I get my credit report from Experian, and learn the surprising truth behind those free credit score commercials from a few years ago.

Part of a series:

I recently decided to start the process of getting my credit report (and get over my resistance to doing it). Since there are three different credit bureaus, this means that, to be complete, I had to do this three times.

But that’s a lot of administrative work, so I decided to break the task into parts, so I could manage one credit report at a time.

Last time was Equifax, so if we’re going in alphabetical order, that means that it’s time for Experian.

But first, let’s talk about a certain set of TV commercials from around the time of the Great Recession.

Table of Contents

“Free” Credit Score

Sometime in the Great Recession, when there was lots in the news about the economy, subprime mortgages, not to mention the new rules and regulations around the Dodd-Frank Act and consumer safety, I started seeing commercials on TV that looked like these:

I didn’t follow the financial markets too much at this time, but I did remember hearing that the government was working to make it easier for people to be able to read their own credit reports, even making them free in a limited way.

I assumed that these commercials had something to do with that offer.

Later on, I learned that this was not the free site set up by the government, but instead a paid offer that claimed to give you a free credit report or credit score, but only if you signed up for some kind of subscription service. Scam alert!

I didn’t think much more of that, except to always to remind people to specifically go to annualcreditreport.com to get their free credit reports, lest someone remember the jingle from the above commercial and go there instead.

However—and this is mindblowing—it wasn’t until doing the research for this article that I found out that the company behind those misleading ads was none other than Experian! The credit bureau was on one hand banding together with the other credit bureaus to give free credit reports to the masses, while at the same time specifically trying to undermine that effort by launching a competing and confusingly similar service.

So keep this in mind as I trepidatiously look at my own credit report from Experian, and hope that I don’t get roped into some subscription service that I don’t want or need.

Ordering the Experian credit report

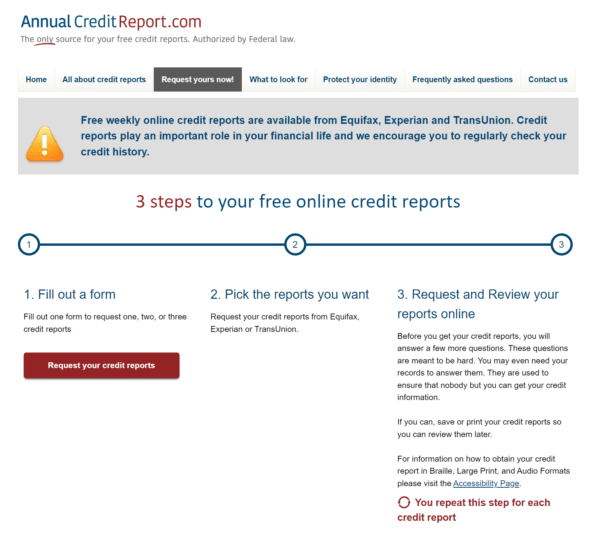

The way you order your Experian credit report is the same way you order any of the three credit reports: you go to annualcreditreport.com.

There’s a big red button in the middle of the page that says “Request your free credit reports”. Click that and you’ll be taken to a page that shows you the three steps to getting your credit report. Click “Request your credit reports” there to continue. (Yes, it’s redundant.)

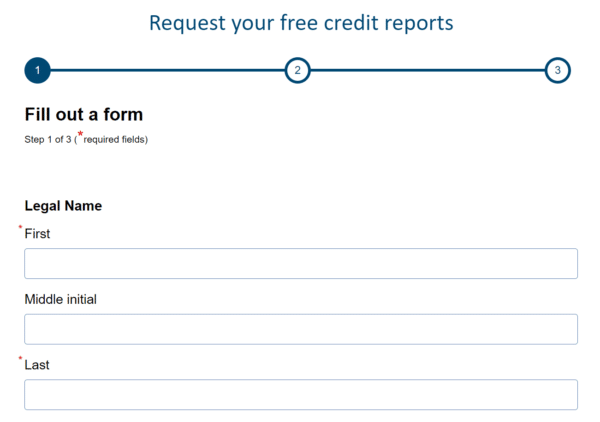

The requisite personal information follows. Fill the form out and click “Next”.

You then have the option of requesting 1, 2, or 3 reports from any or all of the credit bureaus. I’m doing these reports one at a time, so I clicked the checkbox for Experian and then “Next”.

Next, Experian wanted to ask me some personal financial questions, in what is known as Know Your Customer (or KYC). Stuff like: “Which of these banks did you open an account with at some point?” They try to trick you by having some “None of the above” questions, but hopefully you’ll know your own history.

Fill that form out and click “Next”.

And that’s it! Behold your Experian credit report.

Reading your Experian credit report

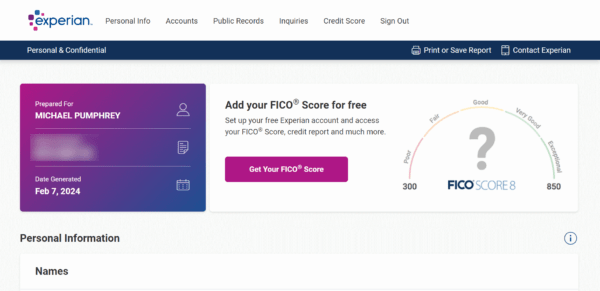

I always recommend clicking “Print Report” first, before anything else, just so you don’t forget to do it. I did this here and was rather dismayed to find that instead of a well-organized and formatted document like Equifax had, Experian just dumped the whole report onto a single webpage, without proper pagination or anything.

Then again, this report was in fact just a single web page, with the tabs at the top just scrolling to their representative sections. This made for easy searching, though at the cost of a very long document.

The report started with an immediate sales pitch: “Add your FICO Score for free”. Apparently, if I created a free Experian account, I’d get access to my credit score and much more. But I don’t trust Experian after the above misdirection, and my credit score is a different thing entirely from my credit report, so I didn’t bother.

Next, the report contained a who’s who (or rather, a where’s where) of every address I’ve ever lived at, plus phone numbers, and all the different permutations of my name that I’ve used on official documents.

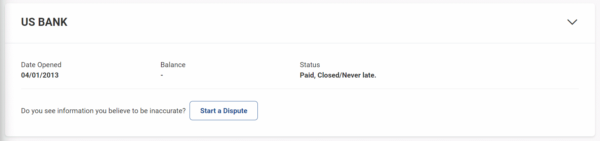

Following that was an alphabetical list of accounts, both bank and credit cards, both open and closed accounts. I particularly appreciated the statuses next to each account, such as “Open/Never late.” and “Paid, Closed/Never late.” In this way, you can easily see if you have a problem, or worse, if it shows you as being late when you weren’t.

You can drill down into each of these accounts, and there’s a nice graph of your payment history over time, showing your balance and whether you were in good standing or not.

I then got treated to every company that’s run a hard or soft inquiry on my credit over the past year or so, which included some questionable/spammy companies. Americas Moneyline Inc? Stay back, Satan.

Beyond that, there was another ad for their free credit score offering, and then the requisite Fair Credit Reporting Act disclosure, and that was it.

What I learned

Now that I’ve got two different credit reports under my belt, I feel like I can compare and contrast them.

While there was nothing wrong with the Experian report, and it appeared to match Equifax’s report in its scope, there nevertheless was a certain chintzy nature to the report. Perhaps that just came down to the janky way that they wanted you to print the report out, but there was something about the report that felt cheap in a way.

If nothing else, once I log out of my report, there is no way that I’m likely to refer to the PDF when compared to the Equifax version, and since they appear to be identical, this means that I’m pretty much done with Experian.

If nothing else, they’re not going to swindle me into signing up for anything.

Your turn

If you’re following along at home, now is the time to sign up and get your Experian credit report. It’s super easy, and just like Equifax, takes less than five minutes to view.

And while I was kind of dissing the Experian report, it’s still important to get it, because they could have different information from the other bureaus. You want to make sure that every credit report is accurate, and fix the information if it’s not.

Now that’s a tip I suggest you take from my bro.