Refinancing a mortgage is getting pricier due to the Adverse Market Refinance Fee, but refinancing doesn’t offer the benefits you think.

There’s a new fee in town.

The Federal Housing Finance Agency has instituted a 0.5% fee on refinancing of conventional home mortgages.

Named the Adverse Market Refinance Fee, it’s designed to help Fannie Mae and Freddie Mac, the government-sponsored mortgage lenders, recoup some losses due to the pandemic.

(Here are some more details, if you’re curious.)

So if your home is worth $300,000, then the new fee you’re going to pay is $1,500.

(Translating for the Bay Area: “So if your home is worth $1,200,000, then the new fee you’re going to pay is $6,000.”)

This is in addition to all the standard fees associated with refinancing which could be up to 2-6% of your loan amount.

New fees are a drag of course, but in this case, it doesn’t matter.

Because if I were you, I wouldn’t bother with a refinance anyway.

Here’s why.

Table of Contents

Why refi?

Refinancing a mortgage is the process of creating a new mortgage on an existing property, dissolving the old mortgage, based on current equity and home values. The new mortgage may have different terms than the existing mortgage.

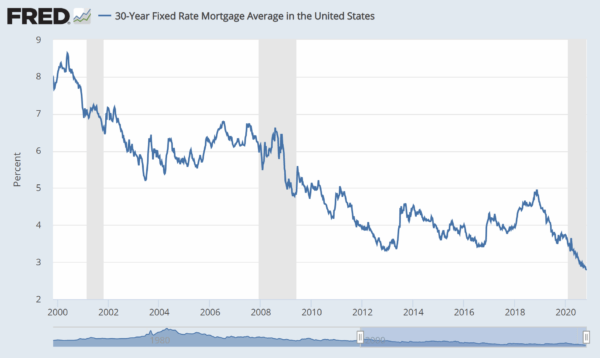

The advertisements are all over the place these days, telling us to refinance because “mortgage rates are at historic lows”.

And that is by and large true. Rates these days are below 3% on average.

But that doesn’t necessarily mean that you should refinance your mortgage.

But first, here are some reasons why one might refinance a mortgage:

A lower rate

People refinance to get a lower interest rate. And a lower rate means that you pay less.

Given a $300,000 mortgage at 4%, you end up paying upwards of $200 less per month compared to a mortgage at 3%.

That difference is money in your pocket that can be used to pay off your mortgage faster.

The problem is that refinancing costs money. The mortgage company isn’t doing it out the kindness of their heart. They want closing costs from you. This is a fixed fee, granted, but it does mean that the amount you’re likely to save in interest has to be greater than the amount of closing costs you pay, otherwise you’re not saving money.

Assuming closing costs are typically 5%. So in the case of a $300,000 mortgage, that’s $15,000. So with a reduction from 4% to 3%, you’d need to hang out in the home and pay interest for around 6 years before you’d even make your money back.

It’s rarely worth it.

Now if you have a crazy interest rate, like 8%, or if you have one of the really terrible loans, like an ARM (adjustable rate mortgage), or a balloon mortgage (one of those that needs to be paid off in full after a few years), then you probably want to get out of those pronto and get a conventional fixed-rate mortgage. But that’s true regardless of the interest rate.

In general, refinancing won’t save you money, and if it does, it probably won’t save you a lot. I’d focus my efforts on paying off the mortgage instead of trying to move the money around.

Get money out

Not everyone does a refi to get a lower rate and pay off their mortgage faster. Some people refi to “get money out” of their home. This means that they get a new mortgage that’s larger than their existing mortgage, with the extra money paid out to the owner, to be used for any purposes that you’d like.

In general, this seems like a terrible idea. I don’t care how low the interest rate is: the goal is to have less debt, not more. You can’t become wealthy by taking on more debt. It just doesn’t work.

Also, treating your home as an ATM is kind of like stealing from your future.

And don’t forget, you have to pay fees for this. Not a good plan.

An alternate idea: Pay more

I have a suggestion that could save you thousands of dollars over the life of your loan: Pay more each month.

You don’t need permission for this. You just pay extra. You can set up automatic payments and forget about it. It can work just as if you had refinanced from a 30 year loan to a 15-year loan; just pay as if it were a 15-year loan.

And the best part is that it won’t cost you a thing.

The quicker you pay that mortgage down, or even off, that’s interest you don’t have to pay.

Don’t just move money around

Everyone wants to feel like they are making progress with their debts.

That’s why things like refinancing your home feels so appealing. It’s simple, it’s easy, lots of companies want you to do it, and you can feel like you’re making progress.

But just moving money around doesn’t get you out of of debt. Making and executing a plan gets you out of debt.

Ultimately, paying off a mortgage is incredibly boring. You just keep on paying, year after year, chipping off principal until there’s nothing left. There’s nothing slick about it.

And that’s how you know it’s a good plan. If it feels boring and not “slick”, that’s probably what you want to do.

So yes, it’s unfortunate that this new refinance fee is being instituted, but it shouldn’t really matter to you.