Explore an official tool called the “Loan Simulator” which shows you how to find the best repayment strategy for your student loans.

I have a confession. When it comes to student loans, I can’t keep the different repayment options in my head. All of the acronyms, PAYE, REPAYE, IBR, IDR, ICR, all sort of swish around in my head.

Some of this is due to my own personal situation. When I had my student loans, if there were different options for paying them back other than, well, just paying them back, I didn’t know about them.

If there were options that I had known about, I might well have discarded them anyway, because they tend to involve paying less per month, which I didn’t want, because that would have meant paying more in total.

Point being, I paid off my loans the hard way, using a standard repayment plan.

You, however, have a galaxy of options.

How do you find out your best repayment plan out of all the options?

Luckily, there is a tool to answer that question for you.

Table of Contents

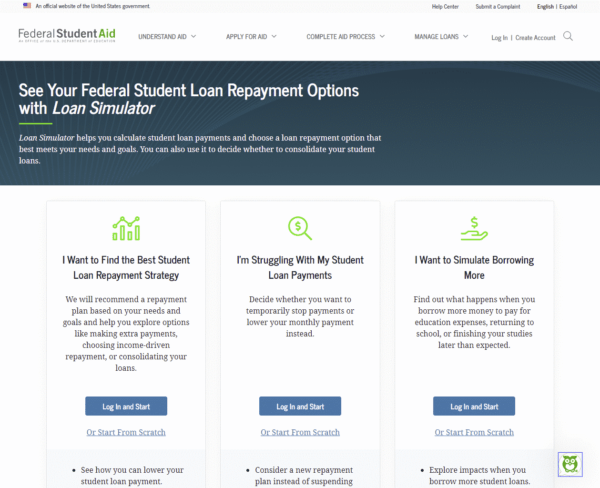

The Loan Simulator

The tool I’m referring to is called the Loan Simulator.

The Loan Simulator is a wizard on the Federal Student Aid website that takes your loan information and your goals and tells you what the best type of repayment options are for you.

It’s quick, easy, free, and rather slick.

I want to go through the process with you to show you just how easy it is, and how powerful it is too.

So let’s get started.

Entering your information

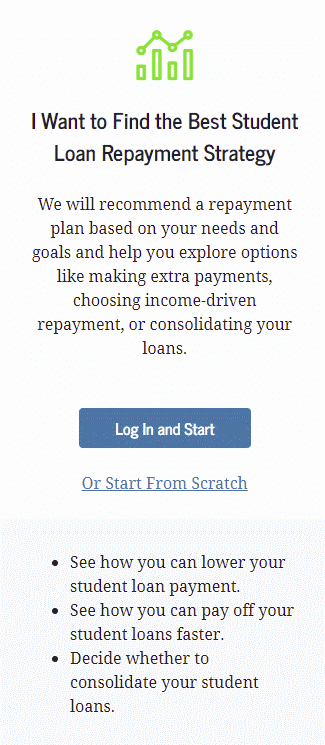

On the main page, there are a number of different options, for our purposes today, click in the first area, where it says “I Want to Find the Best Student Loan Repayment Strategy“

You can log in if you want, but I’m going to go for the anonymous option and click “Or Start From Scratch“

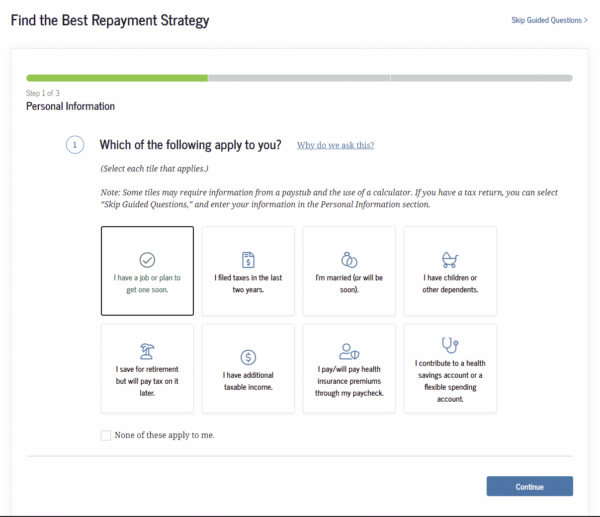

This first step asks you demographic information about your job and marriage situation. This is because it helps to estimate your Adjusted Gross Income (AGI), which is relevant when calculating income-based repayment options.

I chose “I have a job or plan to get one soon.“

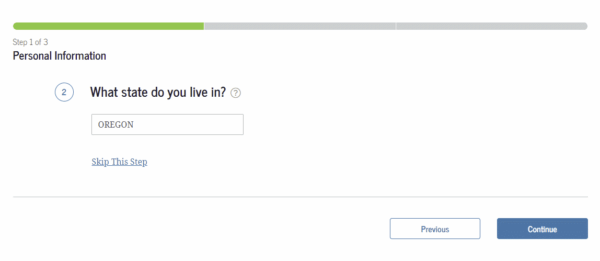

Next, it will ask for your home state. Enter the state and click Continue.

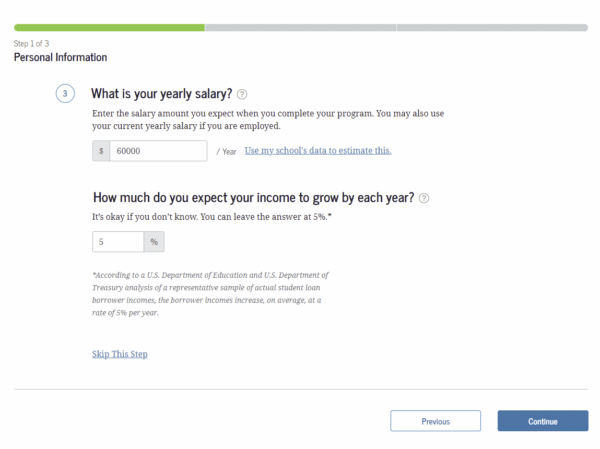

Next, it will ask for your yearly salary. I’m entering $60,000 and leaving everything else as the defaults.

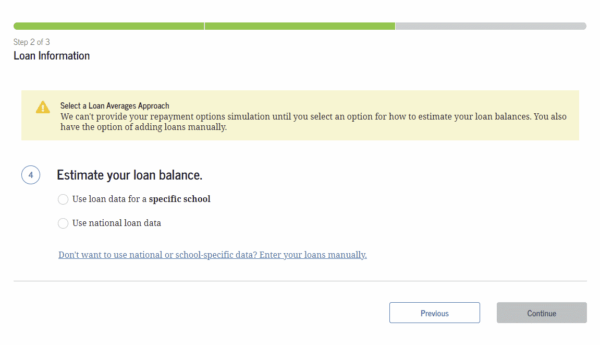

You have a few options here for entering your loan information. There’s a big song and dance about entering the name of the place where you got your degree, and what your degree is, and it will look up average student loans for that situation.

But that’s actually much more complicated than it needs to be. And you should really know what your loan balances are anyway, so if you don’t know them, go find that out first.

Then click the link that says “Don’t want to use national or school-specific data? Enter your loans manually.“

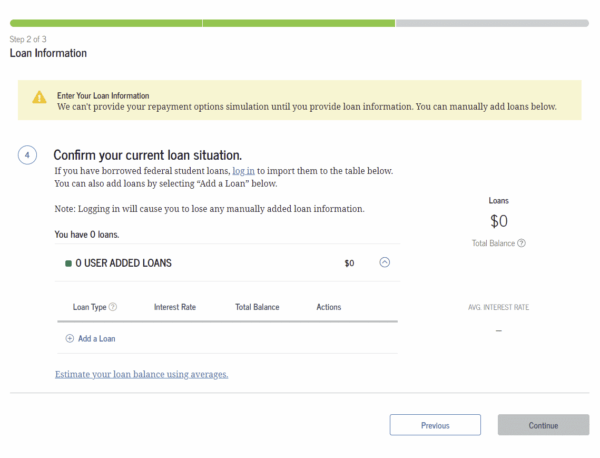

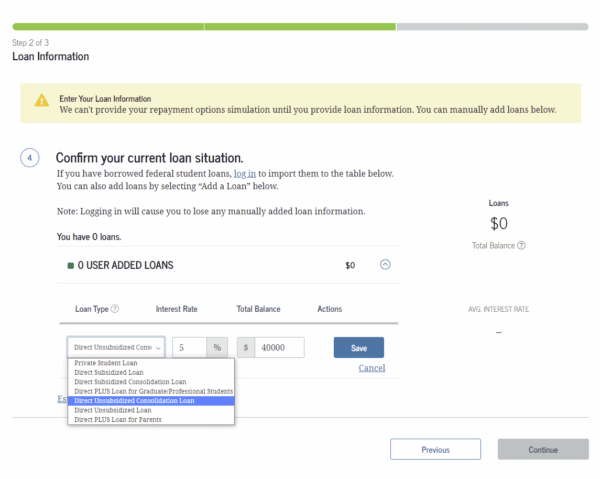

Next, it will ask you for your loan balances and the type of loans that they are. This part is crucial to get right, because different loan types will have different rules (and eligible payment plans) associated with them.

For this exercise, I’m adding a single $40,000 Direct Unsubsidized Consolidation Loan at 5%. Click Add a Loan to add your own details and then click Save and Continue.

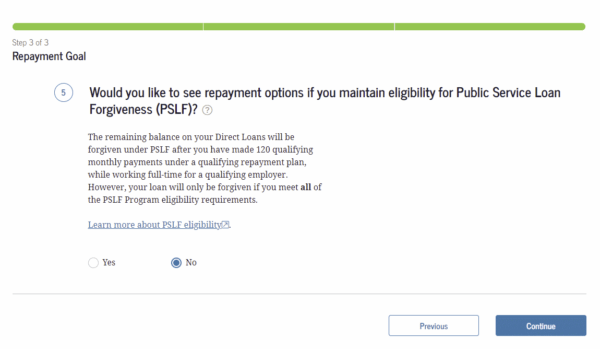

Next, it will ask if you are looking to attain Public Service Loan Forgiveness, the program that allows for student loan forgiveness if you work in certain types of jobs.

I’m going to click No here, but be aware that clicking Yes expands your options significantly. (You can also change this later.)

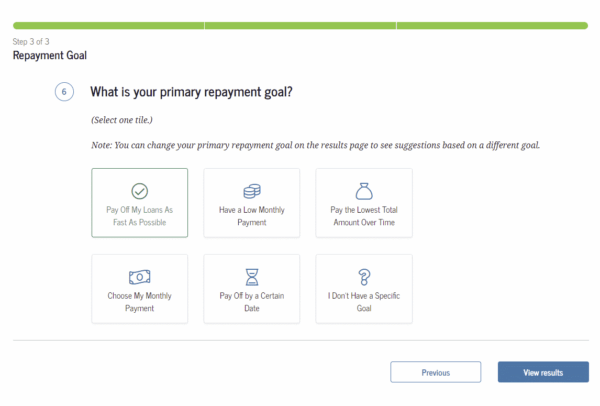

Finally, it will ask what your goal is. You can easily switch back and forth on these options on the next page, so it doesn’t matter what you choose here.

Click “View Results” and we’re at the finish line.

Understanding the results

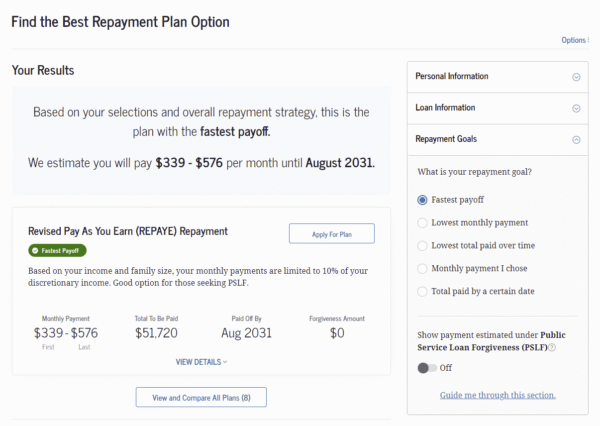

In my example, the result that is given is the Revised Pay As You Earn (REPAYE) Repayment. This is because I chose the “fastest payoff” option.

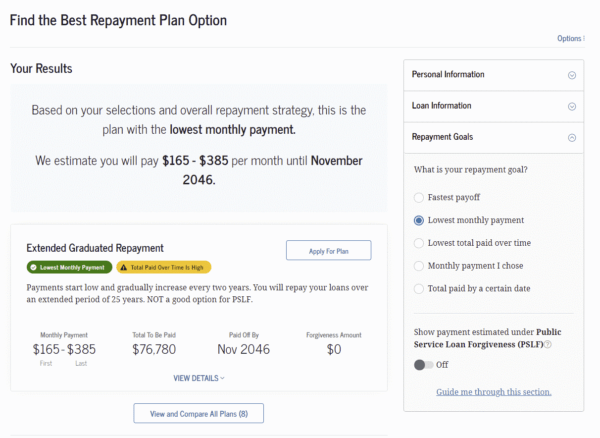

If I were to switch the radio buttons on the right to, say, lowest monthly payment, the answer changes to “Extended Graduated Repayment“. (Note that this adds $25,000 and 15 years to the life of the loan. That’s the price you pay to lower your payments.)

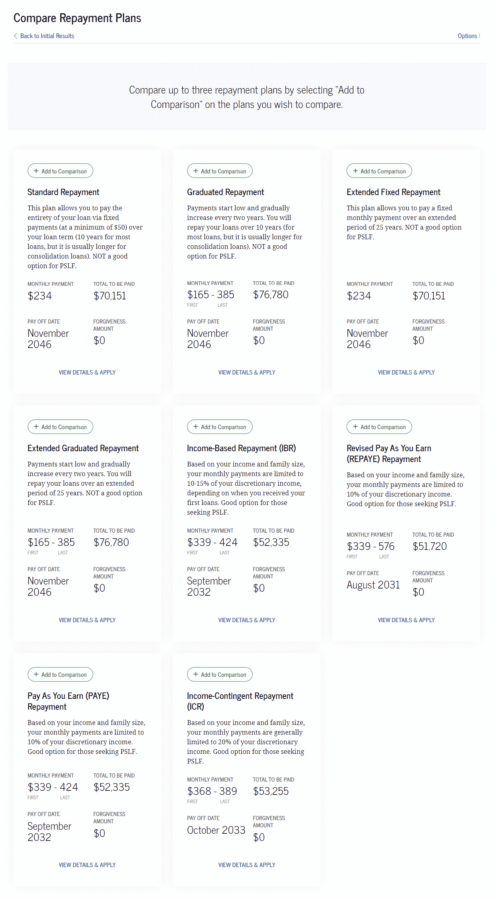

If you want to see all of your options, click the “View and Compare All Plans” option at the bottom. Beware, it’s a long list of plans, and I’m not entirely sure that it’s worthwhile, but it’s there.

Click “Back to Initial Results” to go back to the summary page.

PAYE back your loans

With this tool, you can get a sense of which payment plan is best for you.

While this is an official tool, I’d still look into the plans yourself to see if the figures quoted match the reality.

And, zooming out a bit, let’s recognize that if you can afford to pay more on your student loans each month rather than less, you will save money over the long run.

I don’t think trying to run out the clock by paying the minimums for 25 years is a good plan. You want these loans gone, and I believe that they can be paid off. I’ve seen plenty of people who started out thinking it was impossible, and then eventually pay them off completely.

So, to sum up, I highly recommend using the Loan Simulator tool to check your loan repayment options, whether or not you are looking to change your plan. You may be surprised to find that there are better options for you in the alphabet soup that is the student loan program here in the United States.