I’ve talked before about the importance of keeping track of your frequent flyer miles. “But it’s too complicated!” is only a valid complaint if you desire to travel less and have it cost more money. Is that you? Didn’t think so.

I’ve also mentioned that there are some cases where it makes sense to let miles expire. And so here are two case studies of two different situations. Apply these to your own experiences to know what action to take in your own case.

Table of Contents

Case study #1: United

United’s program was only relevant to me while US Airways and United were both in Star Alliance, so I could earn US Airways miles on United flights. When US Airways merged with American and joined oneworld, United ceased to be much of a concern. Their frequent flyer program has recently been totally gutted (just like Delta’s) and I think there’s pretty much no reason to fly either if you can avoid it. (Which usually you can’t.)

I currently have around 23,000 United miles. Actually, they aren’t United miles at all, but Continental’s, which was absorbed by United a few years ago.

Interestingly, I have no idea how I accrued most of these miles. I know what flight they came from, which was a round trip to India on Emirates, but I don’t know how these miles came to be associated with Continental, as at no time did I ever tell Emirates my Continental account number. The miles just showed up in my account one day, months after my flight. A great mystery, but one that has certainly worked in my favor.

Now, some things to know about redeeming on United’s mileage program. A round-trip ticket in the US is 25,000 miles. But as I’ve argued before, that’s not a great use of miles, unless you’re traveling during the holidays. Better to save up for an international award, which at the moment is 60,000 miles if going to Europe.

I could just buy 2,000 miles, burn an award, and be done with this program. After all, I don’t plan on earning United miles any time soon. But, I also once said that about my small cache of American miles, which recently got combined with my US Airways miles, making them more useful. So never say never.

Result: These are miles worth saving.

Unfortunately, these miles were also expiring. At the end of this month.

My usual trick of transferring a single mile to a program using points.com didn’t work, because for some reason, United won’t let you do that.

So I looked at the myriad options available to me. And the one that made the most sense is: buy something from the United online shopping mall.

This is one of the easiest ways to earn miles. You click through the portal to some shopping site, buy something, then somehow the store notifies the airline, and you earn a certain number of miles per dollar.

I’m not much of a shopper, though, so I find it difficult to find something to buy that I was already planning on buying. Also, buying something online will often incur shipping charges. How could I minimize all this?

Here’s the trick when ordering things through an online shopping portal: Ship To Store. Boom, no shipping charges.

I ended up buying some batteries at Home Depot (cost: $5.97) and shipping them to a store near me.

A bit of a pain to head to a Home Depot perhaps, but I earned 18 miles on the transaction and, more importantly, extended my 23,000 United miles for another 18 months. During that time, I can accrue more and potentially figure out what to do with them.

Case study #2: Hawaiian

In 2012, during the trip when I launched this site, I flew from Oahu to the Big Island on Hawaiian Airlines. As there was no other program I could reasonably bank the flight miles to, I banked them on Hawaiian. Total miles: 87.

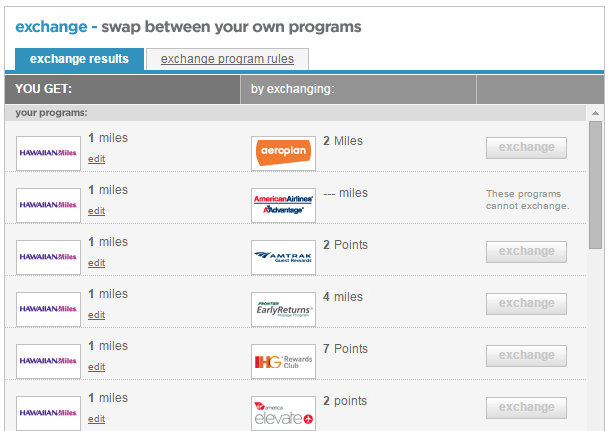

Over the past few years, I’ve extended these miles by doing the “transfer one mile” trip mentioned above, exchanging 6 US Airways miles for a single Hawaiian mile. Yes, that’s a terrible rate, but who cares for a few miles here and there?

Unfortunately, with US Airways gone as a program, there are fewer options for transfer within points.com. And all of the points currencies I have require a minimum of thousands of miles to transfer, or don’t transfer at all.

It should be obvious, but spending thousands of miles to keep 89 miles active is silly. And frankly, I don’t even think it’s worth it to do the shopping mall trick here. While 23,000 United miles could be conceivably worth a few hundred dollars, 89 Hawaiian miles is worth maybe a few dollars, max.

Result: These are miles not worth saving. And so, they will expire later on this summer.

What’s your case study?

Earning miles is great, and having miles in lots of different programs can be a good thing too, but only if you actually accrue enough to make redemption eventually worthwhile. So for most people, if you have miles in more than two airlines, and points in more than three hotel chains, you’re probably spreading yourself too thin.

Sometimes you have to let those hard to reach points go.

But enough about me. What criteria do you use to determine if points are worth saving?