue frequent flier miles, or cash back rewards, or whatever) you are spending extra than you would otherwise. Maybe in the short run this amount is small, but over time the discrepancy can grow.

So the question boils down to: are you likely to spend more in extra charges with your credit card than you are in fraud charges from using a debit card?

For me, since I can confidently put the amount of money I’ve paid out to fraudsters is $0, the answer is a resounding yes.

I’m not saying that using debit cards carries no risk at all, just that the risk needs to be put in proportion. No purchase is without risk, but I prefer the simpler option, where one transaction is all that’s required, and I can’t spend money I don’t have.

But enough about me. Do you think debit cards are risky?