With most people contributing less to the economy, there becomes less incentive to help those people out, which won’t end well for anyone.

I have to admit, I’m kind of surprised that we haven’t seen more economic devastation in our country recently. With tariffs pushing costs up, the end of the de minimis exemption driving import prices up, and the anxiety of generalized financial uncertainty caused by our toddler-in-chief, you’d expect to be paying a lot more for everything.

More to the point, I’d expect the stock market to be in a bit of a free-fall right now. After all, if you grant that companies are eating the costs of these unnecessary price increases, you’d expect their valuations to fall. Less profit potential would seem to indicate less company worth? Maybe?

Now, I know the stock market isn’t the economy, but it certainly seems like something is detached from reality, and I don’t think it’s me.

But then I did some digging, and learned that you and I—consumers and hard-working contributors to the economy—may be insignificant enough, economically speaking, that we may not even matter.

Read on to learn how income inequality as it gets to its final state makes the economy really really weird.

A note for credit: Some of this content is inspired by or derived from this video by the How Money Works channel on YouTube. You should definitely check them out.

Table of Contents

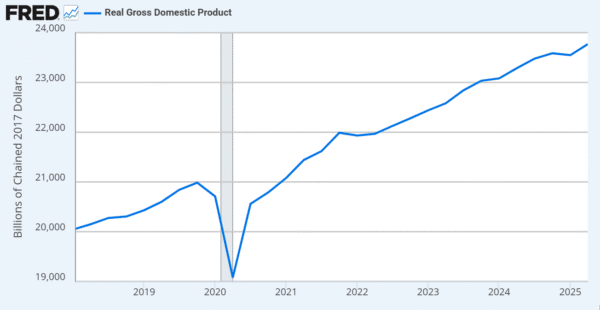

The economy is still growing

The numbers show a healthy growing economy:

Now granted, GDP is a pretty terrible way to measure the economy, as it measures bad activity as well as good. If I took a pile a rocks and moved all of them from one side of a field to the other, and then back again, I would have accomplished nothing (though maybe broken a sweat), but GDP would show two positive actions.

But, GDP is unfortunately the best thing we have. Aside from, of course, the stock market.

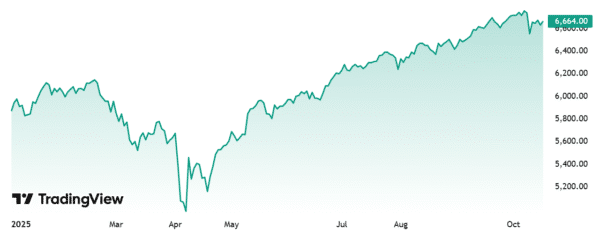

The stock market is still rising

Meanwhile, the stock market is still rising too. Just look at this chart of the S&P 500:

This is absolutely bonkers to me, though it starts to make sense when you realize that the vast majority of the S&P 500 is made of of seven companies (called “The Magnificent 7“) and one of the biggest components of that is a single company called NVIDIA.

NVIDIA, if you don’t know, is a company deeply involved in the AI investment bubble boom.

(I’ve written about NVIDIA before, and it’s yet another reason why I don’t pick stocks.)

I’m not going to get into all the craziness surrounding AI investment/speculation. Go read Ed Zitron to learn more about that.

But I’ll leave you with this image (credit here) which shows how investment in AI has been going recently. Draw your own conclusions as to whether this is healthy.

Point being, AI spending is propping up the Magnificent Seven’s balance sheets, and that means that it’s propping up the whole stock market. And possibly the broader economy.

Who is spending?

But all of this can be brushed aside with perhaps a more important question: in a country where consumption comprises two-thirds of the economy, who is doing the consumption?

And then answer is: all the very wealthy people.

In a recent report by Moody’s, it turns out that Americans in the top 10% of income make up 50% of of total consumer spending. And the bottom 60% of income account for only 20% of total consumer spending.

What that means is that 60% of us contribute very little to the economy. The economy runs on spending, and spending is mainly done by ultra-wealthy people.

How this is a problem

So what we’re seeing is an increasingly bifurcated economy. While the people at the bottom are finding rising prices, unaffordable healthcare, and housing that’s out of reach, the people at the top are doing quite well.

This is a problem for you because there isn’t really much incentive for anyone to help you, economically speaking.

If you’re in charge of an economy, who would you choose to help: The 60% of us who contribute 20% to the economy, or the 10% who contribute 50%?

It probably wouldn’t be us. There just isn’t enough return on investment.

How this could end

To be honest, I’m not sure how this ends. If inequality continues to grow worse, and that bottom 60% contributes less and less to the economy, what then? What happens when millions of people, economically speaking, stop mattering?

Or what happens if that 10% of people becomes smaller and smaller? What if only 2% of the population becomes responsible for 50% of the consumption?

Whether 2% or 10%, relying on small a small group of people to prop up an economy is a fundamental weakness too. If those 10%’s fortunes change, if they stop spending as much, or if they don’t increase their spending in line with economic projections, the whole thing could fall apart.

And honestly, that wouldn’t be such a bad thing. I truly believe that a rising tide lifts all boats, and the sooner the ultra-rich get in a jam and need help, the sooner everyone else is going to have a fighting chance to get back on their feet too.

What you can do

In the meantime, the best thing I can say beyond “stay the course” is to resist the temptation to do anything foolish. It’s tempting to thing that your fortunes are hopeless, and put all your money into something like crypto, thinking that you might “win the lottery“.

You won’t. Stay the course. Don’t take out Buy Now Pay Later loans, learn how to make more money, and for heaven’s sake, vote for people who actually have your best interests in mind. They are out there, we just didn’t vote many of them into office recently.