It can be hard to visualize how paying a debt off works.

There’s an interplay between principal and interest. You pay money to reduce the principal, but during that time, interest on the debt has piled up, reducing the impact of your payment and adding to the amount you owe.

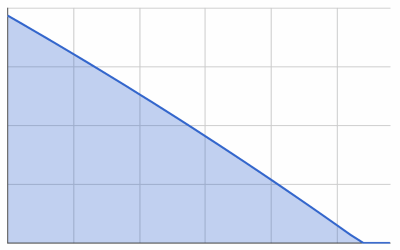

You might think the a debt payoff plan is like this:

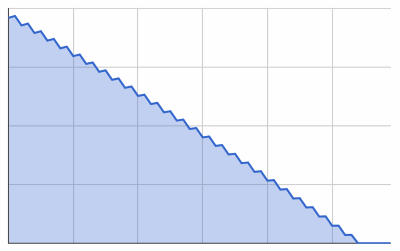

But it’s actually more like this:

(Downward for principal paid, upward for interest accrued.)

The goal is that the amount you pay is greater than the interest you accrue during the same time period. That way you make progress. And as you pay off principal, the amount of interest you accrue becomes less and less.

This means that when you pay extra now, it will positively affect (increase the power of) every other payment you make for the life of the debt.

I think this is worth your attention.

Table of Contents

Paying extra

So, I have a mortgage. It sucks to have so much debt now, but at least I never have to worry about being priced out of the market because of rising rents.

I recently threw down a massive (for me) extra principal payment. I was able to do this mostly because of a tax refund due to the mortgage interest deduction. (Note: I still paid way more than I got back.)

To give numbers, I paid $5,000, a paltry sum when compared to the size of the mortgage.

And yet, it had a strong ripple effect.

The ripple effect

The lump sum payment had two effects, one obvious, one not so obvious.

- Obvious: My principal was reduced by $5,000 (duh)

- Not obvious: My interest payments went down by $20 each month

Now, isn’t that interesting? With $20 less in interest, it means that the same payment will have $20 extra go toward principal.

So the less principal, the less interest. And the less interest, the more goes to principal. It’s a virtuous cycle.

The mighty power of $20 a month

Now, $5,000 for $20 may seem a little underwhelming. What’s the big deal?

The answer is in the long-term. Depending on how quickly I am able to pay off the mortgage, it could be somewhere around 20 years, give or take. (Hopefully much less.)

At $20 a month, that’s $4,800.

That means two things:

- Because I paid $5,000 now, I won’t need to pay about the same amount in interest.

- As interest not paid means principal that is paid, I could get about a 100% bonus on my payoff amount.

That’s right, an almost 100% bonus. A BOGO deal for debt.

And my interest rate is pretty low. With a higher interest rate, the more powerful an early payment is.

What this means for you

Everyone says to pay off your debts as quickly as possible. We all know that. But what’s perhaps more important is that the more you pay now, the less you pay over the long term. Even a single lump sum payment now can affect the entire course of your debt payments for years to come.

Can you find extra money to throw at your debts? I bet you can. And the sooner you do it, the more money you’ll save.

I’m seeing this $20 at a time.

But enough about me. Are you paying extra on your debts?