Ally has changed the way that you can create multiple savings accounts. This can make your savings plans much easier to implement.

Update (February 2020): Ally now allows actual buckets! Read my review here.

I’m a big fan of Ally. They have reasonable rates of return on their online savings account, and they keep raising those rates too.

Update (February 2020): They lowered them too. Easy come, easy go.

They’ve started to do a bunch of other stuff, like credit cards and loans, but that’s irrelevant to us. The important thing is the savings account, which you can easily open.

But we generally don’t want a single savings account. We want buckets, multiple sub-savings accounts that we use for particular purposes, like Travel, or Car, or your Emergency Fund.

In my lengthy post on setting up an account with Ally, I also talked about setting up multiple accounts. That process was terrible; each time you created a new bucket, it’s as if Ally had never heard of you before, forcing you to pointlessly enter the same information over and over again.

Reps from Ally were at FinCon this year. I told them I loved their product, but their sub-accounts process was sucked.

Now, I can’t guarantee that I had anything to do with this, but I’m just saying, it’s fixed now.

How to set up additional savings accounts with Ally

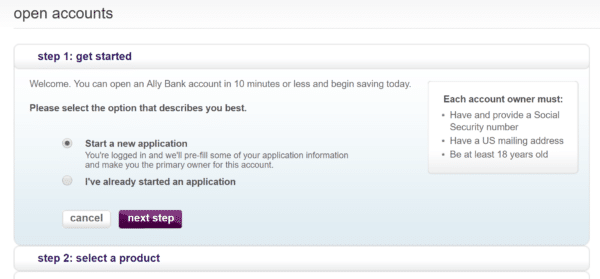

1. You need to have an account with Ally, of course. Once logged in, go to Accounts at the top and select Open Account.

2. As before, it gives you a number of options. (Where are the buttons, people?) Whatever, click Checking, Savings, CDs, and IRAs.

3. In the options that follow, find Online Savings and click Open Account (now there’s a button!).

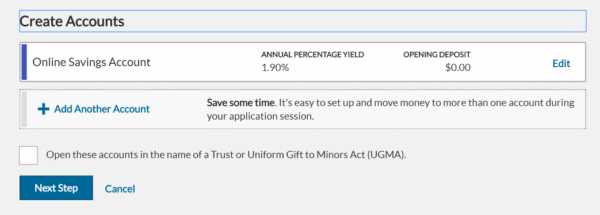

4. This is the part that’s different. Enter the Account Type (Online Savings) and an opening deposit if you want to, and click Add This Account.

5. You can add multiple buckets in one go if you want. Once done, click Next Step.

6. Verify ownership of the account and click Next Step.

7. Read the terms and conditions, check the box, and click Accept and Continue.

8. Read more terms and conditions, and click Submit Application.

9. And that’s it!

In this process, you could have opened a half dozen accounts if you wanted. It’s so much better than it used to be.

It’s extremely rare that a website undergoes a redesign that actually improves an experience. Bravo to Ally on this one.

Now, if you haven’t already, make sure you have some buckets to save up for things you want!

Note: I receive zero compensation from Ally for this sort of thing. I do not do affiliate links or paid product endorsements.

Update (February 2020): Ally now allows actual buckets! Read my review here.