Most people travel and then figure out how to pay for it, but with my plan, you figure it out in advance and come home debt-free.

We’re at the point in the pandemic where the average person in the U.S. is thinking of traveling again. According to statistics published by the TSA, we’re not at 100% pre-pandemic passenger levels, but we’re getting close.

I haven’t been on a plane since December 2019, the longest stretch of no-travel for me in well over a decade. (Early versions of this site tended to resemble a travel hacking blog as much as a financial wellness blog.)

But this no-flying time is going to be changing soon, as my partner and I are about to go visit my family on the east coast for the first time since the pandemic. I’m very excited. 😄

Other people are surely contemplating summer travel, or even fall or holiday travel.

I’ve found that people get the financial side of travel planning all wrong, which causes them to have less money when they get home, without much to show for it.

I want you to travel as much as you want to. So if you’re looking to plan travel, I want you to do it right.

And with the plan I’m outlining below, you can make sure that you always have the money to travel, without coming home with nasty credit card souvenirs.

Table of Contents

What people get backwards

Most people do this:

- Go on trip

- Figure out how to pay for the trip

When in reality, the way to do it is this:

- Figure out how to pay for the trip

- Go on trip

This is what we’re going to do.

The first thing to do is to figure out how much your trip is going to cost.

This might seem mind-bendingly obvious, but it’s actually a step rarely taken, at least not down to the specifics.

On one level, I get it. You don’t totally know what that amazing meal by the seaside is going to cost. You don’t really know how much your Lyfts and taxis are going to be. And as for the souvenirs, who can say?

But on another level, you are an empowered individual, not just some mindless consumer with no control of your actions.

So plan your trip. In advance.

Plan your one-time costs

There are some costs to your trip that only happen one time (or maybe two). These are costs like:

- Airfare

- Hotel/lodging

- Rental car

More to the point, this is all known in advance. (It’s a rare trip where you don’t know what your hotel is going to cost in advance.)

So, the first step is to compile all of these costs.

Here’s an example for two people on a week-long trip together.

- Flight: $600 per person ($1,200 total)

- Rental car: $500

- Hotel: $1,000

- Airport transfer: $50

Total: $2,750

Plan your daily costs

There are certain things that happen every day. You gotta eat. You gotta get where you need to go. You gotta enjoy yourself.

After your one-time travel costs, the next step is to figure out your daily costs.

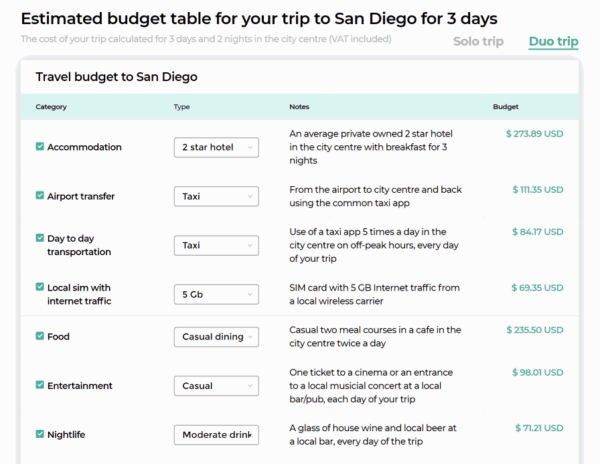

This can be a little more challenging, especially if you don’t know the destination very well. How much is a meal?

Luckily, many resources exist to help you answer this question. If you’re a book buyer, I’ve found that Lonely Planet has good resources in its books on how much to expect to spend daily, and even has tiers for frugal, moderate, and big spenders.

There are also websites with this information. The Trip Cost is a good one to refer to.

So given our two friends’ week-long trip, here are their projected daily costs:

- Food/Drink: $100 per day ($700 total)

- Entertainment: $100 per day ($700 total)

Total: $1,400

Plan for everything else

Then there are some costs that don’t happen every day, but aren’t necessarily one-time costs either

Bigger events tend to fall under this category. The scuba diving boat. The flightseeing trip.

You list those separately:

- Scuba trip: $300 per person ($600 total)

- Flightseeing: $350 per person ($700 total)

Total: $1,300

Add it up

Now with all costs more or less determined, let’s add it up

- One-time costs: $2,750

- Daily costs: $1,400

- Everything else: $1,300

Grand total: $5,450

In general, it’s probably a good idea to round up. This is an estimate, and you always want to plan for the unexpected. Also, plans change.

But for this plan to work, you need to keep to it. Otherwise, you’re like the car reservation agent in Seinfeld, who can take a reservation but not hold it.

So let’s call it a cool $6,000.

Save each month

I don’t know about you, but I don’t usually have six grand just lying around. Also, presumably, you’re not being so wild and spontaneous that you booked this flight for tomorrow. This thing is in a couple of months, possibly a year out.

So the next step is to figure out how you’re going to pay for this trip.

Let’s assume you’re starting from scratch, with nothing saved up.

You need to divide the total cost of the trip by the number of months before the trip, and save that amount each month.

For our example, let’s say it’s in a year.

$6,000, 12 months away means that they would need to save $500 a month in order to afford the trip.

If the trip was in 6 months, they’d need to save $1,000 a month.

You get the picture.

What you get for doing this plan

So what do you get for planning your travel in this way, saving up for your trip months before?

You get to enjoy your trip the same amount, doing all of the things you’d be doing anyway, but when you get home, you have no credit card debt. You’ve paid for the trip.

Sure, if you’re traveling internationally and want to temporarily put spending on a credit card, fine, whatever, but you can come home and pay it right off.

And this is the best part: now you can immediately start planning your next trip.

There’s nothing fun about coming home from an amazing trip feeling refreshed, and then realize that you have to spend the next few months or even years paying it off.

Wouldn’t you rather come home refreshed and say, “that was amazing! Let’s do it again!” And be able to start saving for that trip, unencumbered?

I thought so.

In this way, you can travel more or less forever, and never have debt because of it.

Bottom line

Instead of blindly going on trips and then having a bunch of credit card debt when you get home, you can plan for your trips in advance and come home debt free.

And it’s not hard. Try my plan. I’ve helped people travel all over the world without debt. You can do it too.