Work hard, get a raise. That’s the plan, right?

But let’s say that you’ve been granted a 3% raise for the year. In all seriousness, bravo! But it’s not really a raise.

Table of Contents

With prices inflating, inflating

Life is expensive. Would anyone disagree? News report abound these days with stories about how the drought will push food prices up this year. And people follow the price of gas like it’s their favorite sports team. (“Sports, weather, and gas prices after the break!“)

And all the while, most of us are working at a job, hoping for the promise of a raise. It is often the one major carrot in your job.

And I’m unfortunately here to tell you that you’re probably not getting one.

Apologies to the teachers

Public-sector employees don’t need to hear this; they know it in a literal sense. I have a number of friends and family members who are teachers, and in general they haven’t received a raise in years, with the exception of those who have a long-standing contract, but even then, it’s reasonably understood that they are going to have to fight to maintain that, and may likely lose.

But what about people in other fields? In the private sector, many companies are doing quite well (at least if their names don’t rhyme with Schmest Buy or Zarnes and Zoble) and so it still remains a reasonable assumption that raises will happen.

So why wouldn’t you be getting a raise when you’re getting a raise?

Inflation. And cost of living.

Economics for tennis majors

I’m certainly no economist, but it’s not hard to see that things tend to get more expensive each year. And very smart people are able to calculate by just how much. In the US, one figure that it used is called the Consumer Price Index. Now, this is not a fixed figure, and will vary based on things like how well the economy is doing.

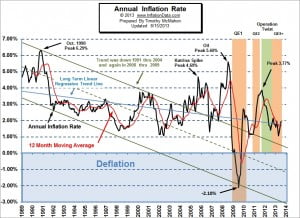

This site aggregates inflation rate data based on the CPI:

So it looks like the current inflation rate right now is about 2%. So this means that a 3% raise actually turns into just 1%.

But at least it’s something, right? Well, yes and no. Look at other years and notice the average values. In 2011, we were trending toward 4%. (In 2008-09, the inflation rate was negative, but our economy was performing like something out of a dystopian horror movie, so perhaps that’s a special case.)

But these values don’t always tell the whole story, and specific sectors can be higher or lower. Take tuition for higher education. According to Bloomberg:

“[T]uition expenses have increased 538 percent in the 28-year period, compared with a 286 percent jump in medical costs and a 121 percent gain in the consumer price index.”

Yikes. That’s more than a 6% annual increase. (And even that seems a bit low; some use 8% as the figure.)

Running in place

My point is, chances are, if you get a raise, it will just barely be enough to keep up with inflation, and therefore you will be making about the same as before.

I don’t mean to make you despondent. If you are currently working for a raise, you certainly shouldn’t stop! (A raise is better than no raise, regardless of the inflation rate.) But let’s be realistic about a job that pays 3% extra a year: you’re doing nothing more than treading water. If you want to improve your financial position, you’ll need something else other than your yearly raise.

Are you beating inflation in your job or work? How are you doing it?

As usual, I apologize for my US bias. Feel free to write in with your experiences below!