Many people don’t know that you can make early withdrawals from your retirement accounts like your 401(k) and IRA. But should you?

See if this scenario feels familiar. Your budget is tapped out and you’re not making enough money to support your life. Or, maybe you just got a giant bill for something, and you don’t know how you’re going to pay for it.

Meanwhile, you know that you’ve amassed a fair amount of money through your 401(k). Or, maybe you’ve put money into an IRA at some point, and it’s just been sitting there.

You might think to yourself, “can I just withdraw that money?” After all, it’s yours, right?

Well, the short answer is that yes, you can withdraw money from your retirement accounts.

But just because you can, doesn’t mean that you should.

In this post, I’m going to talk about the rules that surround withdrawals from retirement accounts, and what that means for whether withdrawing is a good idea.

(Spoiler alert: It probably isn’t a good idea.)

Table of Contents

Withdrawals from a retirement account

Let’s start with a review.

A retirement account is a tax-advantaged investing account that’s designed to help you save money for retirement. It helps facilitate this by leveraging its tax advantages toward benefits later in life.

For example, a typical brokerage account is subject to capital gains taxes. You fund this account with money that you’ve already paid taxes on, and then you have to pay taxes on the earnings (usually 15%). Over a lifetime, that could be a lot of money you’re spending on taxes.

By contrast, a tax-advantaged retirement account waives the capital gains taxes, and sometimes allows you to defer paying income taxes on the money. But the basic rule to make this work is that you don’t withdraw your money before you’re near retirement. Otherwise, you can get hit with penalties.

For the retirement accounts we’re discussing here, penalties generally apply if you’re under age 59 1/2.

Withdrawals from a 401(k)

Say you have a 401(k), which you contribute with pre-tax money right out of your paycheck. When you withdraw money from this account, you will have to pay income taxes on the withdrawals. So far so good.

If you are over 59 1/2 and you withdraw $100,000, you will likely pay upwards of $30,000 in taxes, and get $70,000 out of the deal.

But if you are under 59 1/2 and you withdraw the same amount, you’ll pay that same $30,000 plus another $10,000 in penalties, netting you only $60,000.

That’s a big difference. And not only that, because you’re withdrawing this earlier in life, you’re missing out on the potential gains of not only the money you’ve withdrawn, but also that 10% penalty.

At an average annual return of 8%, $10,000 will quadruple to over $40,000 in less than 20 years. And $100,000 can become $400,000, etc. So that’s money gone up in smoke.

That’s while you can, I would strongly suggest not withdrawing from a 401(k).

Withdrawals from a Roth 401(k)

There’s also the retirement mutant hybrid, the Roth 401(k). This is like a 401(k), except that the contributions you make have already had taxes paid.

This means that withdrawals of Roth 401(k) contributions will not be taxed upon withdrawal (as you never pay taxes twice).

But if you’re under 59 1/2, you will still pay that same 10% penalty. And you will pay income taxes on your earnings.

The math is a little harder here, but remember that from a $100,000 withdrawal, at the very least, $10,000 (and all that future earning) is going up in smoke.

I wouldn’t recommend withdrawing from a Roth 401(k) either. There’s just too much money you’re letting slip away.

Hardship distributions

There is an exception to withdrawals netting that 10% penalty, and that’s a hardship distribution.

A hardship distribution is “on account of an immediate and heavy financial need of the employee and the amount must be necessary to satisfy the financial need.”

There are certain stipulations here, but if you have an immediate and heavy financial need, you can petition to have your penalties waived.

Now admittedly, I’m on the fence about this. A need is a need, and I don’t want you to experience massive medical debt or even bankruptcy, and certainly I wouldn’t you to lose your home if that was a concern.

But at the same time, if I were you, I’d want to figure out if there’s anything else you could do before liquidating your retirement account. Can you get on a payment plan? Can you ask for forbearance? Can you stall for time?

Withdrawing money from your retirement account is a one-way process. There’s not an undo button. (Yes, you can contribute the money again, but the financial damage will have been done.) Make sure that this is the best option.

What about a taking out a 401(k) loan?

You could also take out a 401(k) loan. I’ve talked about this before.

Please don’t do this. You’re setting yourself up for the massive risk that you have to pay it all back more or less instantly. You could be making two emergencies out of one.

Withdrawals from a Traditional IRA

What if you have an IRA and not a 401(k)? An IRA, after all, is an account that you own and manage, and that isn’t subject to the whims of your company.

But unfortunately, a lot of the same problems still hold. For example, there are the same penalties on early withdrawals as with the 401(k), and plus the need to pay taxes.

Withdrawals from a Roth IRA

Finally, we get some good news for early withdrawals with the Roth IRA.

Since the Roth IRA is contributed with your money after you’ve paid taxes on it, the rules around withdrawal are much more forgiving.

You can withdraw your contributions to your Roth IRA at any time with no penalty, so long as your account has been open for at least 5 years.

No penalties, no taxes. Yes, you lose out on future growth, but this is still the best we’ve found.

You can also withdraw money from a Roth IRA without any penalties if it’s to purchase your first home. ($10,000 max.) That might also be worth it.

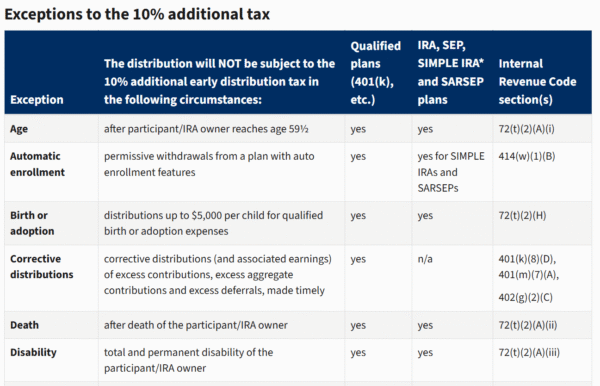

Bonus: Full list of exceptions to the penalty

This table from the IRS contains a giant list of exceptions to the 10% penalty. If any of these situations befall you, you can at least avoid the penalty if you do a withdrawal, which I would highly recommend you try to do.

Bottom line

Yes, you can make withdrawals from your retirement accounts at any time, regardless of your age.

But early withdrawals from your retirement accounts can cost you hefty penalties. And even if you can skirt the penalties, you’re still missing out on all that future growth.

Because of this, I don’t recommend doing early withdrawals except in the most dire financial circumstances. And if you have to do a withdrawal, start with your Roth IRA first.

But really, try to avoid it. Your older self will thank you.