The true story of how I paid off my student loans, and the tricks I used to make it happen more easily and quickly.

With the upcoming resumption of everyone’s student loan payments, I’ve been feeling a lot of different emotions.

I’m feeling angry that people are in this situation and there’s seemingly nothing that anyone can do about it. (Yes, people took out loans knowingly, but did they know that real wages weren’t going to rise like they had in the past?)

I’m feeling a lot of empathy for the people in the situation of needing to pay hundreds of dollars that they had had a reprieve from for a few years.

But it’s all a strange feeling for me, because I no longer have student loans. So it’s a whole different story to sit here, student-loan free, and talk about how hard it is for people.

That said, I had my fair share of student loans, $40,000 in total, so I very much know what it’s like.

So I figured, for solidarity, I’d tell the story of my student loans, something I don’t believe I’ve ever told in full before. If nothing else, it can at least show you that such things are truly possible.

Table of Contents

Post-college blues

I got the bulk of my student loans in 2001 when I graduated from college.

I had four student loans, three of which I was able to consolidate:

- Direct Loan: $14,418 (5.39%)

- PHEAA: $4,814 (6.79%)

- Sallie Mae: $999 (6.79%)

And a fourth which I was not able to consolidate:

- ECSI: $5,500 (5%)

So that’s a total of $25,731. When my consolidation loan went through, I paid about $190 a month, and my other loan was $50 a month. My exact interest rate on the consolidation loan escapes my records (and memory) somehow, but I believe it was around 5.75%.

In other words, my interest rate wasn’t all that different from interest rates today.

More loans

In 2003, I went back to school, and got a private loan for it.

I know, I know! But I didn’t have a choice; the school wasn’t eligible for regular federal loans.

So I had to take out private loans for $15,000.

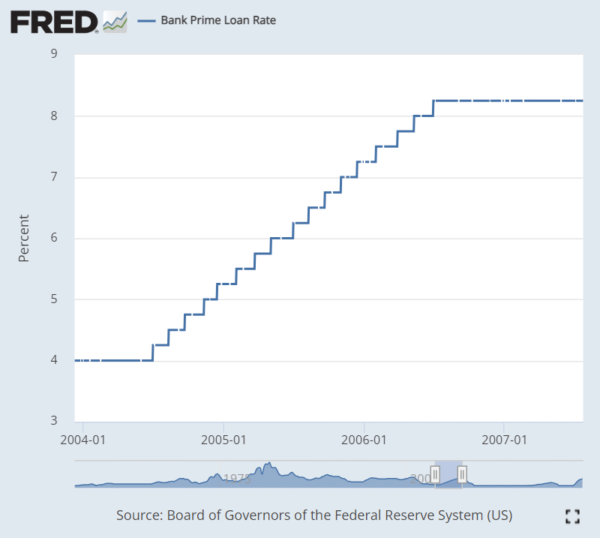

The interest rate was a floating rate, and even though the terms were pretty favorable (Prime +1), this was 2003. And what happened between 2003 and 2008 is very similar to what’s happened over the past few years today.

This was when I really began to care about interest rates, you know? Every few months, my loan payment would rise.

By 2005, I was paying $390 a month in student loans. To put that in context, that’s over $600 in today’s dollars.

Income rising

Meanwhile, my income thankfully rose. From my retail job making $13 an hour, by 2004 I was making $36,000 a year, and by 2008 I was up to $58,000 a year.

Because of this, I was able to put a little extra away each month.

I have always believed in the Debt Snowball, and so I started with that small, unconsolidateable loan, and put maybe $50 extra a month towards it. By 2006, I had paid it off, my first student loan payoff!

But the consolidation and private loans were going to be much harder and take much longer.

How I was able to pay off my debt

Aside from diligence, tenacity, and patience, I credit three factors that enabled me to pay off my student loans

- No other debt. While people all around me were buying cars and taking out massive car loans, I bought a car for $1,200 in 2001 and kept it for a decade. Yes, it wasn’t much to look at, and it was a bit of a challenge to keep on the road, but it worked, and it was so much cheaper than if I had succumbed to my desire to “look good”. I reckon this alone was a financially life-changing experience.

- Income. I’ve long said that the most impactful way to build wealth is to take advantage of your income, not to spend less. While you can certainly spend less, there’s a limit to what you can not spend, but income, at least theoretically, has unlimited upside. And so when I got raises, I didn’t increase my lifestyle costs, and poured money into my student loans.

- Moving to Portland (and leaving New York City). I lived in New York City from 2003 to 2010, and leaving it was one of the best decisions of my life, not only financially, but also emotionally. Even better, when I left and moved to Portland, OR, I was able to keep my existing job. This meant that, by doing nothing else, the cheaper cost of living meant that I immediately had an extra $500 of spending money each month. You can imagine where I put it.

Endgame

Once I got to Portland, I had about $7,000 left in my consolidation loan, and maybe $12,000 in my private loan (both housed in Sallie Mae).

I waited a bit to make sure that my finances were stable, and then, feeling confident, I blew away the consolidation loan in one go. I had had about that much in an emergency fund, a just-in-case fund for my move to Portland. I decided that I wanted to be done.

For most of the rest of the year, I just socked away cash, month after month. My goal was a total annihilation of my student loans. I didn’t care that I would have no savings left. I could always build that up. I wanted to be done.

And being helped by my move to Portland, making everything so much cheaper, it allowed me that extra $500 a month to put away.

For dramatic flair, I wasn’t paying extra on my student loans at this point. This wasn’t a mathematical decision, it was an emotional one. I wanted to be done.

And in July of 2011, I logged into Sallie Mae, and set up a payment of $10,951.16.

This wasn’t a Debt Snowball. This wasn’t a Debt Avalanche. This was a Debt Blunderbuss.

And just like that, I had no more student loans.

Reflections

$40,000 in loans from when I got them is worth about $62,000 today. So when I tell you that I understand what it’s like to have a ton of student loans, I’m not kidding around.

I know what it’s like to feel like those loans will be there forever. I fully expected to take the full 25 years to pay them off.

But what I’ve learned is that the distance between impossible and inevitable is closer than you think. And a mere ten years after I graduated from college, my student loans were a distant, unpleasant memory.

If you think I’m somehow special here, you’re wrong. All I did was to stand up and say “no more”. I got mad as hell, and I didn’t take it anymore. And then I kept at it, year after year, until I had the (purchasing) power to knock them all out.

Now I ask you: do you want to feel the same way? Do you want to wake up and feel the relief that comes with having no student loans?

I thought so. Once you’re ready, reach out to me, and let’s get a plan in place for you. I paid off my student loans, and I can help you do the same.

One Comment

Steve

Congrats!

Love that letter from Sallie Mae. “Congratulations! We so loved having you give us money and please let us know as soon as we can get back into that tryst again, here’s our number kisses!