I was a super nerdy kid. If you doubt this, this story will confirm it.

When I was in middle school, I became very interested in Bulletin Board Systems (or BBSs). These were computer networks that allowed you to communicate with others in real time. You called the (local) BBS using a computer modem, and communicated via a text-based terminal window. Once connected to the network, which could have anywhere from two to a few dozen phone lines connected, you could play online (text-based) games like trivia, download and upload files, or just chat together.

These were real communities. One BBS in particular, ONIX, which you can still access to this day for free, had yearly picnics, where we would all get together in a park to and see people beyond their online nicknames. It seems adorably quaint in the age of YouTube comments, but it’s how it was, at least until the internet came around.

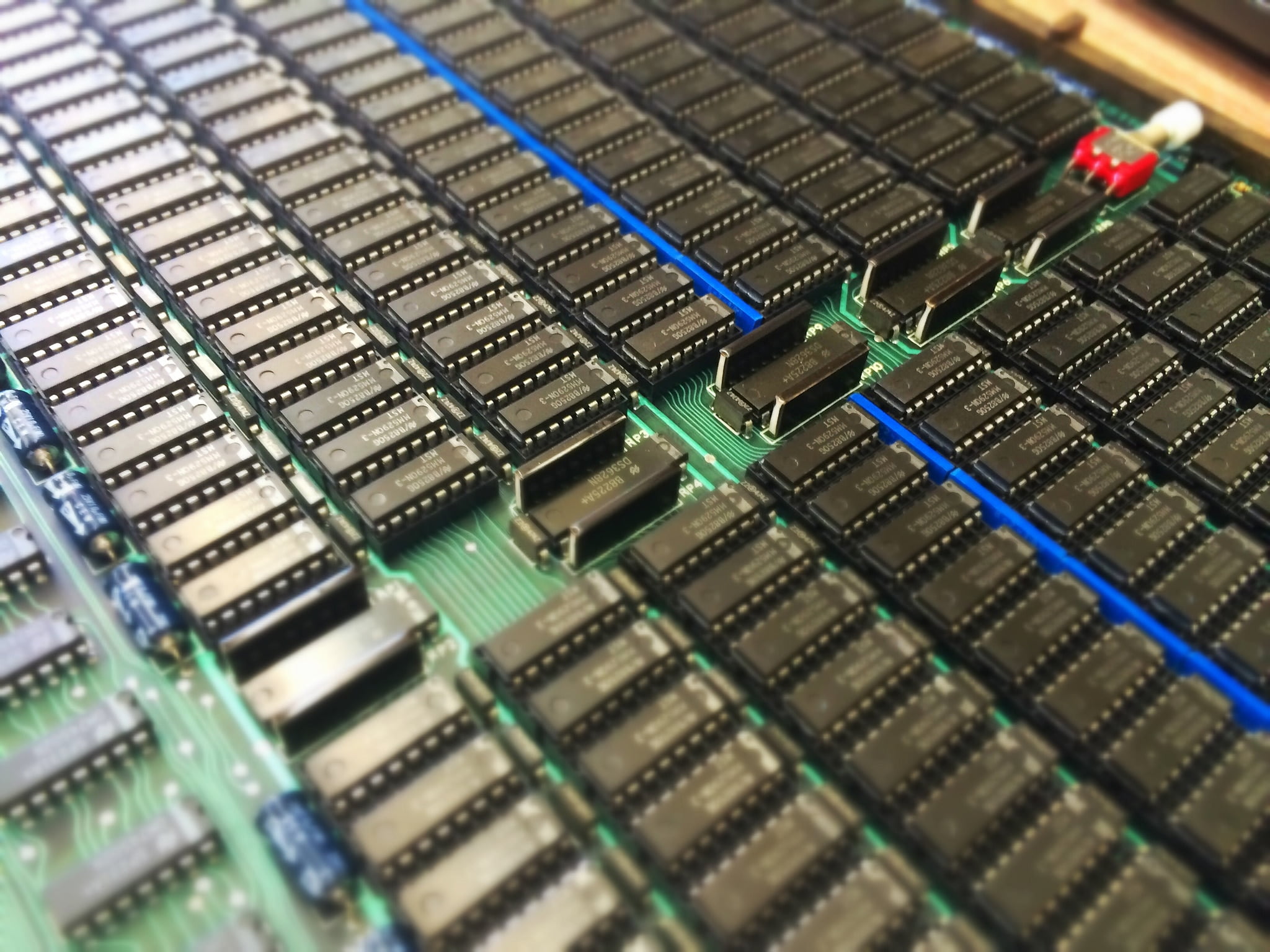

In order to get online, one had to have a modem. And with my family’s aging home computer, a Tandy 1000 EX, a modem was difficult and expensive to come by.

I wanted to get online without having to go to a friend’s house, so I did some research (again, not easy in the days before the Internet) and found that I could purchase a 1200bps modem for about $80.

(To put this in perspective, 1,200 bits per second translates into 0.0012 Mbps, which now that I think of it is not all that different from what you can get with Comcast on a bad day.)

Now, $80 to a 12 year old at that time is a huge sum of money. My brother had subcontracted out part of his paper route to me, netting me around $5.50 a week if memory serves. And I received some amount of allowance from my parents, though the precise amount eludes my memory. (This was before I had discovered spreadsheets.) And it’s not like I had real bills or expenses at this point in my life.

But still, a chance to “get online” from my home, to be able to talk with my friends there, was an enticing one, and I persevered.

So I saved up for it. Every week, I would put a little money away, eschewing what middle school delights I could in order to achieve the ability to buy a piece of real computer equipment. I daydreamed about all the fun that I could have connecting to all those BBSs, names which betrayed their origins in a nerd class: Starfleet Command, Starbase 10, Valhalla.

I was a kid; there were no credit cards. If I wanted this, I was going to have to pay for it. I guess I could have detailed what I wanted to my parents and waited for my birthday to come around, but I had no assurances that they would go along. In fact, at the time, I’m not sure they really got what a modem was (as most people wouldn’t have at the time), much less why I wanted one so much. So it was all on me.

I don’t recall how long it took me to save for it. I can wager a guess that it took a few months, which in middle school years is a serious long-term project.

Even back then, I had the idea of float, which is to say, a baseline amount of money to have in possession at a given time. But the thing about float is that there’s nothing wrong with dipping down below your float, so long as you return to it. In fact, in a given month, to this day I routinely dip below my float, only to rise up above it, bobbing up and down (like something that floats, get it?).

So toward the end, I decided that if I dipped into my float and took out a little bit of money, I could afford the modem just a little bit sooner than if I waited until I acquired it at a later time. There would be a short period of deprivation and lack of means, but just like an emergency fund, I would build it up right after. It saved me about a week of waiting.

And so, armed with the necessary funds, I purchased the modem. And it was just as awesome as I thought it would be, then and for the next few years until the Tandy 1000 EX went to its 8-bit grave.

Lessons

There are a few lessons that I take from this reminiscence. The first one is more of a reminder to us than anything else of the simplicity of the transaction: that it is possible to save up for something before purchasing it.

It is as simple as it is profound. And rare: how often do we think of purchasing things (or experiences) in terms of a plan? “This is going to cost this much, and I can put away that much per month, so it’ll take me so long to be able to afford it.” It feels rare in my experience. We identify a desire we have, and then purchase it, and then figure it out later, even if that means going into debt because we bought something we couldn’t afford.

But there’s another lesson here, and that is that there is a pleasure from the anticipation of a purchase. When you can just buy it now, there is a pleasure in involved in the immediacy, but it’s a surface pleasure. But when you want something and you need to wait and wait and wait to achieve it, you can savor the process, enjoying the daydreaming, thinking about the future and the sense of accomplishment. It becomes a much deeper and more satisfying pleasure.

Waiting until you can afford something not only keeps you on a financially sound path, but also can be more pleasurable over the long term. Just ask the middle schooler who saved his dollars for months, all just to get online.

But enough about me. What are you saving up for these days?