I’ve been preparing for my latest adventure recently. And while this involves things like digging out my passport, buying travel guides, and maybe booking some lodging (I always wait until the last minute on this), one of the more pleasing parts of this planning process is digging out my change jar.

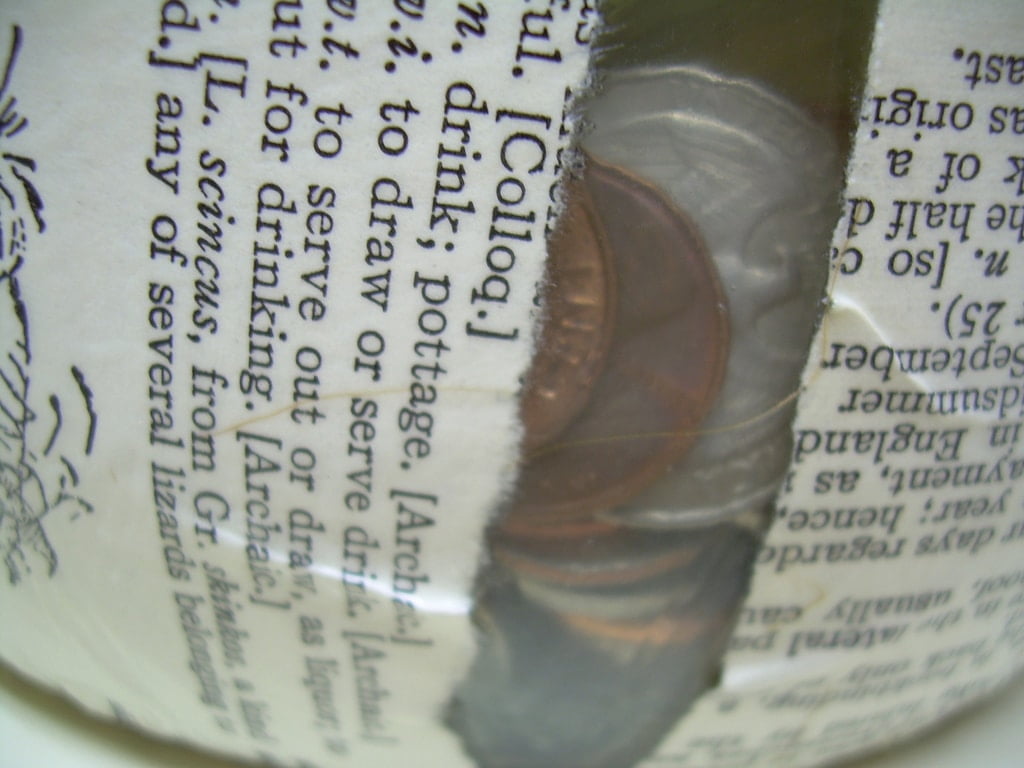

My change jar is exactly that, where I put my coins at the end of the day. As the jar (actually just a cup) fills up, I periodically put them into coin rolls and throw them in a box. And then I forget about them. The trick is that I never spend those coins.

Table of Contents

Coins for travel

Except, of course, when I’m going on an adventure. You see, I call my change jar my Supplemental Adventure Savings Fund. It is one of many savings funds I have set up, one that I forget about. I know it’s there in theory, but because it’s “off the books” I’m able to fool myself into thinking that it’s not there. It’s not part of my banking system, so it doesn’t show up on any statement. It’s not something that I even have counted up, so I can’t keep the figure in my head. It’s just a place where I dump my change.

The advantage of this method is that you can forget about the money until such time as you determine that you need it. I’ve always prioritized travel, so I long ago decided that the only thing I would spend my change on is for extended travel adventures. Not for weekend trips, not for clothes, not for lunch money. It’s an infrequent target, so that way I give it time to build up.

Banks often offer this feature where they round up all of your purchases to the nearest dollar and dump the extra $0.63 or so into a separate savings account. And while this is perfectly fine, if you’re a person who watches statements like a hawk, you will see how much money you have in this change account, and it won’t be such a pleasant surprise when you go to access it. (One suggestion would be to not focus on your statements so much, but I don’t recommend that at all.) By all means set one of those up, but it shouldn’t really be much of a ruse. Instead, set up an automatic deduction each month and have it be part of your monthly budget.

Maybe not for use with taxes

Since it’s tax season here in the US, I would be remiss if I didn’t mention that some people use this approach in their taxes, taking a little too much out of their checks, and then getting a fat refund at the end of the year. I’m on the fence on this method. On one hand, it does sort of allows you to fool yourself into having some extra savings. On the other hand, you’re giving the government an interest-free loan for an entire year, so you miss out on the ability to use that money, either by paying off debt or by investing. But the issue that breaks the tie for me in the “no” column is that this “enforced” savings plan is illiquid; you can only reap the benefits in April. The change jar can be raided whenever.

(I tend to keep my taxes pretty even, so I don’t owe or get back anything, but if you’re currently getting a hundred or so dollars back, I don’t see a problem with leaving it like that, as long as you have a plan for where it goes. If you’re getting back $10,000 each year, might want to adjust that.)

Intentionally lax

You may think it odd that as some who suggests that everyone be intentional is so lax in this area. But I don’t see this as a contradiction. I have an emergency fund and I have savings account for things that I’m planning on doing/purchasing in the future. But I also find it useful to put in a system where certain things fly under my own radar. It’s no different than setting your clock a few minutes fast so that you’re less likely to be late. Yes, you’re smart enough to know that your clock is fast, but in the morning, you may not want to do the math. You can fool yourself to being on time. And it’s only a few minutes.

For large purchases, I don’t recommend saving money in this manner; this should only be a supplement to your other savings. But change, in my particular example, is easy to forget, small enough a part of my budget that I won’t really notice it. Another advantage is knowing that you have slack. Whatever you have saved up, be it for travel or some other project, you know that somewhere you have a bit more. And I’d rather err on the side of having more than having less. Call it my emergency fund’s emergency fund. That creates a little supplemental peace of mind. And you can never have too much of that.

In the end, my change jar had about $250 in it, which is just about enough for a train pass to get me around Japan. But in my mind, it was free. Not bad.

But enough about me? What are your strategies for getting yourself to save?