I got my credit report from Equifax and show how easy it is to view your financial history and fix any errors if necessary.

Image credit: Tyler Lahti, CC BY-SA 4.0, via Wikimedia Commons

Part of a series:

One of those pieces of financial wisdom that you hear a lot is that you should “get your credit report”.

Often times this gets confused with getting your “credit score”, which is very much not the same thing. While the credit score is one company’s view of how good at managing debt you are, the credit report is a more comprehensive review of your financial history and status.

There are two reasons to get your credit report: to know what companies see when they pull your report, and to check for (and fix) errors.

If you have negative financial behavior, there’s nothing you can do about that but wait the 7-10 years for the behavior to drop off your credit report. But if you have negative financial behavior that’s incorrect, that didn’t actually happen, then that’s a problem.

And incorrect stuff happens all the time, from clerical errors to identity theft. Imagine if someone stole your identity, opened a bunch of credit accounts, and then never paid any of them off. That would not look very good on your credit report.

Negative information can be disputed and removed from your credit reports, but only if you know about it. So it’s very important to get your credit report and look it over carefully.

It’s been a while since I got my credit report, so I decided to go through the process myself, just to see how easy it is.

And it is easy. The process to go from the website to my first credit report took less than five minutes. That’s impressive.

There are three credit reports, one from each of the following credit agencies: Equifax, Experian, and TransUnion. Going through all three reports at once is a lot of work, so I decided to just get one report, Equifax, and will get to the others later.

Since you can now get your reports for free, on a weekly basis, this makes this process a snap.

So here’s what happened when I ordered my Equifax credit report.

Table of Contents

Ordering the Equifax credit report

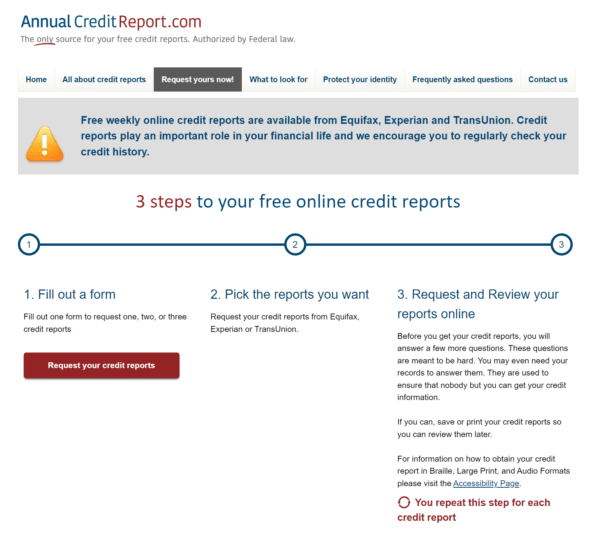

The way you order your Equifax credit report is the same way you order any of the three credit reports: you go to annualcreditreport.com.

I mention the website explicitly, because for a time there was a bunch of copycat websites that tried to trick you into using their services, but they weren’t free.

But annualcreditreport.com is run by the federal government, and, frankly, you can tell this by how unpolished and utilitarian it is.

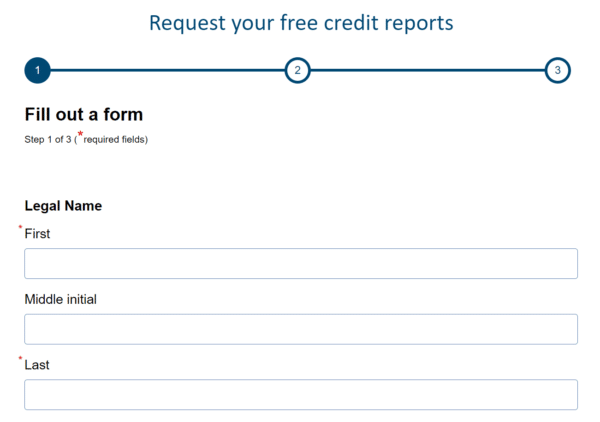

There’s a big red button in the middle of the page that says “Request your free credit reports“. Click that. You’ll then be taken to a page that shows you the three steps to getting your credit report. Click “Request your credit reports” to continue.

You’ll then be asked to enter some personal identification. Fill the form out and click “Next“.

You then have the option of requesting 1, 2, or 3 reports from any or all of the credit bureaus. I’m doing them one at a time, so I clicked the checkbox for Equifax and then “Next“.

Then the site will want to send you a verification code either by phone or by email. Go through that process to verify yourself.

And that’s it. Your Equifax credit report will automatically appear on the screen. Honestly, I was amazed at how easy it was.

Reading your Equifax credit report

Before we get started, I recommend you click the “Print Credit Report” button on the top right of the page. This will save your report in an easy-to-digest (if long) PDF format. Just do it now so you can save this report for your records.

The page starts on a Summary, with basic demographic and financial data for you. What I saw was as follows:

- Report date

- Credit File Status

- Average Account Age

- Accounts with negative information

- Length of Credit History

- Oldest Account

- Most Recent Account

- List of credit accounts

Right away you can see if anything is amiss. I would look right at the “Accounts with negative information”, and if that number is greater than 0, to look at those accounts to see what they are, and if the information is correct.

There are a number of different sections going down the left side of the page. They are:

- Revolving accounts: These list accounts with revolving debt, such as credit cards. You can see balances, number of late payments, and the age of the account. You can also see recent closed accounts too.

- Mortgage accounts: This section is very similar to the above Revolving accounts section, but for mortgages, if you have them.

- Installment accounts: This section is very similar to the above too, but for installment accounts if you have them.

- Other accounts: If you have “child support obligations, charge cards, or rental agreements”, they will be shown here.

- Consumer statement: This section will display any official statements of dispute that you have filed with the credit bureau. This happens when you dispute information on your report.

- Personal information: Your name, Social Security Number, Date of birth, and every address you’ve lived at, going back (in my case) almost 30 years.

- Inquiries: This section lists the number of soft and hard credit inquiries that banks, credit cards, and other services have run on your account. This is very useful to see who is checking your credit history.

- Public Records: This section shows public records such as Bankruptcies, if you have any.

- Collections: If you have any debts that are in collections, they will be shown here. This section is very important to check, especially if you’re unaware that you had debt that’s gone to collections, which does happen.

- Your Rights: A listing of your rights under the Fair Credit Reporting Act, which is a law designed to protect you against shady financial practices.

- Dispute: If you would like to dispute any information you believe to be incorrect on your report, you can do that here.

- Products for You: Well, they had to try and sell you something, didn’t they?

What I learned

I hadn’t read one of my credit reports in a while, so I was very interested to see if anything was surprising.

Thankfully, there wasn’t anything surprising. This is good, because surprises are generally not good when it comes to your credit report.

Here are some things I found interesting about my Equifax report:

- I have a credit history of 17 years. This means that they have evidently forgotten about the credit card that I got in college (the one they usually give out with the free t-shirt on campus). Maybe for the best?

- Maybe they only meant active credit. I keep an old, fee-free card around to increase my age of credit, which is an easy way to increase your credit score. That one is evidently 17 years old.

- Credit companies have given me so much credit that I could pay off my mortgage at a stroke if I

lost my mindwanted to. (Don’t do this, even if you can.) - I have a listing in this report of every place I’ve ever lived, going all the way back to 1996.

- I’ll note that they list my “current” address as my PO Box, which personally is just fine by me.

I was pleased that nothing looked incorrect or worrisome. I could look at all of the entries on the various pages and recognize them all.

But it was also good to know that if something had been amiss, it was easy to find the link to dispute the information.

Your turn

It was so easy to get my credit report from Equifax. If you haven’t gotten your credit report recently, try it yourself and see how easy it is. If there’s nothing shocking, then it’ll only take a few minutes of your time. And if there is something worrisome there, you’ll be glad you found it, so you can take steps to fix it. The sooner you do that, the better.