A new research paper tries every strategy under the sun to beat the market, but the results show that market timing still doesn’t work.

I always worry a little bit when clients are really interested in investing.

I worry because when you spend enough time thinking about investing, you may start to think, “I could find a way to beat the market!” You could start looking for better returns, and start developing strategies that you think might outperform basic, boring index funds.

You might even start to read books by Ray Dalio or, heaven forbid, Tony Robbins, to unlock the “secrets” of wealth building.

The problem there is that there are no secrets.

Here is the “secret” to building wealth: put as much money as you can into reliable interest-earning accounts, and repeat this over and over for as long as you can.

But the allure of trying to “time” the market is irresistible, which is why I was so interested in a new research paper that tried to systematize every possible way that one could reasonably time the market—720 strategies in all—and found out what worked and what didn’t.

This should set the matter to rest, right?

Table of Contents

The paper

The paper, by researchers at Dimensional Fund Advisors, and published by Social Science Research Network, developed a methodology that picked from seven different parameters:

- Timing approach (3 options)

- Region (3 options)

- Premium (4 options)

- Window for calculating the historical distribution of the timing signal (2 options)

- Percentile at which to invest in the short side (Breakpoint) or to switch back to the long side (Switchback) (5 options)

- Rebalance frequency (2 options)

From this, they were able to create 720 different market timing strategies.

(Why 720? It’s the product of the total number of options above: 3 × 3 × 4 × 2 × 5 × 2 = 720.)

I think we can reasonably agree that it would be rather difficult for us to find a 721st strategy, so this should presumably be the final word on the subject, in the same way that the book Every Planar Map is Four Colorable was to visual cartography.’

The results

Now I could detail what those options and parameters mean above, but to me that would be missing the point. (Feel free to read the report if you’re curious.) What’s much more salient to me is the results of the study. Did any strategies beat the market?

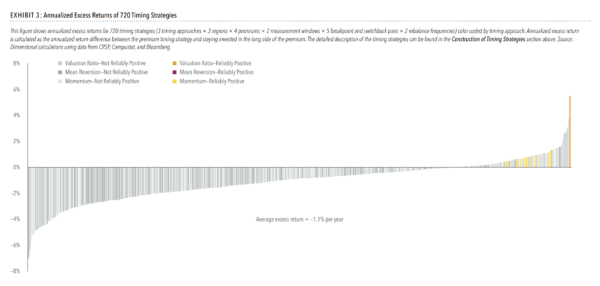

Surprisingly, yes. Out of the 720 strategies, 30 of them were able to beat their respective targets.

In particular, two strategies generated an excess return of 5.5%. They beat the market by 5.5%!

But before we get too excited, the report notes:

“While these results might look promising, we would expect some combination of parameters to generate excellent results just by chance due to the large number of timing strategies examined here. Similarly, we would expect a few people to flip 10 heads in a row if we ask a large number of people to repeatedly flip a coin.

Indeed…the observed outperformance is very sensitive to the exact parameters used for strategy construction. Changing one single parameter of the strategies, such as the breakpoint or the rebalance frequency, would reduce the excess return by more than half and make it no longer reliable.”

Analysis

If you flip a coin, you’ve got a 50% chance of getting heads.

If you flip a coin 10 times, you’ve got of 0.1% chance of getting heads on every flip.

That isn’t likely, but if millions of people are flipping coins, you can expect someone out there to get those 10 coin flips right eventually.

And such is the case with “miracle” traders who wow us with stories of “predicting” the next boom or bust cycle, and making zillions of dollars in the process.

Is it skill or luck? Probably a little of both.

But the thing about luck is that, eventually, it runs out. Over time, the people and funds that outperform the market eventually revert to the mean. They can’t do it forever.

As this report shows, it is possible to beat the market, but only in limited circumstances, and mostly based on luck:

“While it is tempting to focus on a few shiny objects in the backtests, when looking at the big picture, it is clear that the odds of using valuation ratios, mean reversion, or momentum to successfully time the premiums are poor. Because the market, size, value, and profitability premiums are positive on expectation and can show up strongly over short periods of time, the opportunity costs of mistiming the premiums are potentially high.”

But no need for us to fret, they say:

“Although our findings may be disappointing to investors who are looking for the best time to invest in the premiums…the volatility of premiums should give investors some comfort for why the expected premiums are positive in the first place; the willingness to bear uncertainty and potential underperformance is rewarded with higher expected returns.”

In other words, being “average” when it comes to making our money work for us is actually pretty good, and certainly more than good enough for our needs, as we’ll still get fairly high expected returns.

What kind of returns? Well, if past performance is any guide (which I know isn’t a guarantee) you can expect to earn around 8% if invested in low-cost index funds matching broad-based equities, such as the S&P 500.

If I were you, I would spend less time trying to beat that 8%, and more time working to get the money to be able to earn that 8%.

After all, after 720 strategies, the results are still clear: you can’t beat the market.