The credit agency, TransUnion, seems to have the least interesting credit reports, but getting yours from there is just as important.

Part of a series:

- How to get your credit report from Equifax

- How to get your credit report from Experian

- How to get your credit report from TransUnion

I’ve been writing for the past few weeks about how you can get your credit reports for the three major credit agencies.

Because of new legislation, what was once something you could do only once a year, per agency (and thus had to devise creative ways of staggering your reports), you can now get your free credit report from each agency once a week, which effectively means whenever you want.

But it’s not enough just to get (download) your credit report. You have to read it as well.

Just like how it’s not enough to take a car rental reservation; you also have to hold the reservation.

Because reading one credit report is probably not that much fun, I thought it would be best to get your three different reports at different times, and write about them separately. Break the un-fun stuff into manageable chunks, you know?

The only problem with this approach is that this assumes that there’s something interesting about each credit report/agency to justify three different articles.

Table of Contents

Hi, I’m in Delaware

Alas, we have TransUnion. TransUnion doesn’t make headlines, and there’s been no big leak or hack that put it in the news. They didn’t create catchy commercials or try to undermine the government’s plan to offer free credit reports.

They’re basically the Delaware of credit reports.

And you know exactly what I mean by this:

Nevertheless, here we go.

Ordering the TransUnion credit report

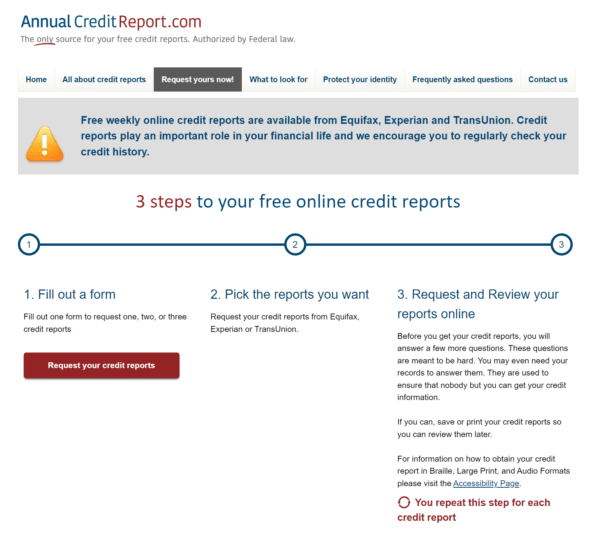

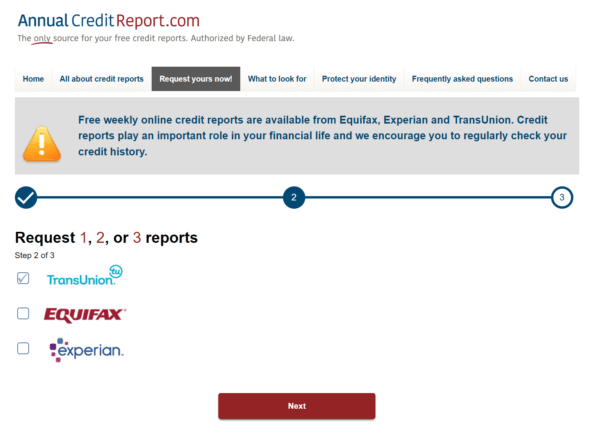

The way you order your TransUnion credit report is the same way you order any of the three credit reports: you go to annualcreditreport.com.

There’s a big red button in the middle of the page that says “Request your free credit reports”. Click that and you’ll be taken to a page that shows you the three steps to getting your credit report. Click “Request your credit reports” there to continue. (Yes, it’s redundant, and if you’ve been reading this article series, I guess so is this section.)

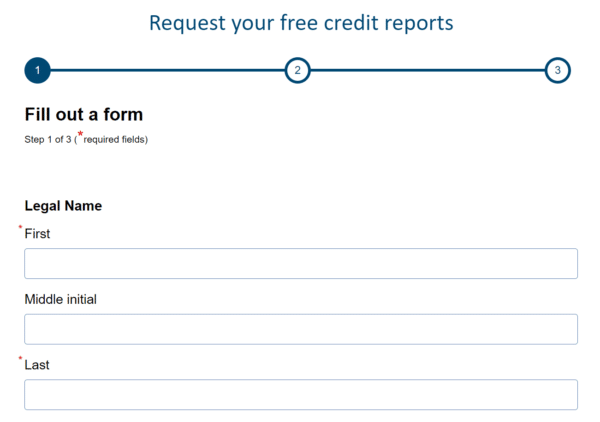

Next, the personal info. Fill it out and click “Next”.

Then check TransUnion from the list below, since we’re only doing that one now. Then click “Next”.

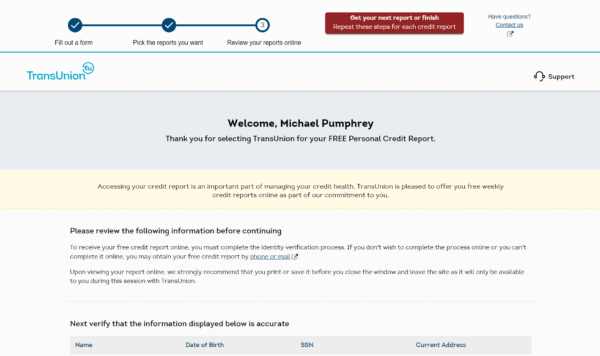

From here, TransUnion wanted to verify me. It asked me for my email address and phone number.

I usually give out a fake phone number on these things to cut down on spam, but that didn’t work here, as it wants to verify you through SMS or phone call. If you give an incorrect phone number, there’s no way to go back, and you’ll have to start the whole process over. So bite the bullet, and give them the correct phone number.

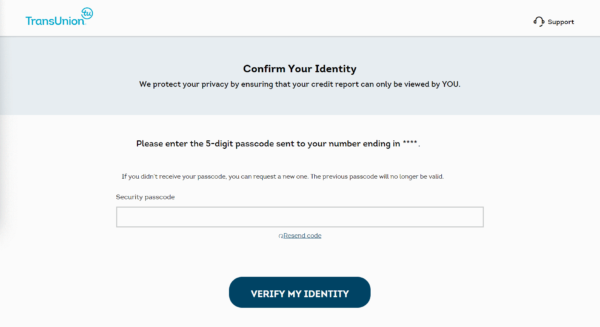

It went through a standard Two Factor Authentication verification process, where I had to regurgitate a five digit PIN. And then I was in.

Reading your TransUnion credit report

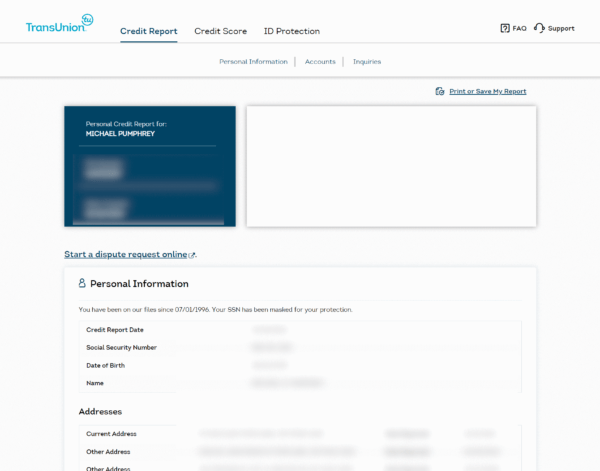

First things first, click “Print or Save My Report”. That way, you’ll have a copy before you accidentally get signed out and can’t get back in again.

The saved document, I was sad to see, was exactly like Experian’s: just a raw scraping of the web page, with no print-friendly formatting. So, in terms of preferences, the Equifax PDF is by far the superior document.

But what of the actual content?

The report starts with “Personal Information”, consisting of name, and basic info, current and previous addresses, a giant list of phone numbers, and employers. This last section was woefully unpopulated, displaying only two positions I’ve held over the past 20 years, and only one of them showing a valid job title.

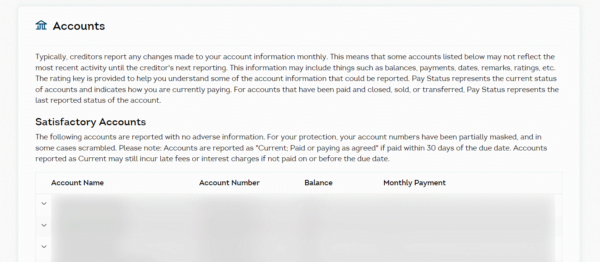

Much more important is the next section: “Accounts”. This section shows all of your credit, bank, and mortgage accounts, all listed alphabetically by bank name. It shows your balance, and your monthly payment.

All of this was under “Satisfactory Accounts”. I don’t have any “unsatisfactory” accounts, but presumably if you had any, they would be shown in a separate section.

Next is a list of inquiries on your account. Instead of the usual “hard” and “soft” inquiry language, they instead said “Regular Inquiries” and “Account Review Inquiries”, which is actually better and less euphemistic now that I think about it. There was also a “Promotional Inquiries” section, for all those companies who are trying to sell you something you don’t want.

Below that, everything is boilerplate, summary-of-your-rights stuff. This report is clearly the most compact out of all of the credit reports I’ve gotten. It also gives you information on how to submit a dispute, in case some of the information is incorrect.

The ability to dispute is, after all, the whole point of reading your credit report. If something is incorrect, you want to fix it. And if you have negative items on your report, then you at least want to know about them.

What I learned

Unfortunately, I learned nothing.

The report was fine, and had all the appropriate information on it. But I couldn’t help but feel a little underwhelmed with the information as it was displayed. It seemed to have the least amount of information of any of the other credit reports.

In short, it felt like getting this report was just a requirement to “completing the set”. I’m glad I did it, but that’s about it.

Your turn

It’s still possible that your TransUnion report may be more interesting than mine. Also, it may turn up an issue that the other credit reports don’t, which is why, despite my feelings of underwhelm, it’s important to get (and read!) your TransUnion report.

It only takes a few minutes to do, and the process is painless. Just go to annualcreditreport.com and get started.

It’s maybe not quite like being magically whisked away, but you’ll be glad you did it.

Title image source: Reddit